What Do I Need for a Loan?

Contents

If you’re wondering what documents you need in order to apply for a loan, look no further! This blog post has everything you need to know.

Checkout this video:

Types of Loans

There are a few things you’ll need in order to get a loan. The most important thing you’ll need is a good credit score. You’ll also need a down payment, and you’ll need to prove that you have a steady income. If you have all of these things, you should be able to get a loan.

Secured Loans

A secured loan is a loan in which the borrower pledges some asset (e.g. a car or house) as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan. The debt is thus secured against the collateral, and if the borrower defaults, the creditor can attempt to recover the debt by seizing and selling the asset used as collateral.

Unsecured Loans

Unsecured loans are not backed by collateral, so they’re riskier for lenders. As a result, unsecured loans tend to have higher interest rates than secured loans. They’re also harder to qualify for if you have bad credit.

Unsecured personal loans are available from banks, credit unions, and online lenders. The best way to compare offers from multiple lenders is to use a personal loan calculator.

Some common types of unsecured loans include:

-Credit cards: A type of revolving credit, you’ll only be charged interest on the amount you spend each month.

-Personal lines of credit: A type of revolving credit, you’ll only be charged interest on the amount you spend each month. However, lines of credit typically have higher limits than credit cards.

-Personal loans: A type of installment loan, you’ll borrowing a fixed amount of money that you’ll need to pay back with interest over a set period of time.

Loan Requirements

There are a few things you’ll need in order to get a loan. First, you’ll need to have a source of income so that you can repay the loan. You’ll also need to have a good credit history so that the lender will feel confident that you’ll repay the loan. Finally, you’ll need to have some collateral so that the lender has something to seize if you default on the loan.

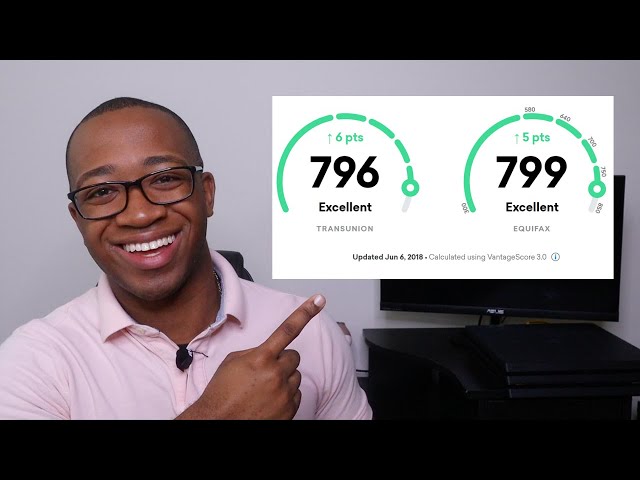

Credit Score

Your credit score is one of the most important factors in determining whether you will be approved for a loan. Lenders use your credit score to evaluate your creditworthiness and decide whether to lend to you. The higher your credit score, the better your chances of being approved for a loan with a lower interest rate.

A good credit score is generally considered to be a score of 700 or above. However, each lender has its own definition of what constitutes a “good” credit score, so it’s important to shop around and compare rates before applying for a loan.

If you have a low credit score, there are still options available to you. You may be able to get a bad credit loan with a high interest rate, or you may be able to improve your credit score by taking some steps to improve your credit history.

Employment Status

Many lenders require that you be employed full-time, or at the very least, employed part-time with a steady income. Lenders want to see that you have the financial ability to repay your loan, and employment is oftenUsed as a gauge for this ability. If you are unemployed, you may still qualify for a loan if you can provide documentation of another source of income, such as alimony, child support, or disability benefits.

Debt-to-Income Ratio

Debt-to-Income Ratio: Lenders use your debt-to-income ratio (DTI) to evaluate your current financial situation and your ability to repay a new loan. They want to be sure that you’re not overextended. To calculate your DTI, add up all of your monthly debt payments and divide them by your gross monthly income. Most lenders look for a DTI of 36% or less, though there are some exceptions. For example, some government programs allow for a higher DTI.

Your debt includes more than just your monthly loan payments. Lenders will also factor in things like credit card payments, child support, and alimony when they’re calculating your DTI. So even if you don’t have any outstanding loans, you might still have a high DTI if you have other debts that you’re struggling to pay off.

Collateral

In order to get a loan, you will need to offer something of value to the lender as collateral. This is usually in the form of property, savings, or investments. The collateral is used as a way to secure the loan, in case you are unable to repay it. If you default on the loan, the lender has the right to seize the collateral and sell it in order to recoup their losses.

