When to Refinance Your Car Loan

Contents

You may be wondering when the best time to refinance your car loan is. We’ve got the answer, and some tips to get you the best rate.

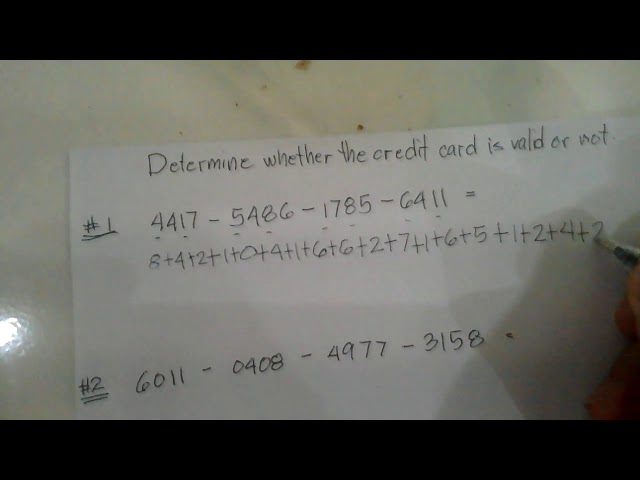

Checkout this video:

Introduction

Are you considering refinancing your car loan? If so, you’re not alone. In fact, according to a recent study by Experian, the number of people who refinanced their car loans increased by almost 50% in the first quarter of 2019 compared to the same period last year.

With interest rates at historic lows, now might be a good time to refinance your car loan and lower your monthly payments. But before you do, it’s important to understand how refinancing works and what it could mean for your finances.

In this guide, we’ll cover everything you need to know about refinancing a car loan, including when it makes sense to do it and how to get the best terms.

When to refinance

Refinancing your car loan can save you money on interest and lower your monthly payments. But it’s not always the best move. Here’s when you should (and shouldn’t) refinance your car loan.

If you can lower your interest rate

One reason to refinance is to lower the interest rate on your loan. A lower rate means you’ll pay less each month, and over the life of the loan, you’ll pay less in total interest. Try to get a loan with a lower interest rate than your current loan. Even a small difference can save you money over time.

If you have a high interest rate

Auto loans come with both fixed and variable interest rates, so it’s important to understand which one you have before considering refinancing. If your loan has a fixed interest rate, that rate will remain the same for the life of your loan no matter what happens in the market. Variable interest rates, on the other hand, can change over time.

If you have a high interest rate, it may make sense to refinance your loan in order to get a lower rate and lower monthly payments. However, it’s important to keep in mind that you’ll likely need to have good credit in order to qualify for a lower rate. If you don’t have good credit, you may still be able to refinance your loan, but you may not be able to get a significantly lower interest rate.

If you’re not sure whether or not refinancing makes sense for you, consider speaking with a financial advisor who can help you assess your options and make a decision that’s right for your unique situation.

If you have a variable interest rate

An auto loan refinance can save you money if you qualify for a lower interest rate than you’re currently paying. If your credit score has improved since you got your original loan, or if you’ve simply had the loan for a long time and want to lower your monthly payments, an auto loan refinance may be worth considering.

If you have a variable interest rate, refinancing to a fixed-rate loan may help to protect you from increasing interest rates in the future.

If you have an adjustable-rate loan

If you have an adjustable-rate loan, you should refinance as soon as possible to lock in a lower interest rate. This will save you money on interest over the life of the loan.

How to refinance

Refinancing your car loan can save you money in interest and lower your monthly payments. It can also help you pay off your loan faster. But there are some things you should know before you refinance your car loan. Here’s what you need to know about refinancing your car loan.

Research lenders

Before you begin the process of refinancing your car loan, it’s important to do your homework and research different lenders. You can start by talking to your current lender to see if they offer any refinancing programs, but don’t stop there.

Be sure to compare rates and terms from a few different lenders before making a decision. Remember, the goal is to save money so you want to make sure you’re getting the best deal possible.

You can use an online loan calculator to estimate your new monthly payment and compare it to your current payment. This will give you a good idea of how much money you could save each month by refinancing.

Compare rates and terms

When you refinance, you’ll likely be offered a loan with a lower interest rate and/or a longer loan term. These can both save you money, but there are other factors to consider as well.

Lower interest rate: A lower interest rate means you’ll pay less in interest over the life of your loan. Depending on how much you owe and the interest rate of your current loan, this could save you hundreds or even thousands of dollars in the long run.

Longer loan term: A longer loan term gives you lower monthly payments, but it also means you’ll be paying more in interest over the life of the loan. If you refinance for a longer term, make sure you can afford the monthly payments and that it won’t put undue strain on your budget.

Other factors to consider: In addition to the interest rate and loan term, there are other things to think about when you refinance. For example, some lenders charge origination fees or prepayment penalties. These fees can add hundreds of dollars to the cost of your loan, so be sure to compare offers from multiple lenders before deciding which one is right for you.

Apply for a new loan

When you know it’s time to refinance your car loan, the first step is to apply for a new loan. You can do this through a bank, credit union, or online lender.

Be sure to compare rates and terms from multiple lenders before you choose one. Pay attention to things like the interest rate, loan term, monthly payment, and any fees or charges.

You’ll also need to provide some information about your current car loan, such as the balance and whether you have any equity in the vehicle.

Once you’ve chosen a lender, you’ll need to fill out an application and provide some supporting documentation. This may include things like proof of income and assets, as well as your current car loan statement.

The lender will then review your information and make a decision on whether or not to approve your loan. If approved, you’ll receive a loan offer with terms and conditions that you can either accept or reject.

Conclusion

You’ve hopefully learned a lot about when to refinance a car loan. If you think refinancing is the right move for you, the next step is finding the best lender. We can help with that.

RateGenius offers an easy, convenient online experience and quick approvals. Plus, we work with over 150 lenders, so you can be sure you’re getting the best rate possible.

If you’re ready to start saving money on your auto loan, give us a call at (888) 749-3563 or fill out our online form to get started.