What is a Loan Estimate?

Contents

A Loan Estimate is a three-page form that you receive from a lender after you submit a loan application. This form gives you important information about the loan you are applying for, including the estimated interest rate, monthly payment, and closing costs. The Loan Estimate also tells you how much money you will need to bring to closing, and how long you have to shop for a home before the offer expires.

Checkout this video:

What is a Loan Estimate?

A Loan Estimate is a three-page form that you receive from a lender after you have applied for a mortgage. The Loan Estimate tells you important details about the loan you have requested. This includes information about the interest rate, monthly payments, and closing costs. The Loan Estimate also includes information about the lender’s fees and how those fees were calculated.

What are the three business days?

The three business days are the days on which you’ll receive the Loan Estimate,

the day on which you can expect to receive your loan funds, and the day on which

you can expect your first mortgage payment to be due.

What are the four pages?

A Loan Estimate is a four-page document that’s issued when you apply for a mortgage. It provides important information about the loan you’re applying for, including the estimated interest rate, monthly payment, and closing costs. It also includes information about the lender, such as their name and contact information.

How to Read a Loan Estimate

A Loan Estimate is a three-page document that you receive from a lender after you have submitted a loan application. The Loan Estimate tells you important details about the loan you have applied for. It includes information such as the loan amount, interest rate, monthly payment, and closing costs. It is important to read and understand your Loan Estimate so that you can make an informed decision about the loan you are applying for.

Page One

The Loan Estimate form is three pages long. The first page has your name, address, the type of loan you applied for, your loan term, your estimated rate and monthly payment. If you applied with a co-borrower, their information will be listed here as well. Below that, you’ll see an itemization of all the projected costs associated with your loan.

##Origination Charges

These are the fees charged by the lender to cover the cost of processing your loan application and originate (create) your mortgage. These fees are paid to the lender at closing.

Loan Discount Points

A point is equal to 1% of your loan amount. Buying points sometimes enables borrowers to get a lower interest rate on their loan. You can choose to buy points or pay a higher interest rate instead. One point costs 1% of your loan amount. This means that on a $100,000 loan buying one point would cost $1,000 at closing. Ask your Loan Officer if buying points makes sense for you given today’s interest rates and given your goals for owning this home.

Origination Points 0% discount 1 point No origination fee $0 $1,000 paid at closing

0% discount 2 points No origination fee $0 $2,000 paid at closing

Loan Terms

The Loan Estimate will show you the loan amount, interest rate and monthly payments for the life of your loan. It also shows if there are any prepayment penalties or fees. The term is the length of time you have to repay your loan.

Projected Payments

On the Loan Estimate, in the section labeled “Projected Payments,” you’ll find information on your monthly principal and interest payment, as well as any escrow amounts for taxes and insurance. Here’s what you need to know about each:

• Principal and interest: This is the amount you’ll pay each month towards your loan balance. It does not include escrow amounts for taxes and insurance.

• Escrow: This is an estimate of the amount you’ll need to pay each year for property taxes and homeowner’s insurance. The lender will hold this money in an escrow account, and will use it to pay your property taxes and insurance when they come due.

Page Two

Now that you’ve reviewed the first page of your Loan Estimate, let’s look at the second page. On this page, you’ll find more detailed information about the terms of your loan, as well as an estimate of the costs you’ll need to pay at closing.

Here’s what you’ll find on page two of your Loan Estimate:

-Loan Terms: This section includes information about the term of your loan, the interest rate and monthly payment amount.

-Prepayment Penalty: Some loans come with a fee if you pay off your loan early. This section will tell you if your loan has a prepayment penalty and how much the fee will be.

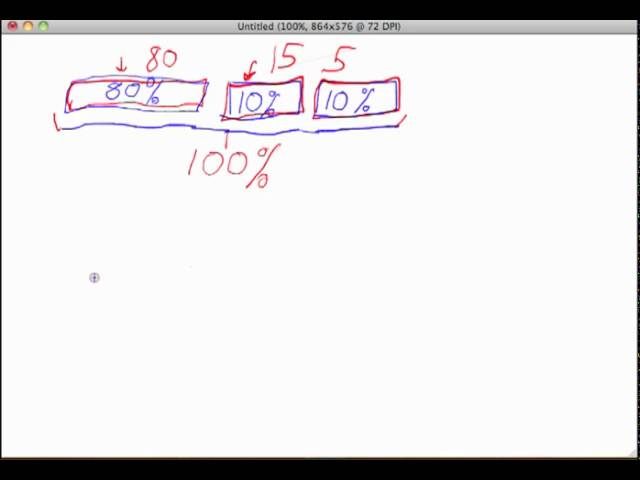

-Mortgage Insurance: If you are taking out a loans with less than 20% down, you will likely be required to purchase mortgage insurance. This section provides more information about mortgage insurance premiums (MIP) and private mortgage insurance (PMI).

-Estimated Taxes and Insurance: This section provides an estimate of the property taxes and homeowners insurance you will need to pay each year. These amounts will be added to your monthly payment amount.

-Estimated Total Monthly Payment: This is an estimate of your total monthly payment amount, including principal, interest, taxes and insurance (PITI).

