How to Qualify for a Loan

Contents

There are a few key things you’ll need to do in order to qualify for a loan . Learn about the process and what you’ll need to get started.

Checkout this video:

Introduction

In order to qualify for a loan, you will need to meet the lender’s criteria. This can vary from lender to lender, but there are some general things that you will need to have in order to qualify. Firstly, you will need to have a good credit history. This means that you have made all of your previous payments on time and that you have not defaulted on any loans in the past. If you do not have a good credit history, you may still be able to qualify for a loan if you can prove that you have the ability to repay the loan. You will also need to have a steady income in order to qualify for a loan. This could come from employment, self-employment, benefits, or a combination of these things. The lenders will want to see that you have a regular income in order to repay the loan. Lastly, you may need to provide collateral in order to qualify for a loan. This means that you will put up something of value (such as your home or your car) as security for the loan. If you default on the loan, the lender can take away your collateral.

What You Need to Know Before You Qualify for a Loan

Before you even begin the process of qualifying for a loan , there are a few things you need to know. The first and most important thing you need to know is what kind of loan you are looking for. There are many different types of loans , and each one has different requirements. It is important that you know what you are looking for so that you can be sure to qualify.

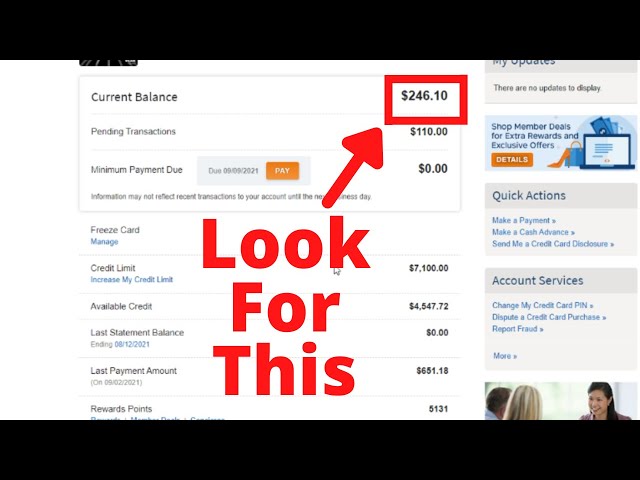

Your Credit Score

One of the first things any lender will look at when you apply for a loan is your credit score. Your credit score is a number that ranges from 300 to 850 and represents your creditworthiness. The higher your score, the better your chances are of qualifying for a loan with favorable terms.

Lenders use your credit score to determine whether you’re a good candidate for a loan and how much interest to charge you. If you have a poor credit score, you may still be able to qualify for a loan, but you’ll likely pay a higher interest rate.

There are several things you can do to improve your credit score, including paying your bills on time, maintaining a good credit history, and using less of your available credit. You can also check your credit report for errors and dispute them if necessary.

If you’re not sure what your credit score is, you can check it for free on several websites, including AnnualCreditReport.com and CreditKarma.com.

Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is the percentage of your monthly income that goes toward paying down debts—including your mortgage, car loan, student loans, and credit card debt.

Lenders want to be sure that you can afford your monthly debt payments, and a high DTI ratio could indicate that you’re struggling to do so. If your DTI ratio is too high, you may not be able to qualify for a loan—or you may only qualify for a loan with a higher interest rate.

To calculate your DTI ratio, divide your monthly debt payments by your monthly income. You can also use an online DTI calculator.

For example, say your monthly income is $3,000 and your monthly debts are $600 (car loan), $500 (student loan), and $400 (credit card). Your DTI ratio would be 25% ($1,500/$6,000).

In general, lenders prefer to see a DTI ratio of 36% or less. If yours is higher than that, you may want to focus on paying down some of your debts before applying for a loan.

Your Employment History

Lenders want to see a steady employment history because it helps them determine if you’re likely to repay your loan. A strong employment history shows that you have a steady income, which is necessary to repay a loan.

Lenders typically want to see at least two years of steady employment, though some may consider borrowers with less time on the job if they have other strong qualifications (such as a high credit score). If you’re self-employed, lenders will usually require that you have been in business for at least two years.

To prove your employment history, lenders will typically ask for your W-2 forms from the past two years or your most recent federal tax return if you’re self-employed. They may also contact your employer directly to verify your employment and income.

Your Income

One of the most important factors in qualifying for a loan is your income. Lenders will want to see that you have a steady income stream and that you are able to make your loan payments on time. There are a few different things that lenders will take into account when considering your income, including:

-Your employment history

-Your current salary

-Any other sources of income (e.g. child support, alimony, etc.)

It’s important to remember that each lender has their own criteria for what they consider to be a “good” or “bad” income, so it’s always best to shop around and compare offers before you commit to a loan.

How to Qualify for a Loan

Before you can qualify for a loan , you must first meet a lender’s qualifications. While each lender has different standards, there are some general qualifications that most lenders require. These include having a good credit score , a steady income, and a low debt-to-income ratio. If you can meet these qualifications, you have a good chance of being approved for a loan .

Get a Cosigner

One option for increasing your chances of qualifying for a loan is to have a creditworthy cosigner. A cosigner is somebody who agrees to take joint responsibility with you for repaying the loan. The cosigner doesn’t actually receive any of the loan funds, they just agree to make payments if you can’t.

The presence of a cosigner can sometimes make up for shortcomings in your own finances. For example, if you have little income or a very high debt-to-income ratio, adding a cosigner may help you qualify. Adding a cosigner may also help you get a lower interest rate on the loan, since lenders will view the loan as less risky.

Of course, there are downsides to having a cosigner as well. The biggest one is that if you can’t make your payments, it will negatively impact your cosigner’s credit score and financial standing just as much as it will yours. That’s why it’s important to be absolutely sure that you can afford the loan before you ask somebody to cosign.

Find the Right Lender

To qualify for a loan, you’ll need to find the right lender. There are many different types of lenders, and each one has different requirements. Finding the right lender is essential to qualifying for a loan.

The first step in finding the right lender is to shop around. Talk to several different lenders and compare their terms. It’s important to find a lender who offers competitive rates and terms that fit your needs.

Once you’ve found a few potential lenders, the next step is to check their requirements. Each lender has different requirements for loan qualification. Some common requirements include a minimum credit score, proof of income, and collateral.

If you meet the requirements of a particular lender, the next step is to apply for the loan. The application process will vary from lender to lender, but in general, you’ll need to fill out an application and provide supporting documentation.

After you’ve applied for the loan, the lender will review your application and make a decision. If you’re approved, you’ll receive the loan funds and can begin using them as you see fit.

Apply for the Loan

The first step in applying for a loan is to complete a loan application. The loan application is a document that lists your personal information, current employment information, monthly income and expenses.

You will also need to provide supporting documentation to verify the information on your loan application. This may include pay stubs, tax returns, bank statements and other financial documents.

Once you have gathered all of the required documentation, you will need to submit it to the lender. The lender will then review your application and supporting documentation to determine if you qualify for the loan.

Conclusion

In order to qualify for a loan, you will need to have a good credit score and a steady income. You will also need to provide collateral, such as a house or a car. The lender will then evaluate your application and decide whether or not to approve the loan.