What Are Credit Cards?

Contents

A credit card is a plastic card that gives the cardholder a line of credit with which they can make purchases.

Credit Cards?’ style=”display:none”>Checkout this video:

What are credit cards?

Credit cards are a type of loan that allows you to borrow money from a lender and then pay it back over time. You can use credit cards for purchases, cash advances, and balance transfers. Credit cards typically have high interest rates, so it’s important to pay off your balance in full each month to avoid paying interest. There are also several fees associated with credit cards, such as annual fees, late payment fees, and foreign transaction fees.

How do credit cards work?

Credit cards are a type of loan that allows you to borrow money from a lender and then pay it back over time. You can use credit cards for a variety of purposes, including making purchases, transferring balances, and taking out cash advances.

When you use a credit card, you are essentially borrowing money from the card issuer. The amount of money that you can borrow is called your credit limit. Your credit limit is based on your credit history, income, and other factors.

Every time you make a purchase with your credit card, you are borrowing money from the card issuer and you will need to pay that money back over time, with interest. The interest rate on your credit card is the price you pay for borrowing money and it is generally expressed as an Annual Percentage Rate (APR).

Your monthly credit card statement will show all of your activity for the month, including any new charges, payments, interest charges, and any other fees. You will need to pay at least the minimum payment by the due date to avoid being charged late fees. If you only make the minimum payment each month, it will take you longer to pay off your debt and you will end up paying more in interest.

It’s important to understand how credit cards work before you apply for one. Be sure to read through all of the terms and conditions before you agree to open a new account.

What are the benefits of using a credit card?

There are many benefits of using a credit card, including the following:

-Convenience: Credit cards are accepted almost anywhere in the world, so you can use them to make purchases or withdraw cash no matter where you are.

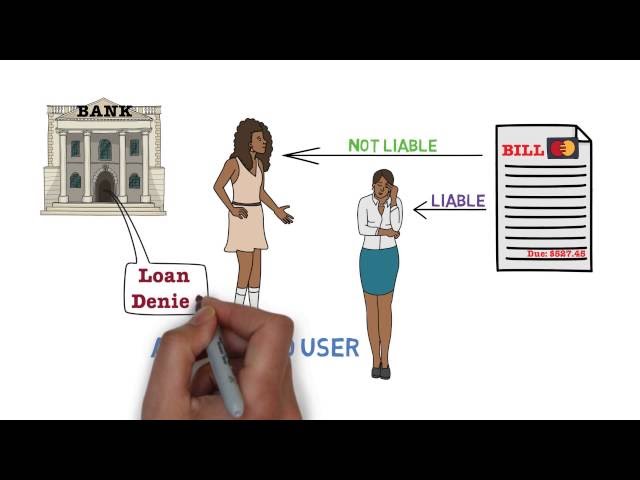

-Safety: Credit cards offer a level of safety and protection that other payment methods don’t. For example, if you lose a credit card, you can report it to the issuing company and they will cancel the card and issue you a new one. Additionally, most credit card issuers offer fraud protection, so you’re not responsible for unauthorized charges.

-Rewards: Many credit cards offer rewards programs, such as cash back or points that can be redeemed for travel, merchandise, or gift cards.

-Build credit: If you use a credit card responsibly (i.e., make payments on time and keep your balance low), it can help build your credit history and improve your credit score.

What are the drawbacks of using a credit card?

There are a few potential drawbacks to using a credit card, including the following:

-You may be charged interest on your purchases if you don’t pay off your balance in full each month.

-Credit cards can be a form of debt, which can lead to financial stress.

-If you miss payments or default on your credit card, this can damage your credit score.

-There is also the potential for fraud and identity theft when using a credit card.

Types of credit cards

There are many different types of credit cards available to consumers today. Each type of credit card offers different features and benefits. Some of the most popular types of credit cards include cash back cards, rewards cards, balance transfer cards, and low interest rate cards. Let’s take a closer look at each type of credit card .

Secured credit cards

A secured credit card is a credit card that requires you to put down a deposit, which acts as your credit limit. For example, if you put down a $200 deposit, your credit limit will be $200. If you don’t make your payments, the issuer can keep your deposit.

People often get secured credit cards to build or rebuild their credit. Because secured cards are less risky for issuers, they may be easier to get than unsecured cards. And because they report to the major credit bureaus like any other credit card, using one responsibly can help you build credit over time.

If you’re thinking about getting a secured card, consider these factors:

– How much money are you able to put down for a deposit? The higher the deposit, the higher your credit limit — and the more it will cost you if you don’t make your payments and lose your deposit.

– How easy is it to get approved for the card? Some issuers have stricter requirements than others.

