What is a Piggy Back Loan?

Contents

A Piggy Back Loan is a mortgage loan that is used in conjunction with a first mortgage loan. The second loan “piggybacks” on the first loan.

Checkout this video:

What is a Piggy Back Loan?

A piggyback loan is a mortgage loan where a separate loan is taken out for a portion of the purchase price of the property. This second loan “piggybacks” on the first one and allows the borrower to make a smaller down payment. For example, if you wanted to buy a $200,000 house and had only saved up $10,000 for a down payment, you could take out a first mortgage for $190,000 and get a second mortgage—or piggyback loan—for $10,000. This would allow you to put 10% down on the purchase instead of 20%.

How Does a Piggy Back Loan Work?

A piggyback loan is a mortgage loan where a second loan is taken out at the same time as the first. The two loans are structured differently, with the first being a traditional mortgage and the second often being an adjustable-rate home equity line of credit.

Piggyback loans were created because lenders were not allowed to provide borrowers with more than 80% of the home’s value as a loan. This meant that borrowers who wanted to put down less than 20% would have to pay for private mortgage insurance (PMI). Private mortgage insurance protects the lender in case of default, but it was an added cost that many borrowers were not willing to pay.

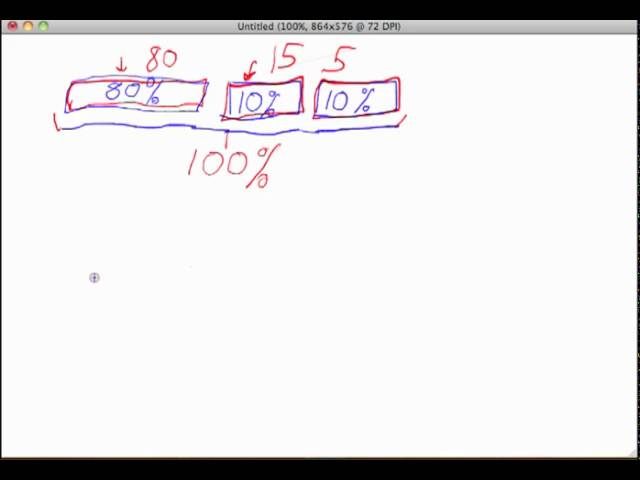

With a piggyback loan, the borrower takes out two loans at once. The first loan covers 80% of the home’s value and is a fixed-rate mortgage. The second loan, known as a piggyback loan, covers 10% of the home’s value and is an adjustable-rate home equity line of credit (HELOC). The borrower only pays interest on the HELOC when they use it, and they can use it for any purpose, such as home improvements or debt consolidation.

Piggyback loans are no longer as common as they once were, but they can still be a helpful way to finance a home purchase without having to pay for PMI. If you are considering a piggyback loan, be sure to compare offers from multiple lenders to get the best rate and terms.

The Pros and Cons of Piggy Back Loans

Piggy back loans can be a great way to finance a home purchase, but they also come with some risks. Before you decide to take out a piggy back loan, it’s important to understand both the pros and cons.

Pros:

-You can avoid private mortgage insurance (PMI): If you put less than 20% down on a home, you’re typically required to pay PMI. However, if you take out a piggy back loan for a portion of your down payment, you may be able to avoid this added cost.

-You can make a smaller down payment: If you don’t have enough cash saved for a traditional 20% down payment, a piggy back loan can help you buy your home sooner.

-You can potentially get a lower interest rate: Some lenders offer lower interest rates for piggy back loans than they do for traditional loans. This could save you money over the life of your loan.

Cons:

-You’ll have two monthly payments: In addition to your mortgage payment, you’ll also have to make payments on your piggy back loan. This can make it more difficult to make ends meet each month.

-You could end up owing more than your home is worth: If your home value decreases and you have an adjustable rate mortgage, your monthly payments could increase and put you at risk of foreclosure. With a fixed rate mortgage, you’ll still be required to make the same monthly payment even if your home value goes down.

-You may not qualify for certain programs: If youLater decide that you want to refinance your home or take out a home equity loan, you may not qualify if you have a piggy back loan. That’s because these types of loans are considered “liens” against your property and some programs won’t allow them.

Alternatives to Piggy Back Loans

A piggyback loan is a second mortgage taken out at the same time as the first mortgage. The loan is piggybacked onto the first mortgage and both loans close simultaneously. This type of loan allows the borrower to avoid paying private mortgage insurance (PMI).

Piggyback loans are no longer as common as they once were. Before the housing market crash in 2008, piggyback loans were used frequently to help borrowers avoid paying PMI. Now, there are a number of other loan products available that allow borrowers to avoid paying PMI without taking out a second mortgage.

If you’re considering a piggyback loan, there are a few things you should know:

Piggyback loans can be fixed-rate or adjustable-rate mortgages (ARMs).

The interest rate on the piggyback loan is usually higher than the interest rate on the first mortgage.

Piggyback loans typically have shorter terms than first mortgages, so they may require refinancing before the end of the term.

Piggyback loans may not be available in all areas or from all lenders.

If you default on your first mortgage, you will still be responsible for repaying the piggyback loan.