Costs at Closing

Your Loan Estimate will show you an itemized list of all the fees due at closing. These include the loan origination fee, which is charged by the lender for processing your loan; any points you pay to lower your interest rate; appraisal fee; title insurance; and escrow fees, among others.

Other Costs

The next section on your Loan Estimate is entitled “Other Costs” and contains a breakdown of all the additional costs and fees associated with your loan. Here’s what you can expect to find:

*Origination Charges:* This is the fee the lender charges for processing your loan. It can be a flat fee or a percentage of your loan amount, and is typically paid at closing.

*Discount Points:* Discount points are an optional fee you can pay to lower your interest rate. One point equals 1 percent of the loan amount, so paying one point on a $200,000 mortgage would cost $2,000.

*Lender Credits:* Some lenders offer “lender credits” in lieu of charging origination fees or discount points. This means they agree to cover some of your closing costs in exchange for a higher interest rate.

*Appraisal Fee:* An appraisal is required on most home loans in order to determine the value of the property being purchased. The fee for this service is typically paid upfront when you order the appraisal.

Homeowners Insurance: Homeowners insurance is required by most lenders in case your home is damaged or destroyed by fire, wind, hail or other hazards. The premium is usually paid alongside your monthly mortgage payment.

“`

How to Use a Loan Estimate

A Loan Estimate is a three-page form that you receive after applying for a mortgage. The Loan Estimate shows you what loan terms the lender is willing to offer you. It will also show you the estimated monthly payment, closing costs, and the total amount you will pay over the life of the loan.

Page Three

Now that you know how to read a Loan Estimate, let’s look at page three more closely. This page provides you with more detailed information about the loan terms, including the interest rate, monthly payments, and closing costs.

The first thing you’ll notice on page three is the “Loan Terms” section. This section provides an overview of the loan, including the interest rate, term (length of the loan), and amortization type. The interest rate is the percentage of the loan amount that you will pay in interest over the life of the loan. The term is the length of time you have to repay the loan, and amortization is how your interest and principal payments are structured over time.

The “Monthly Payments” section on page three breaks down your monthly payment into three parts: principal, interest, and escrow (if applicable). Your principal is the amount of money you borrow from your lender, and your interest is the fee charged by your lender for borrowing that money. Your escrow account is used to pay your property taxes and insurance premiums (if applicable) on your behalf.

The “Closing Costs” section on page three provides an estimate of the costs you will need to pay at closing. These costs can include things like appraisal fees, credit report fees, and title insurance. The “Total Closing Costs” listed on this page includes both borrower-paid and seller-paid closing costs (if applicable). You can find more information about how these costs are paid in our article on Who Pays What in a Real Estate Transaction?

The last thing to note on page three is the “Projected Payments Schedule” table. This table shows you how much money you will need to have available at closing, as well as an estimate of your monthly payments for principal, interest, and escrow (if applicable) for each year of your loan term.

Comparison of Costs

Comparing the “Total Loan Cost” section of your Loan Estimate to other offers will help you understand which loan is the best deal. The table below shows how to compare loan costs:

Loan Estimate Other Loan Offer

Compare the

-Finance Charge -Finance Charge

-Total Points -Total Points

– Origination Charges -Origination Charges

portion of the

-Discount Points -Discount Points

Cost Estimates collections to see portion of the Cost Estimates collections to see which has a lower cost.

Page Four

Now that we’ve gone over all three pages of the Loan Estimate, let’s briefly review what each page is for.

Page One: The first page of the Loan Estimate gives you an overview of your loan terms and costs. This includes information on your loan amount, interest rate, monthly payment, and estimated closing costs.

Page Two: The second page of the Loan Estimate breaks down your estimated closing costs so that you can see how much you’ll need to pay for things like appraisal fees, title insurance, and other miscellaneous expenses.

Page Three: The third page of the Loan Estimate provides you with more detailed information on your loan terms and costs. This includes a breakdown of your interest rate and monthly payments, as well as any prepaid finance charges (if applicable). Additionally, this page includes important disclosures regarding things like adjustable rates, prepayment penalties, and other possible fees.

Additional Information

If you have questions about this Loan Estimate, contact the person listed in Section A.

You must get a new Loan Estimate if there are changes to any of the terms in Sections A through J. But there are a few exceptions:

-You can choose to waive changes in Paragraphs A1 and B3, but only if all of the following are true:

-(i) The interest rate disclosed in Paragraph B3 will not increase;

-(ii) The periodic principal and interest payment amount disclosed in Paragraph C2 will not increase; and

-(iii) Neither you nor any related party will pay any fees to anyone other than the creditor, a mortgage broker, or a real estate agent.

-A creditor may require that you accept a revised estimate with different loan terms if, for example:

--The interest rate increased because market conditions changed between when you applied for the loan and when it closed; or

--Taxes or insurance premiums rose; or

--The creditor learned that information you provided was inaccurate.

If the changes might make you ineligible for the loan, different rules apply. For example, if your employment status changed and now you don’t have enough income to qualify for the loan, the creditor must give you a new Loan Estimate that reflects those changed circumstances.