– Does the issuer report to the major credit bureaus? If not, using the card won’t help you build credit.

– What are the fees? Many secured cards have annual fees, and some also have monthly or one-time fees. Compare offers to find one that has low or no fees.

Unsecured credit cards

An unsecured credit card is a credit card that isn’t backed by any collateral, such as a savings account, home equity line of credit, or automobile. An unsecured card is also sometimes called a “plain vanilla” credit card.

The biggest advantage of an unsecured card is that it’s much easier to get than a secured card. That’s because you don’t have to put down a deposit, which acts as collateral in case you default on your payments.

Unsecured cards are also helpful for building or repairing your credit history because they report your activity to the major credit bureaus. However, if you carry a balance on your unsecured card from month to month, you’ll likely have to pay interest on that balance, which can add up quickly. And if you’re late with payments or max out your credit limit, you could damage your credit score.

Some issuers offer both secured and unsecured cards. If you’re not sure which type of card is right for you, compare the features and benefits of each before applying.

Prepaid credit cards

Prepaid cards look and work like credit cards, but there’s no credit line attached to them. You load money onto the card in advance, and then use it wherever credit cards are accepted.

Prepaid cards charge various fees, but they can be a good way to control spending or give a teenager their first taste of financial independence. Just keep in mind that prepaid cards don’t help you build credit because they’re not reported to the major credit bureaus.

How to use credit cards responsibly

Credit cards can be a great way to help build your credit score and improve your financial situation. However, it is important to use them responsibly. This means only using them for things you can afford and making sure you make your payments on time. Let’s dive into the details of how to use credit cards responsibly.

Do not spend more than you can afford to pay back

When used responsibly, credit cards can provide a convenient way to make everyday purchases, spread the cost of larger items, or access funds in an emergency. But if you don’t keep on top of your repayments, you could end up paying more in interest and fees than the value of your original purchase.

Here are some tips to help you use credit cards responsibly:

– only spend what you can afford to pay back;

– make sure you keep up with your minimum monthly repayments;

– aim to pay off your balance in full each month;

– check your statements regularly and report any suspicious activity to your card issuer as soon as possible;

– if you’re struggling to keep on top of your repayments, contact your card issuer to discuss your options.

Pay your bill on time

One of the most important things you can do to maintain a good credit score is to pay your bill on time, every time.late payments can negatively impact your credit score, so it’s important to make sure you pay at least the minimum payment by the due date. You should also try to keep your balances low, as high balances can also impact your credit score.

Do not max out your credit limit

One of the worst things you can do with your credit card is to max it out. This will not only give you a lower credit score, but it will also make it more difficult for you to make your payments on time. If you have a balance that is close to your credit limit, try to pay it down as soon as possible.

How to choose the right credit card

With so many different credit cards available, it can be hard to know which one is right for you. Do you want a low interest rate? A rewards program? No annual fee? It’s important to understand the different types of credit cards before you choose one.

Consider your financial needs

When you’re choosing a credit card, the first step is to figure out what you need from it. If you carry a balance from month to month, you might want to look for a card with a low APR (annual percentage rate). If you travel frequently, you might want a card that doesn’t charge foreign transaction fees. And if you have good credit, you might be able to qualify for a rewards card that offers cash back or points.

Some cards offer a combination of these features, but most cards focus on one or two. So before you start shopping around, it’s helpful to think about which features are most important to you. Once you know what you’re looking for, you can start comparing cards and finding the one that’s right for you.

Compare credit card features

Before you start filling out credit card applications, it’s important to understand what you’re looking for in a credit card. Do you want a card that offers rewards points? Or do you prefer a lower interest rate? Maybe you simply want a card with no annual fee.

Figuring out which features are most important to you can help you narrow down your choices and choose the best credit card for your needs. Once you’ve comparison-shopped and found the right credit card, be sure to read the terms and conditions carefully before you submit your application.

Read the fine print

When you’re considering a new credit card, it’s important to read the fine print before you make a decision. This includes both the terms and conditions of the card, as well as the fees and interest rates that may apply.

One of the most important things to look for is the APR, or annual percentage rate. This is the interest rate that will be applied to your balance if you don’t pay it off in full each month. It’s important to note that different cards may have different APRs for purchases, balance transfers and cash advances.

Another thing to watch out for are annual fees. Some cards charge an annual fee just for having the card, regardless of whether you use it or not. Others may waive the fee if you meet certain criteria, such as making a certain number of purchases per year.

Finally, make sure you understand any rewards programs that come with the card. These programs can be a great way to earn points or cash back on your spending, but they can also be complex. Make sure you know how to earn and redeem rewards before you sign up for a card.