How to Qualify for a VA Loan

You may be wondering how to qualify for a VA loan. The Department of Veterans Affairs (VA) does not make loans, but instead they guarantee a portion of the loan.

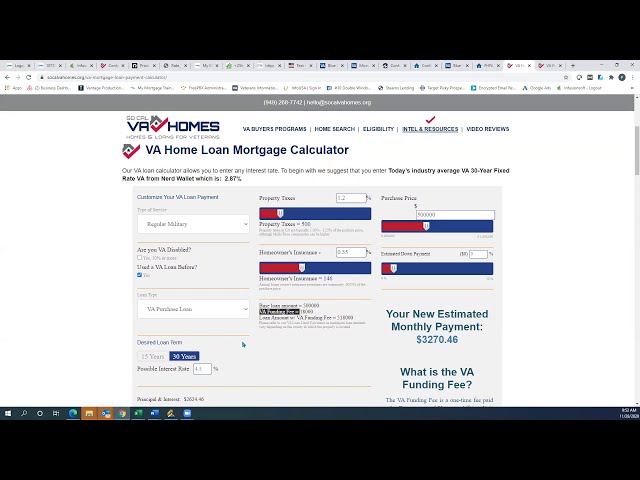

Checkout this video:

Overview of the VA Loan Program

The Department of Veterans Affairs (VA) Loan program is designed to help veterans, service members, and their families finance the purchase of a new home. The VA Loan program offers a number of benefits, including no down payment, no private mortgage insurance, and flexible credit guidelines. In order to qualify for a VA Loan, you must meet the service requirements, have a valid Certificate of Eligibility (COE), and satisfy the lender’s credit and income requirements.

What is the VA Loan Program?

The VA loan program is a government-backed mortgage program that enables qualifying veterans, active service members, and their spouses to purchase or refinance a home. VA loans are available through participating lenders and are insured by the Department of Veterans Affairs.

VA loans offer several benefits that make them a great option for eligible borrowers, including:

-No down payment required

-No private mortgage insurance (PMI) required

-Competitive interest rates

-Easier qualification requirements than conventional mortgage programs

To qualify for a VA loan, you must be a veteran, active service member, or the spouse of a service member who is eligible for VA benefits. You will also need to obtain a Certificate of Eligibility (COE) from the VA before you can apply for a loan.

Who is eligible for a VA Loan?

VA direct and VA-backed Veterans home loans can help Veterans, service members, and their survivors to buy, build, improve, or refinance a home. You’ll still need to have the required credit and income for the loan amount you want to borrow. But a Veterans home loan may offer better terms than a non-Veterans home loan. For example, practically all VA Loans offer no down payment options and don’t require private mortgage insurance (PMI).

To be eligible for a VA Loan, you must be a qualified Veteran, have completed service during certain wartime or occupational periods, or be the spouse of a Veteran who died during service or as a result of a service-related disability. Active duty service members and National Guard or Reserve members may also qualify after at least six years of service.

What are the benefits of a VA Loan?

There are many benefits to a VA Loan including:

-No down payment is required

-There is no monthly mortgage insurance premium

-Closing costs can be paid by the seller

-Competitive interest rates

-Easier qualifying standards than other loan programs

The VA Loan Process

The VA loan process can seem daunting, but if you follow these simple steps you will be on your way to homeownership in no time. The first step is to get your Certificate of Eligibility (COE). This can be done through the Veteran’s Administration website. Once you have your COE, you will need to find a lender that participates in the VA loan program.

How to apply for a VA Loan

The VA Loan Process has four steps:

1. Get a Certificate of Eligibility from the VA to prove you are a veteran, reservist or active duty service member, or a surviving spouse.

2. Shop for a lender that participates in the VA Loan Program.

3. Apply for a VA Loan.

4. Work with your lender and the VA to get the home you want.

How to get pre-qualified for a VA Loan

The first step in getting a VA loan is to get pre-qualified. This can be done through any VA-approved lender, and you will need to provide some basic financial information in order to get started. Once you have been pre-qualified, you will then need to get a Certificate of Eligibility from the VA in order to move forward with the loan process.

How to get pre-approved for a VA Loan

The first step in getting a VA loan is to get pre-approved. You can do this with a loan officer at a bank, credit union, or other type of lender, or with a VA-specific lender.

Getting pre-approved is an important first step because it gives you an accurate idea of how much you can afford to borrow and budget for your monthly mortgage payment. The pre-approval process also gives lenders an opportunity to evaluate your creditworthiness and decide whether you qualify for a loan.

To get pre-approved for a VA loan, you will need to provide the following information:

-Your social security number

-Your contact information

-Your employment history

-Your income and asset information

The VA Loan Closing Process

VA loans are unique among other loans because there is no down payment or monthly mortgage insurance requirement. But, there is a “funding fee” which can be rolled into the loan or paid upfront. Also, the VA has a list of approved lenders who they work with to originate these loans. So, it’s important to choose a lender that you’re comfortable with and that you feel confident about. The closing process for a VA loan is similar to any other loan, but there are a few things that are unique to VA loans.

What to expect during the VA Loan closing process

The home-buying process can be exciting, stressful, and confusing all at the same time. Our goal is to help you understand the process so that you feel confident and comfortable every step of the way. Part of that process is understanding what happens during a VA Loan closing.

First things first: You (and your spouse, if you’re married) will need to sign a ton of paperwork. The good news is that your VA Loan Specialist will be by your side throughout the entire process to explain everything and answer any questions you may have.

Next, your real estate agent or attorney will likely attend the closing to make sure everything goes smoothly on your end. They’ll also be there to answer any questions about the property itself.

At the closing table, you’ll need to bring a government-issued photo ID as well as any money required for your down payment, closing costs, and prepaid items (like homeowners insurance). Your VA Loan Specialist will let you know exactly how much money to bring in advance so there are no surprises on closing day.

Once everyone has signed all of the necessary paperwork, the loan funds will be disbursed and the property officially becomes yours!

How to prepare for the VA Loan closing process

You’ve found the perfect home and made an offer. It was accepted, and now it’s time to close on your VA loan. Congratulations! You’re one step closer to homeownership. Below is a general overview of how the VA loan closing process works.

The first thing you should do is contact a Veterans United Loan Officer to get prequalified for a loan amount. They will also pull your credit report, verify your employment history and income and order a property appraisal. Once you have been prequalified, you will need to provide documentation to support the items that were used to prequalify you.

Once everything has been received and reviewed, your Loan Officer will send you a list of conditions that need to be met in order for your loan to be approved. These conditions will need to be satisfied before we can schedule your closing. Once all of the conditions have been satisfied, we will schedule a time and place for you to sign your loan documents and receive the keys to your new home!