What is Cash Credit?

Contents

A cash credit is a type of short-term loan that allows businesses to borrow money against their future credit sales. This type of financing can be a useful way to bridge the gap between customer payments and your own business expenses.

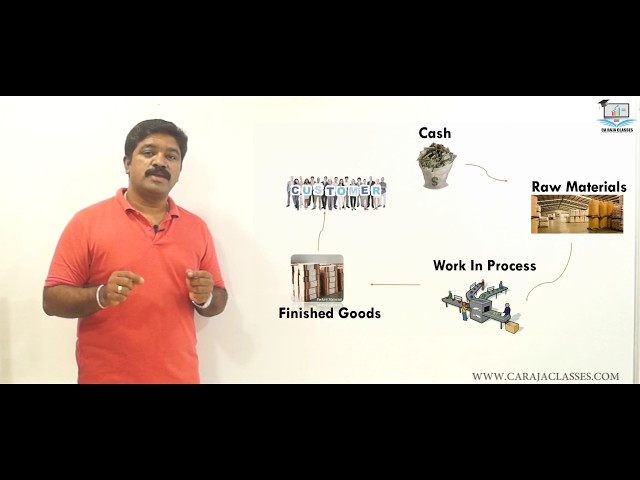

Checkout this video:

What is Cash Credit?

A cash credit is a short-term loan that is used to cover a company’s operating costs. The loan is typically repaid within 30 days, although some lenders may give a grace period of up to 60 days. Cash credits are usually unsecured, which means that they do not require collateral. Interest is charged on the outstanding balance of the loan, and the borrower is responsible for any fees associated with the loan.

How Does Cash Credit Work?

Cash credit is a type of loan that allows businesses to borrow money up to a certain limit in order to cover short-term expenses. The loan is secured by collateral, such as inventory, and is typically used for seasonal businesses or businesses with fluctuating inventory needs. This type of loan is different from a term loan, which is paid back in fixed installments over a set period of time.

Cash credit loans are typically repaid within one year, and the interest rates are usually variable. Because the loan is secured by collateral, the interest rates are usually lower than unsecured loans. If you default on the loan, the lender can seize the collateral to repay the debt.

What are the Benefits of Cash Credit?

There are many benefits of cash credit, and it is one of the most popular methods of financing business operations. When used correctly, it can provide a business with the working capital it needs to grow and expand.

Some of the benefits of cash credit include:

-It is a flexible source of funding that can be used for a variety of purposes, including inventory, equipment, or working capital.

-It is easy to obtain and typically requires no collateral.

-Repayment terms are typically short, so businesses can quickly get out of debt.

-Interest rates are often lower than with other types of financing, such as loans from banks or credit cards.

If you are thinking about using cash credit to finance your business, be sure to compare offers from multiple lenders to find the best rates and terms.

How to Get Cash Credit?

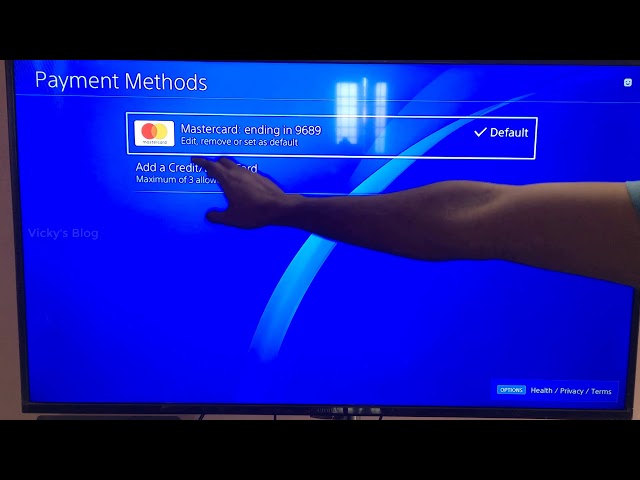

There are a few ways to get cash credit. You can either earn it through a rewards program or sign up for a cash back credit card. Alternatively, you can receive cash credit as a promotional offer from your credit card company.

If you want to earn cash credit, look for a credit card that offers Rewards Points or Cash Back. With these programs, you can earn money back on every purchase you make. For example, you might earn 1% back on every purchase, which means you’ll get $1 back for every $100 you spend. Some cards also offer bonus categories where you can earn more cash back. For example, you might earn 5% back on gas and groceries.

You can also receive cash credit as a promotional offer from your credit card company. These offers are usually for a limited time and come in the form of statement credits or bonus points. For example, your credit card company might offer $100 in statement credits if you spend $1,000 in the first three months of opening your account. Or they might offer 10,000 bonus points if you spend $2,500 in the first three months. To take advantage of these offers, make sure you read the terms and conditions carefully so that you understand how to qualify.