The Employee Retention Credit: What You Need to Know

Contents

The Employee Retention Credit (ERC) is a refundable tax credit for eligible employers that retain employees during the COVID-19 pandemic. If you are an eligible employer, learn more about how the ERC can help you keep your employees and what you need to know to claim the credit.

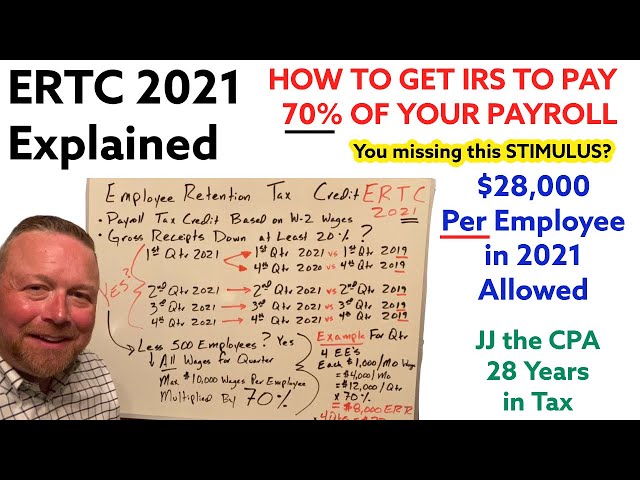

Checkout this video:

The Basics of the Employee Retention Credit

The Employee Retention Credit is a refundable tax credit for eligible employers that retain their employees during the COVID-19 pandemic. The credit is available for eligible employers that have experienced an economic hardship due to the pandemic. To be eligible, employers must have experienced a decrease in gross receipts of at least 50% when comparing any quarter in 2020 to the same quarter in 2019. If your business meets these criteria, you may be eligible for the Employee Retention Credit.

What is the Employee Retention Credit?

The Employee Retention Credit is a refundable tax credit for eligible employers that retain their employees during the COVID-19 crisis. The credit is equal to 50% of the qualified wages paid by the employer to certain eligible employees, up to $5,000 per employee. Qualified wages also include certain health plan expenses allocable to those wages.

Employers are eligible for the credit if their operations have been fully or partially suspended due to orders from an appropriate governmental authority related to COVID-19, or if they have experienced a significant decline in gross receipts in any calendar quarter in 2020. A significant decline in gross receipts is defined as a decrease of more than 50% when comparing quarterly 2020 gross receipts with the same calendar quarter in 2019.

The credit is available for retaining employees from March 13, 2020 through December 31, 2020. The credit is refundable, meaning that it will be paid out even if the employer owes no taxes.

Employers can claim the credit on their quarterly employment tax returns (Form 941), starting with the second quarter of 2020. The credit will then be applied against employment taxes owed. If the credit exceeds employment taxes owed, the excess will be refunded to the employer.

Who is eligible for the Employee Retention Credit?

The credit is available to all employers that pay qualifying wages to employees, regardless of size. The credit is especially beneficial to small businesses because it is a fully refundable tax credit, meaning that if it exceeds the amount of taxes owed, the employer will receive a refund for the difference.

To be eligible, an employer must have experienced either a full or partial shutdown due to a government order related to COVID-19, or a significant decline in gross receipts (defined as a 50% decrease when comparing any quarter in 2020 to the same quarter in 2019).

If an employer was not in business in 2019, they are instead compared to the average gross receipts for the four quarters prior to the relevant quarter. Once an employer meets one of these requirements, they are then eligible for the credit for each employee that they paid qualifying wages to.

How much is the Employee Retention Credit?

The Employee Retention Credit is a fully refundable tax credit for eligible employers that retain their employees during the COVID-19 pandemic.

The credit is equal to 50% of the qualified wages (including allocable qualified health plan expenses) that eligible employers pay to their employees. The maximum credit is $5,000 per employee ($10,000 if married filing jointly).

Qualified wages also include amounts paid under a sick leave or family leave policy for reasons related to the COVID-19 pandemic.

