What Is Loan Servicing and How Does It Work?

Contents

If you’re thinking about taking out a loan , you’ll want to know about loan servicing and how it works. In this blog post, we’ll explain what loan servicing is and how it works, so you can make an informed decision about whether or not it’s right for you.

Checkout this video:

What is loan servicing?

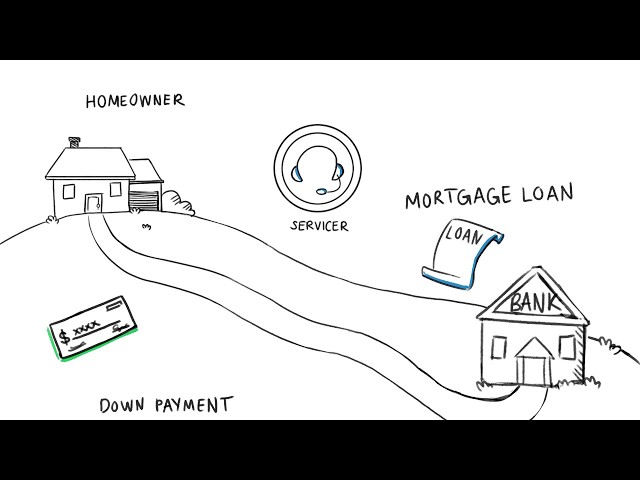

Loan servicing is the process of collecting payments from borrowers, managing the borrower’s account, and maintaining records of the loan. Servicers are responsible for sending monthly statements to borrowers, collecting payments, and responding to customer inquiries. They also keep track of the loan balance and make sure that insurance and property taxes are paid on time. If the borrower falls behind on payments, the servicer may begin the foreclosure process.

Loan servicers are usually big banks or other financial institutions. Some servicers are owned by the lender, while others are independent companies that have been hired by the lender to handle loan servicing.

When you take out a loan, you will be asked to choose a servicing option. You can choose to have your loan serviced by the lender or by an independent servicer. If you choose an independent servicer, you will need to provide your contact information so that they can send you monthly statements and collect payments.

Loan servicers are regulated by state and federal laws. These laws protect borrowers from unfair practices, such as being charged extra fees or not being told about changes to their loans. If you have a problem with your loan servicer, you can file a complaint with the Consumer Financial Protection Bureau (CFPB).

What are the benefits of loan servicing?

Loan servicing provides a number of important benefits for both lenders and borrowers. For lenders, loan servicing can help to ensure that loans are repaid on time and that borrowers remain current on their payments. Loan servicers can also help to identify potential problem loans and take action to prevent defaults.

For borrowers, loan servicing can provide a single point of contact for questions and concerns about their loans. Servicers can also help borrowers to understand their options if they encounter difficulties making their loan payments.

Loan servicers play an important role in the financial system by helping to ensure that loans are repaid and helping borrowers to avoid default.

How does loan servicing work?

From the standpoint of the borrower, loan servicing is the process that your lender uses to manage your loan from the time you close until the loan is paid off or transferred to another servicer. This includes collecting your monthly payments, crediting them to your account, and sending you an annual statement. Servicing also involves paying your property taxes and insurance premiums from your escrow account, if you have one.

Loan servicers are required by law to provide certain information and services to borrowers. For example, servicers must give you information about the balance of your loan and how to reach someone who can help you if you have questions about your account. And if you fall behind on your payments, servicers must work with you to bring your account current.

In addition, loan servicers must comply with certain laws designed to protect borrowers, such as the Servicemembers Civil Relief Act (SCRA), which provides certain protections for active-duty military members.

You can find out who services your loan by looking at your mortgage statement or contacting your lender.

Who is responsible for loan servicing?

The short answer is that loan servicers are responsible for loan servicing. But what exactly does that mean?

Loan servicers are the companies that collect payments on behalf of the lender or owner of the loan. They’re also responsible for maintaining contact with borrowers, managing escrow accounts, and handling customer service issues.

In other words, loan servicers play a vital role in making sure that loans are repaid and that borrowers have a positive experience.

It’s important to note that not all lenders service their own loans. In fact, many lenders sell their loans to third-party servicers after they’ve been originated. This is because servicing loans is a complex and time-consuming task that requires a lot of resources.

By selling their loans to servicers, lenders are able to free up time and money so they can focus on originating new loans. And because servicers are experts in loan servicing, borrowers often benefit from lower interest rates and better customer service.

If you have a loan, it’s important to stay in touch with your servicer and keep them up-to-date on your contact information. That way, you can be sure that you’ll always receive important communications about your loan – such as changes in your interest rate or payment date – in a timely manner.

What are the different types of loan servicing?

Loan servicing is the process that helps you manage your loan from start to finish. It includes everything from collecting your monthly payments to handling customer service inquiries to processing changes to your loan.

There are two main types of loan servicers: mortgage servicers and student loan servicers.

Mortgage servicers are responsible for collecting monthly mortgage payments and managing the day-to-day servicing of the loan. They also handle customer service inquiries, process changes to the loan, and provide information about the status of the loan.

Student loan servicers are responsible for collecting monthly student loan payments and managing the day-to-day servicing of the loan. They also handle customer service inquiries, process changes to the loan, and provide information about the status of the loan.

What are the challenges of loan servicing?

Loan servicing can be a complex and challenging process, particularly when loans are delinquent or in default. Some of the challenges of loan servicing include:

-Managing large volumes of data and information

-Maintaining accurate records

-Communicating with borrowers

-Dealing with borrowers who are in financial distress

-Handling customer inquiries and complaints

-Adhering to regulations and compliance requirements

What are the trends in loan servicing?

The loan servicing industry has changed dramatically in recent years, driven by technological advances, new regulations, and evolving borrower expectations. Here are some of the most important trends shaping the loan servicing landscape today:

1. Increased regulation and compliance requirements. Regulatory pressures are increasing for all financial institutions, and loan servicers are no exception. New rules from the Consumer Financial Protection Bureau (CFBP) and other agencies are making it harder for servicers to operate without incurring significant penalties for non-compliance.

2. The rise of digital servicing. Borrowers now expect to be able to manage their loans online, and servicers are responding with new digital platforms that offer self-service features and 24/7 access to account information. These platforms can help servicers improve operational efficiency and borrower satisfaction at the same time.

3. heightened borrower expectations. In addition to demanding digital capabilities, borrowers also expect a higher level of customer service from their servicers. They wantservicers who are easy to communicate with and who proactively manage their accounts to avoid problems like missed payments or negative equity.

4. The need for improved data management. With more data being generated byservicing platforms, there is a greater need for servicers to have robust data management capabilities. This includes the ability to collect, store, and analyze data to support decision-making at all levels of the organization.

5 . Increasing levels of delinquency and default. The trend of increasing delinquency and default rates that began during the Great Recession has continued in recent years, putting additional pressure on servicers to keep loans performing well. This is especially true for loans that are delinquent or in danger of becoming delinquent, as these loans are more likely to result in loss mitigation activities or even foreclosure .