What to Use Your Credit Card For

Contents

Get the most out of your credit card by using it for these 5 things. You’ll be surprised at how much you can save!

Checkout this video:

Introduction

In today’s materialistic world, it is very easy to get caught up in the idea of spending money. Whether it’s buying the latest fashion trend or taking a luxurious vacation, there is always something that we want that requires us to spend money. And while there is nothing wrong with spending money on things that we want or enjoy, it is important to be mindful of how we are spending our money. This is where credit cards come in.

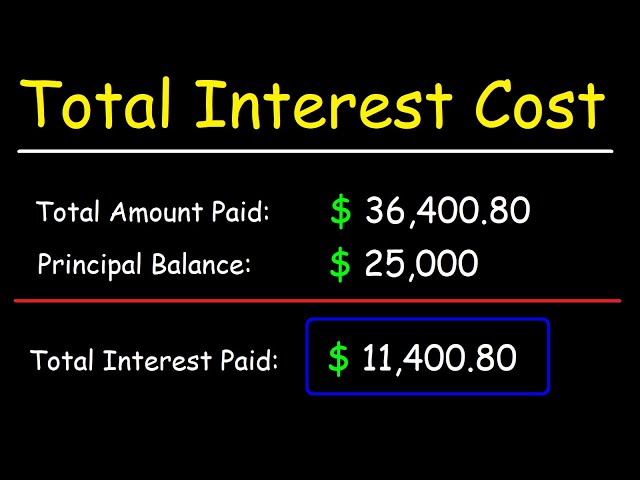

Credit cards can be a great way to finance large purchases or cover unexpected expenses. But they can also be a quick way to rack up debt if we are not careful. That’s why it’s important to use credit cards wisely and only for certain purchases. So what exactly should you use your credit card for? Below are five examples:

1. Emergencies: Credit cards can be a lifesaver in an emergency situation. For example, if your car breaks down and you don’t have the cash on hand to cover the repairs, you can put it on your credit card and pay it off over time.

2. Planned Expenses: If you know you are going to have a large expense coming up (e.g., a wedding, vacation, home renovation), using a credit card can help you spread out the cost and avoid going into debt. Just be sure to have a plan in place for how you will pay off the balance before making the purchase.

3. Everyday Purchases: If you find yourself using your credit card for everyday purchases such as gas or groceries, you may want to reevaluate your spending habits. It’s generally best to use cash or debit for these types of expenses so you don’t end up paying interest on them.

4. Online Shopping: Shopping online can be dangerous because it’s easy to spend more than we intended when we’re not standing in front of the items we’re buying. But if you use caution and only shop with reputable retailers, using a credit card for online purchases can actually be safer than using debit because you have more protection against fraud thanks to things like fraud alerts and dispute processes.

5. Rewards Points: Many credit cards offer rewards points that can be redeemed for things like cash back, gift cards, or travel expenses. If you pay off your balance in full each month, using a rewards credit card can be a great way to save money or earn perks just for making everyday purchases

What You Should Use Your Credit Card For

There are a lot of things that you can use your credit card for. You can use it for buying things online, in stores, and even over the phone. You can use your credit card for travel expenses, and you can use it for emergencies.

Everyday Purchases

Your credit card is a powerful tool that can help you build your credit, if used responsibly. But what exactly does that mean? Essentially, it means using your credit card for the right purposes – purposes that will help, not hurt, your credit score.

Here are some examples of everyday purchases that are good candidates for using your credit card:

-Gasoline

-Groceries

-Restaurant meals

-In-app purchases

-Online shopping

-Recurring subscription services (like Netflix or Spotify)

Emergency Purchases

If you ever face an emergency and need to buy something but don’t have the cash on hand, your credit card can be a lifesaver. Unexpected car repairs, medical bills, or travel expenses can all be put on a credit card. Just make sure you have a plan to pay off the balance as soon as possible to avoid accruing interest charges.

Large Purchases

Making large purchases with a credit card is one of the smartest ways to use your plastic. When you buy something expensive, you typically have a grace period of at least 20 days to pay it off before interest kicks in. That gives you time to save up the cash to pay off your balance in full. And if you do that, you’ll avoid paying any interest at all.

Another advantage of using your credit card for big purchases is that it provides extra protections that other payment methods don’t. For example, if you use a debit card and the item you bought is never delivered, it can be hard to get your money back. But if you use a credit card, you can dispute the charges and temporary withhold payment while you wait for a resolution.

Travel Purchases

If you’re anything like the average American, you probably spend a lot of time planning your dream vacation. But what about the actual process of booking airfare, hotels, and other activities?

Here’s where using a credit card can come in handy. First, many cards offer travel-related perks, such as free checked bags or priority boarding. Plus, if you use your card to book your trip, you may be able to earn rewards points that you can use toward future travel.

And if something goes wrong with your travel plans, your credit card may offer protection in the form of trip cancellation and interruption insurance. This can reimburse you for non-refundable expenses if your trip is cut short or canceleld due to a covered reason, like a severe weather event.

So when it comes to making your dream vacation a reality, don’t forget to consider using your credit card to help cover the costs.

What You Shouldn’t Use Your Credit Card For

Credit cards are a great way to earn rewards and build credit, but there are certain things you should never put on your credit card. Things like gambling, cash advances, and anything else that could put you at risk of defaulting on your debt. In this article, we’ll go over a few things you should avoid using your credit card for.

Cash Advances

A cash advance is a service provided by most credit card issuers. It allows cardholders to withdraw cash, either through an ATM or over the counter at a bank or other financial institution, up to a certain limit. Cash advances usually come with high fees and interest rates, so they should be used sparingly.

Balance Transfers

Balance transfers are when you move the debt from one credit card to another. This can be a great way to get a lower interest rate, but only if you do it right. Here are a few things to keep in mind when doing a balance transfer:

-Make sure you understand the terms of the balance transfer. Some offers will have a low introductory rate but then the rate goes up after a certain period of time.

-Know how much you will be paying in fees. Some cards will charge a fee for balance transfers, so make sure you know what that fee is before you make the transfer.

-Make sure you can pay off the debt in the introductory period. If not, you could end up paying more in interest than you would have with your old card.

Gambling

While it may be tempting to use your credit card to buy lottery tickets or gamble at the casino, you should avoid doing so. Not only can gambling lead to debt, but if you use your credit card to gamble, you could lose your line of credit and damage your credit score.

Conclusion

In conclusion, credit cards can be a great tool to help you manage your finances and build your credit. However, it’s important to use them responsibly and only charge what you can afford to pay off in full each month. If you’re not sure whether you can trust yourself with a credit card, there are other options available, such as debit cards or prepaid cards. Whatever you decide, just make sure you do your research and understand the terms and conditions before signing up for anything.