How to Claim the Employee Retention Credit

The new Employee Retention Credit can help employers keep their workers on the payroll during the COVID-19 pandemic. The credit can be claimed for eligible payroll expenses incurred after March 12, 2020, and before January 1, 2021. To be eligible, your business must have been affected by the pandemic. Here’s what you need to know about claiming the Employee Retention Credit.

When can I claim the Employee Retention Credit?

Eligible employers can claim the credit for qualifying wages paid after March 12, 2020, and before Jan. 1, 2021.

How do I claim the Employee Retention Credit?

To claim the Employee Retention Credit, you will need to file Form 941 for each quarter in which you wish to claim the credit. You will also need to complete Schedule B of Form 941, which is used to calculate the credit.

Tips for Maximizing the Employee Retention Credit

The Employee Retention Credit (ERC) is a refundable tax credit for eligible employers that retain employees during the COVID-19 pandemic. The credit is equal to 50% of the qualified wages paid to eligible employees, up to $5,000 per employee. The credit is available for wages paid from March 13, 2020 through December 31, 2020. In order to maximize the credit, employers should keep the following in mind:

Keep good records

The key to taking advantage of the employee retention credit is to keep good records. You will need to document your eligible payroll costs, as well as the number of employees you have on your payroll. The IRS has provided a template that you can use to help track this information.

You will also need to keep track of any PPP loans you have received, as well as any other government assistance. These loans and assistance programs may impact your eligibility for the employee retention credit.

If you have questions about how to take advantage of the employee retention credit, or if you need help keeping track of your eligible payroll costs, please contact a tax advisor or accountant.

Plan ahead

Although the employee retention credit is a valuable tool for businesses that have been adversely affected by the COVID-19 pandemic, there are a few things to keep in mind when planning to claim the credit.

First, businesses should make sure that they are eligible for the credit. To be eligible, a business must have experienced a significant decline in gross receipts or be ordered to suspend or significantly reduce operations due to COVID-19. Additionally, businesses that are part of a group of related businesses that together meet the gross receipts test may be eligible for the credit.

Second, businesses should consider whether they would be better off claiming the payroll tax deferral or the employee retention credit. The payroll tax deferral allows businesses to delay payment of certain payroll taxes, but it does not provide any immediate cash relief. The employee retention credit provides a direct reduction in payroll taxes owed, but it is only available for a limited time period. Businesses should carefully consider which option would provide the most benefit before making a decision.

third, businesses should keep in mind that the employee retention credit is only available for 2020 and 2021. This means that businesses will need to plan ahead and make sure they have enough cash on hand to cover their payroll tax liability for these years.Businesses should also keep track of their gross receipts on a monthly basis so that they can determine whether they are eligible for the credit in future years.

The employee retention credit can be a valuable tool for businesses that have been affected by COVID-19, but it is important to plan ahead and understand all of the requirements before claiming the credit.

Know the rules

The Employee Retention Credit is a refundable tax credit for eligible employers that retain their employees during the COVID-19 pandemic.

To be eligible, an employer must:

-Have experienced a full or partial suspension of operations due to a governmental order related to COVID-19, OR

-Have experienced a significant decline in gross receipts (defined as less than 50% of the comparable quarter in 2019)

Eligible employers can claim the credit for each qualified employee that is retained from March 13, 2020 through December 31, 2020. The credit is equal to 50% of the qualified wages paid to the employee, up to $10,000 in total per employee ($5,000 maximum credit per employee per calendar quarter). Wages taken into account for purposes of the credit are wages paid after March 12, 2020 and before January 1, 2021.

The credit is available to both for-profit and nonprofit employers. For-profit employers can claim the credit against payroll taxes (including both federal income taxes withheld from workers’ paychecks and the employer’s share of Social Security and Medicare taxes). Nonprofit employers can claim the credit against certain employment taxes. Employers can choose to offset payroll tax deposits in anticipation of claiming the credit on their quarterly employment tax return or annual income tax return.