Who Evaluates a Mortgage Loan?

Contents

There are many factors that contribute to the decision of whether or not to approve a mortgage loan. Find out who makes the final call.

Checkout this video:

Who evaluates a mortgage loan?

There are generally three parties who are involved in the evaluation of a mortgage loan: the borrower, the lender, and a third-party evaluator. The borrower is obviously interested in getting the loan approved in order to purchase a property; the lender is interested in being repaid of the amount loaned plus interest; and theevaluator is interested in making sure that the loan meets all necessary requirements.

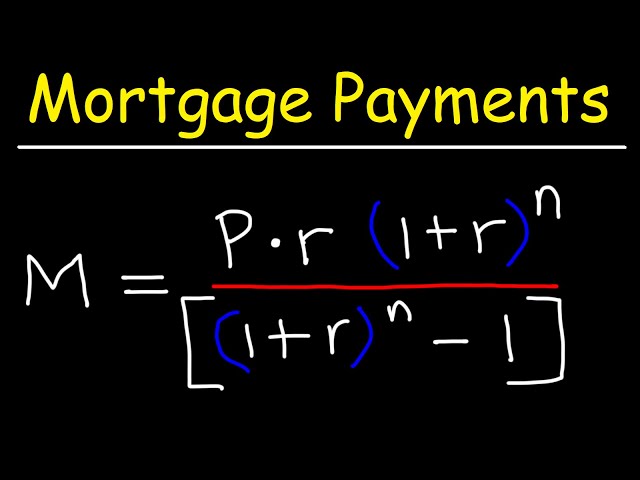

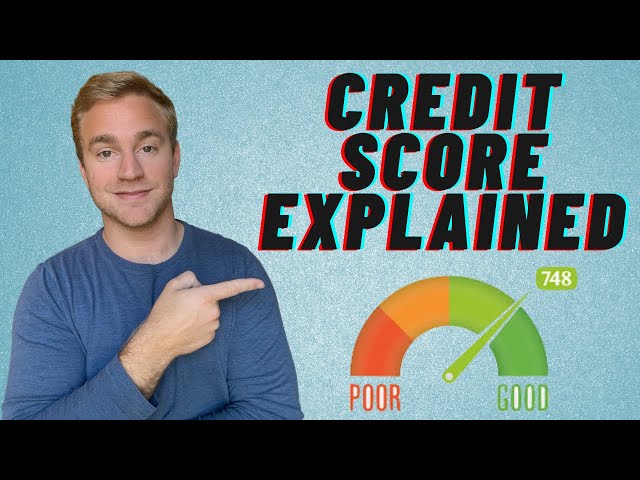

The evaluator will take into account many different factors when determining whether or not to approve a loan, such as the borrower’s credit score, employment history, and current debts. The lenders will also consider these factors, but they will also look at their own internal guidelines to see if the borrower meets their criteria. In some cases, the lender may require that a cosigner be used in order to reduce their risk.

The different types of evaluations

There are several types of evaluations that may be required when you apply for a mortgage loan. The most common is a credit report, which simply runs a borrower’s credit history to assess their creditworthiness. Other types of evaluations include an appraisal, which assesses the value of the property being purchased, and a Title search, which checks for any outstanding liens or claims against the property.

The benefits of having a professional evaluation

When you’re shopping for a mortgage loan, it’s important to understand the role of the loan evaluator. The loan evaluator is the professional who will determine whether or not you qualify for the loan.

There are many benefits to having a professional evaluation, including:

-You’ll know exactly what you can afford: A loan evaluator will take a close look at your finances and assess your ability to repay the loan. This will help you determine how much house you can realistically afford.

-You’ll avoid making any mistakes: The loan evaluator will check for any errors in your application and make sure that all of the required documentation is in order. This will help you avoid any delays or problems with your loan.

-You’ll get an unbiased opinion: A loan evaluator is not affiliated with any particular lender, so you can be confident that you’re getting an unbiased opinion.

If you’re considering a mortgage loan, be sure to get a professional evaluation from a qualified loan evaluator.

How to get a professional evaluation

If you’re thinking about buying a home, it’s important to get a professional evaluation of the property before you make an offer. A professional evaluation will help you determine the value of the property and whether it is a good investment.

There are several different professionals who can evaluate a property, including appraisers, real estate agents, and home inspectors. Appraisers are the most qualified to provide an accurate estimate of the value of a property. Real estate agents can provide general information about properties in an area, but they may not have specific training or experience in evaluating properties. Home inspectors can identify major repair issues that need to be addressed, but they cannot provide an estimate of the value of the property.

When you’re considering hiring someone to evaluate a property, be sure to ask about their qualifications and experience. You should also ask for references from previous clients. Once you’ve hired someone to evaluate the property, they will inspect the property and provide you with a report detailing their findings. This report will include information on the condition of the property as well as an estimate of its value.