How Long Does a Delinquency Stay on Your Credit Report?

Contents

The length of time a delinquent account stays on your credit report depends on the type of debt and your payment history.

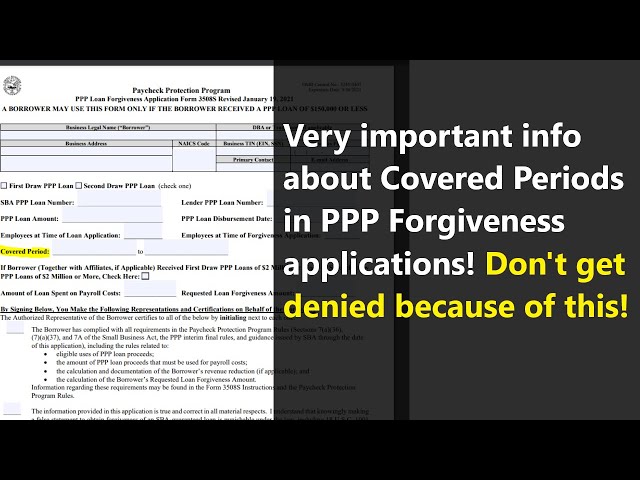

Checkout this video:

The Basics of a Delinquency

A delinquency is when you have a debt that is overdue or unpaid. This can happen if you miss a payment on a loan or credit card, or if you don’t pay your taxes or utility bills on time. A delinquency can also be when you don’t make the minimum payment on a debt.

What is a delinquency?

A delinquency is simply a late payment on a debt. Depending on the type of debt, a delinquency can refer to a payment that is 30 days or more late, 60 days or more late, or 90 days or more late.

Delinquencies can occur on any type of debt, including credit cards, mortgages, auto loans, personal loans, and student loans. When a delinquency occurs, it is typically reported to the credit bureaus by the lender.

Delinquencies can have a significant negative impact on your credit score. The effects of a delinquency will depend on several factors, including the type of debt involved and the severity of the delinquency. In general, however, you can expect your credit score to drop by 100 points or more if you have a delinquent account.

A delinquency will stay on your credit report for seven years from the date of the first missed payment. After that time, the delinquency will be removed from your credit report and will no longer impact your credit score.

If you have one or more delinquent accounts, it is important to take action to get them back on track as soon as possible. The sooner you can bring your accounts current, the less damage they will do to your credit score. You should also make sure to keep an eye on your other accounts so that you don’t fall behind again in the future.

How long does a delinquency stay on your credit report?

A delinquency stays on your credit report for seven years from the date of the first missed payment. After that, it will no longer impact your credit score. However, it is important to note that this does not mean that you will never have to pay the debt back. The delinquency will still show up on your report if the debt is sold to a collection agency or if you are sued for the debt.

The Impact of a Delinquency

A delinquency can stay on your credit report for up to seven years, and it can have a major impact on your credit score. A delinquency can also make it difficult to get approved for new credit. If you have a delinquency on your credit report, it’s important to understand how it will affect your credit.

How a delinquency can impact your credit score

Credit scoring models treat late payments differently depending on how late they are. For example, a payment that is 30 days late will have a lesser impact on your score than a payment that is 60 or 90 days late. Additionally, the longer your history of timely payments, the greater the impact of a single late payment will be.

One common misunderstanding is that once a delinquency is removed from your credit report, it will no longer impact your score. This is not true. Although the delinquent account will no longer appear on your credit report after seven years (or 10 years for bankruptcies), the effect of the late payments will continue to impact your score for up to 10 years.

If you have been delinquent on a debt, it is important to make all future payments on time in order to begin repairing the damage to your credit score. You should also consider talking to a credit counseling agency about ways to get back on track.

How a delinquency can impact your ability to get new credit

A delinquency on your credit report can impact your ability to get new credit in a few ways.

First, if you have a delinquency that is less than 90 days old, it will likely be flagged as a derogatory account by potential lenders. This can hurt your chances of being approved for new credit.

Second, even after a delinquency is more than 90 days old, it can still have an impact on your credit score. The severity of the impact will depend on how late the payments were and how long ago the delinquency occurred.

Lastly, some lenders may require that you have perfect credit in order to qualify for certain products. If you have a delinquency on your report, you may not meet their criteria and could be denied for the loan or credit card you applied for.

If you’re hoping to get new credit in the near future, it’s important to take steps to improve your credit score and remove any negative marks from your credit report.

Steps to Take if You Have a Delinquency

A delinquency, also called a derogatory item, is a negative mark on your credit report. A delinquency can stay on your credit report for up to seven years. When you have a delinquency, it is important to take steps to improve your credit score. You can do this by paying your bills on time, dispute any errors on your credit report, and keep a good credit history.

What to do if you have a delinquency

If you’re delinquent on a debt, there are a few steps you can take to try to improve your credit standing:

-Contact the creditor: You can try to work out a payment plan or dispute the debt with the creditor. If you’re able to come to an agreement, be sure to get it in writing.

-Pay the debt: If you’re able to pay the debt in full, that will be the quickest way to improve your credit standing.

-Wait it out: In general, negative information will stay on your credit report for seven years. So if you can’t pay the debt or come to an agreement with the creditor, your best bet may be to just wait it out.

How to dispute a delinquency

If you have a delinquency on your credit report, you may be able to dispute it. To do so, you’ll need to contact the credit bureau and provide documentation showing that the information is incorrect.

If the credit bureau finds that the information is indeed incorrect, they will remove it from your credit report. However, if they find that the information is correct, the delinquency will remain on your report for seven years.

In either case, it’s important to keep in mind that a disputed delinquency may still damage your credit score, even if it’s eventually removed from your report. Therefore, it’s always best to avoid delinquencies in the first place by making your payments on time and in full each month.

Bottom Line

The bottom line on delinquencies

While the effects of a delinquent account on your credit score will eventually go away, the account itself will remain on your credit report for seven years from the date it was first reported delinquent. That means if you have a delinquency that gets reported every month for six months, it will remain on your report for seven years from the date of the first missed payment.

If you’re trying to improve your credit score, you’ll need to do more than just make sure all your payments are current — you’ll also need to focus on paying down any existing debt. Reducing your overall debt load is one of the best things you can do for your credit score, and it’s something you can start working on today.