Who Qualifies for a Direct PLUS Loan?

Contents

If you’re a graduate or professional student, or the parent of a dependent undergraduate student, you may be eligible to take out a Direct PLUS Loan to help pay for college. Learn more about who qualifies for a Direct PLUS Loan and how to apply.

Checkout this video:

What is a Direct PLUS Loan?

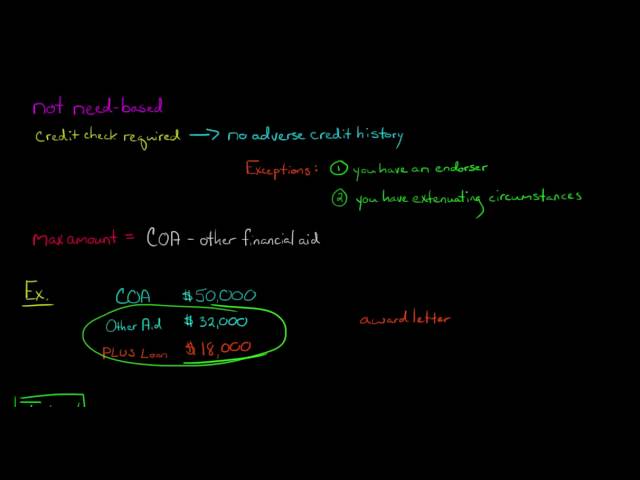

A Direct PLUS Loan is a federal student loan that parent and graduate or professional degree students can use to help pay for education expenses. This type of loan has a fixed interest rate and can be used in addition to other financial aid. The maximum amount that can be borrowed is the cost of attendance minus any other financial aid that the student is receiving.

Who is eligible to receive a Direct PLUS Loan?

The Direct PLUS Loan Program is available to eligible graduate and professional students, as well as the parents of dependent undergraduate students, to help pay for education expenses not covered by other financial aid. In order to qualify for a Direct PLUS Loan, you must:

The borrower must be a U.S. citizen or eligible non-citizen

To qualify for a Direct PLUS Loan, you must be a U.S. citizen or eligible non-citizen, and you must not have an adverse credit history (a credit check will be done).

You are considered to have an adverse credit history if you have any of the following on your credit report:

-defaulted on a federal student loan

-been more than 90 days late on payments for any other debt

-been subject to a court order or judgment related to payments on a debt

-been declared bankruptcy within the last five years

-had your wages garnished within the last five years

-had tax liens imposed on you within the last five years

The borrower must not have an adverse credit history

A Direct PLUS Loan is a federal student loan that is available to eligible graduate and professional students, as well as the parents of dependent undergraduate students, to help pay for education expenses not covered by other financial aid.

To be eligible to receive a Direct PLUS Loan, the borrower must not have an adverse credit history. An adverse credit history is defined as having any one of the following:

-More than 90 days late on any debt repayment

-A current debt that is more than 90 days late and has been submitted to a collection agency or otherwise charged off

-Any bankruptcy discharge within the past five years

-Any foreclosure within the past seven years

-Any tax lien within the past five years

The borrower must be enrolled in an eligible program of study

To be eligible to receive a Direct PLUS Loan, you must first file a Free Application for Federal Student Aid (FAFSA®) form. Then, you (the borrower) must:

– Be enrolled in an eligible program as at least a half-time student at an eligible school

– Not have an adverse credit history (a credit check will be done)

– Meet other eligibility criteria that your school and the U.S. Department of Education establish

How to apply for a Direct PLUS Loan

The first step is to fill out and submit the Free Application for Federal Student Aid (FAFSA®) form. You will need to provide information about your financial situation and your family’s income. After you have submitted your form, you will be notified if you qualify for a Direct PLUS Loan. If you do, you will then need to complete a Master Promissory Note.

Complete the Free Application for Federal Student Aid (FAFSA)

In order to apply for a Direct PLUS Loan, you must first complete the Free Application for Federal Student Aid (FAFSA®) form. This form is used to determine your eligibility for federal student aid.

The Direct PLUS Loan Application will ask you to provide information about yourself (e.g., name and date of birth), your current address and phone number, your school’s name and address, your parent’s information (if you’re a dependent student), and your current employment information (if you’re employed).

Complete a Direct PLUS Loan Master Promissory Note (MPN)

PLUS loans are federal student loans for parents and graduate or professional degree students. The U.S. Department of Education offers these loans through schools participating in the Direct Loan Program.

To get a PLUS loan, you must complete a Direct PLUS Loan Application and Master Promissory Note (MPN) at www.studentaid.gov.

You’ll need to sign in to the U.S. Department of Education’s website with your FSA ID to complete the form. An FSA ID is made up of a username and password and can be used to log in to Federal Student Aid’s online systems and sign legally binding documents electronically. If you don’t have an FSA ID, you can create one when you log in to www.studentaid.gov/annual-loans/plus/start

You will also need your school’s 9-digit federal school code which you can find on the FAFSA form or by contacting your school’s financial aid office

Complete a Direct PLUS Loan Application

To complete a Direct PLUS Loan Application, you will need the following:

-Your FSA ID

-Your school’s name and address

-The cost of attendance at your school for the period of enrollment for which you are requesting the loan

-The amount of other financial aid you are receiving

What are the interest rates for a Direct PLUS Loan?

PLUS loans help graduate students and parents of dependent undergraduate students pay for college or career school. The U.S. Department of Education offers two types of PLUS loans:

For loans first disbursed on or after July 1, 2020 and before July 1, 2021, the interest rate is 5.3%

A Direct PLUS Loan for parent and graduate students has a fixed interest rate of 5.3% for loans first disbursed on or after July 1, 2020 and before July 1, 2021. The interest rate varies each year.

What are the fees for a Direct PLUS Loan?

The fees for a Direct PLUS Loan are the same for all borrowers. There is a 4.228% loan origination fee and a 1% federal default fee. These fees are deducted from the loan proceeds when the loan is first disbursed. If you are a first-time borrower on or after October 1, 2007, there is also a 1.073% federal capitalized interest fee.

For loans first disbursed on or after October 1, 2020 and before October 1, 2021, the origination fee is 4.228%

If you’re a first-time borrower, the Department of Education will deduct the loan fee before your loan is disbursed. This means the money you get will be less than the amount you actually borrowed.

For Direct PLUS Loans first disbursed on or after October 1, 2020, and before October 1, 2021, the origination fee is 4.228%. This means that for every $100 you borrow, you’ll owe $4.228 in fees.

The fee is deducted proportionately from each loan disbursement you receive. For example, let’s say you take out a $10,000 Direct PLUS Loan. The total loan fees would be $422.80 ($10,000 x 0.04228 = $422.80). You’d get five separate disbursements of $2,000 each over the course of your enrollment period. The fee would be deducted from each disbursement, so your first check would be for $1,977.20 ($2,000 – $2.00 – $21.60).