How Long Will It Take to Pay Off My Loan?

Contents

How Long Will It Take to Pay Off My Loan? It depends on the loan amount, interest rate, and term length. Follow this advice to pay off your loan as quickly as possible.

Checkout this video:

Introduction

You’ve just taken out a loan, and you’re eager to start paying it off. But how long will it take? It depends on the size of your loan, your interest rate, and your monthly payment. This calculator can give you an idea of how long it will take to pay off your loan. Just enter your loan information and click “Calculate.”

How long will it take to pay off my loan?

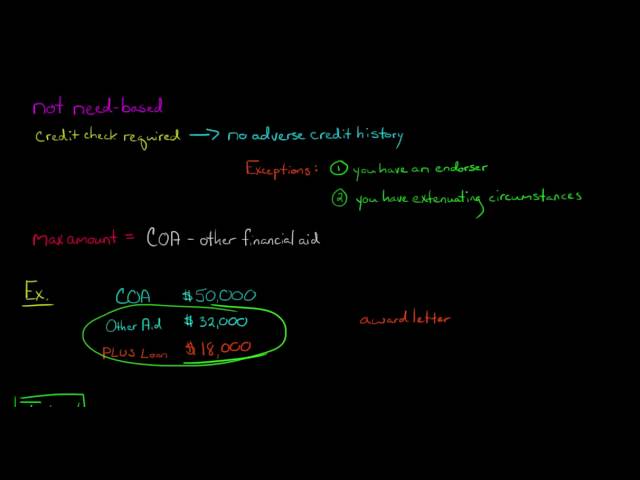

The answer to this question depends on a few factors such as the loan amount, the interest rate, and the payment schedule. In general, the longer the loan term, the longer it will take to pay off the loan. The interest rate will also affect how long it will take to pay off the loan. A higher interest rate will mean that it will take longer to pay off the loan.

Loan repayment period

The repayment period is the number of years it will take you to repay your loan if you make equal monthly payments. The repayment period is based on the amount of money you borrow, the interest rate, and the number of years you have to repay the loan.

If you want to repay your loan faster, you can make larger payments or make extra payments on top of your regular payments. Both of these will help you pay off your loan faster and save you money on interest.

To find out how long it will take to pay off your loan, use our Loan Repayment Calculator. This calculator will show you how much you will need to pay each month to repay your loan within a certain number of years. It will also show you how much interest you will pay over the life of the loan.

Loan repayment amount

Most loans are repaid in monthly installments, but the amount you pay each month can vary depending on the type of loan and your repayment schedule.

For example, if you have a $300,000 mortgage with a 4% interest rate, your monthly payment will be about $1,432. Over the course of 30 years, you’ll pay a total of $514,240 in interest.

But if you make biweekly payments instead of monthly payments, your total interest paid will be $490,581 – that’s more than $23,000 in savings!

To see how much you could save by making biweekly payments, enter your loan information into our Biweekly Loan Repayment Calculator.

Loan repayment schedule

Assuming you make all your payments on time, you can expect to pay off your loan according to the following schedule:

-For a $1,000 loan with a 5% interest rate and a 2-year repayment period, your monthly payment will be $50.

-For a $5,000 loan with a 5% interest rate and a 2-year repayment period, your monthly payment will be $250.

-For a $10,000 loan with a 5% interest rate and a 2-year repayment period, your monthly payment will be $500.

-For a $20,000 loan with a 5% interest rate and a 2-year repayment period, your monthly payment will be $1,000.

Conclusion

Based on the information you provided, it will take you years to pay off your loan. The best way to become debt-free is to make extra payments on your loan each month. Even an extra $50 payment can help you pay off your loan much faster. You should also try to get a lower interest rate on your loan if possible.