Where Can I Get a Loan Quickly?

Contents

If you’re in need of some quick cash, you might be wondering where you can get a loan quickly. While there are many options out there, not all of them may be right for you. In this blog post, we’ll explore some of the best places to get a loan quickly, so you can make the best decision for your needs.

Checkout this video:

Introduction

If you’re in need of a loan quickly, there are a few options available to you. You can get a loan from a bank or credit union, or you can take out a personal loan from an online lender.

Banks and credit unions typically have the lowest interest rates and the best terms, but they can be slow to process loans. If you need the money quickly, an online lender may be a better option. Online lenders typically have higher interest rates and fees, but they can get the money to you faster.

Here are a few places to get a loan quickly:

– Online lenders: Prosper, LendingClub, Avant

– Credit unions: Navy Federal Credit Union, PenFed Credit Union

– Banks: Wells Fargo, Capital One

How to Get a Loan Quickly

There are many ways to get a loan quickly. You can go to a bank or a credit union, or you can use an online lending service. There are also many different types of loans, so you’ll need to decide which one is right for you. We’ll go over all of these options so you can get the money you need as soon as possible.

Research Your Options

Loans can be obtained from many different sources, including banks, credit unions, online lenders, and peer-to-peer lending platforms. The best way to find a loan that meets your needs is to research your options and compare various offers.

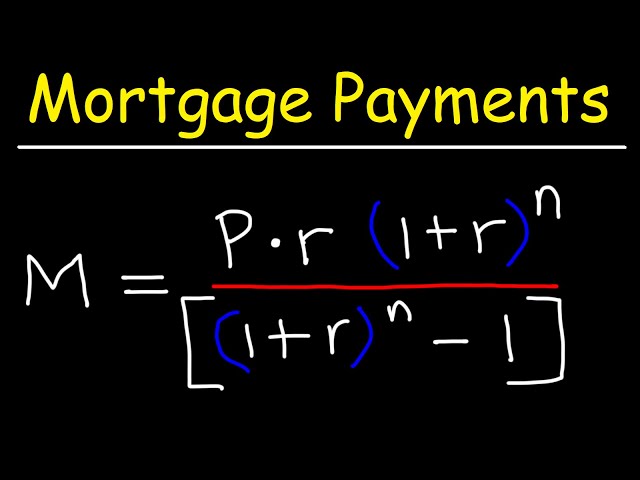

When you’re comparing loans, be sure to consider the following factors:

-The interest rate

-The loan term

-The repayment schedule

-The fees and charges

-The level of customer service

Consider Online Lenders

If you’re looking for a loan quickly, you may want to consider online lenders. Online lenders can often approve and fund loans much faster than traditional lenders. And because they’re based online, they can often offer more flexible terms and conditions.

Some online lenders that you may want to consider include SoFi, LendingClub, and Prosper.

Use a P2P Lending Platform

Peer-to-peer lending platforms are online marketplaces that directly connect borrowers with individuals and institutional investors who are willing to fund their loans. This unique funding model enables borrowers to get their loans funded more quickly than traditional bank loans, and it also often results in lower interest rates.

Some popular peer-to-peer lending platforms include LendingClub, Prosper, and Upstart. To get started, simply create an account on one of these platforms and submit your loan request. Once your loan is approved, the funds will be deposited into your bank account within a few days.

Get a Loan from a Family Member or Friend

If you’re in a bind and need money quickly, one option is to get a loan from a family member or friend. This can be a good option if you have good credit and a close relationship with the person loaning you the money. You’ll likely need to sign a personal loan agreement that outlines the repayment terms.

Before taking out a loan from someone you know, make sure you understand the risks. You could damage your relationship if you don’t repay the loan as agreed. You’ll also need to be honest about your ability to repay the debt. If you can’t repay it, you could end up ruining your relationship and damaging your credit score.

Conclusion

If you’re in a bind and need cash quickly, there are several places you can turn to for a loan. You can visit your local bank or credit union, use an online lending service, or borrow from a friend or family member. Each option has its own set of pros and cons, so be sure to compare them carefully before deciding which one is right for you.