Loan Process

If you are looking to take out a loan, there are a few things that you will need in order to make the process go smoothly. First, you will need to have a good credit score. This will give you a better chance of getting approved for a loan. Second, you will need to have a co-signer. A co-signer is someone who agrees to sign the loan with you and is responsible for making the payments if you are unable to do so. Third, you will need to have collateral. Collateral is something that you can use to secure the loan, such as a piece of property or a vehicle. Fourth, you will need to fill out a loan application. This will provide the lender with information about your financial situation and why you are requesting the loan. Fifth, you will need to provide documentation. Documentation may include things such as pay stubs, tax returns, and bank statements.

Pre-Qualification

One of the first steps in the home loan process is getting pre-qualified for a mortgage. Pre-qualification is an estimation of what you might be able to borrow based on factors including your income, debts and credit score. It’s a helpful first step in becoming educated about your loan options and budget. Keep in mind that pre-qualification does not guarantee loan approval.

A lender will gather information about your employment, financial history and credit score then provide you with an estimate of how much money you might be able to borrow and what interest rate you can expect to pay. This process is usually done online or over the phone and does not require a formal application or a credit check. It’s a good idea to get pre-qualified with multiple lenders so that you can compare pricing and terms before moving forward.

Application

To begin the loan process, you’ll need to fill out an application. Be prepared to provide the following information:

-Your Social Security number

-Your driver’s license or state ID number

-Your current address, phone number and email address

-Your employment information, including your employer’s name and contact information, your job title, your monthly income and your monthly housing payment (if any)

-Information about any other debts you may have, including credit card balances, car loans and child support or alimony payments

Approval

After you’ve submitted your loan application, the lender will review your information and decide whether or not to approve your loan. If you’re approved, the lender will send you a loan offer, which will include the terms and conditions of the loan. Make sure to review the offer carefully before you accept it. Once you accept the offer, the lender will start the process of sending the money to your bank account.

Closing

The final stage of the loan process is closing, which refers to the time when the borrower signs the final paperwork and the loan funds are dispersed. Prior to closing, the borrower will likely need to obtain homeowner’s insurance and title insurance, as well as have a final walk-through of the property to ensure that any agreed-upon repairs have been made. Once everything is in order, closing can take place at the office of the lender, escrow company, or attorney. The borrower will need to sign a number of documents at closing, including the mortgage note, deed of trust (if applicable), and various disclosures.

Repayment

If you’re thinking about taking out a loan, you’ll need to consider how you’ll repay it. You’ll need to have a repayment plan in place before you can apply for a loan. There are a few things to think about when you’re creating a repayment plan. You’ll need to consider your budget, your income, and your debts. You’ll also need to think about the interest rate on the loan.

Interest Rates

Interest rates on personal loans can range from about 6% all the way up to 36%. So, if you borrow $10,000 at an interest rate of 30% and repay it over five years, you’ll end up paying $13,800 in total – that’s almost $4,000 more than the original loan amount.

Of course, the flip side of this is that personal loans can often help people save money on interest payments when compared to other types of debt, such as credit cards or personal lines of credit.

Loan Terms

Loan terms are the conditions under which you agree to repay a loan. They include the length of time you have to repay the loan (the term), the amount you will pay each month (the payment), and the interest rate. All loans have terms, and it’s important to understand them before you agree to a loan.

The term is the length of time you have to repay the loan. The payment is the amount you will pay each month, and the interest rate is the cost of borrowing money. All loans have terms, and it’s important to understand them before you agree to a loan.

Most loans are issued for a specific term, such as five years or 10 years. At the end of the term, the loan is paid off in full. Some loans, such as credit cards, may have no set term; in this case, you’ll need to make regular minimum payments until the balance is paid off.

The payment is the amount you will pay each month toward your loan. It is important to make your payments on time; if you don’t, you may be charged late fees or your account may go into default.

The interest rate is the cost of borrowing money. It is expressed as a percentage of the loan amount and is usually fixed for the life of the loan. For example, if you take out a $100,000 loan at 4% interest, your monthly payment will be $399 for 30 years.

Loan Consolidation

Loan consolidation is when you take out a new loan to repay multiple existing loans. Usually, the new loan has a lower interest rate than the previous loans, which can save you money on interest over time. Loan consolidation can also simplify your monthly loan payments by combining them into one payment.

If you’re considering consolidating your loans, here are a few things to keep in mind:

-Your new monthly payment may be higher or lower than your current payments, depending on the terms of the consolidation loan.

-You may be able to choose a different repayment plan for your consolidation loan.

-You may be able to get a lower interest rate on your consolidation loan if you have good credit and meet other requirements.

-You may be able to consolidate federal and private student loans into one loan.

-Consolidating your loans will not necessarily lower your total monthly payments.