Which is the best credit bureau?

Contents

There are three credit bureaus in the United States: Experian, Equifax, and TransUnion. All three are required by law to provide consumers with a free copy of their credit report once every 12 months. So, which is the best credit bureau?

The answer may depend on your individual needs. Experian is generally considered the best credit bureau for business owners, while Equifax is often considered the best for people with bad credit. TransUnion is usually considered the best

Checkout this video:

Credit Bureaus

There are three major credit bureaus in the United States: Equifax, Experian, and TransUnion. They are all similar but have different ways of calculating your credit score. You can get your free credit report from each of them once every 12 months.

Experian

Experian is one of the three major credit bureaus in the United States, and it is one of the largest credit reporting agencies in the world. Experian collects and maintains information on more than one billion consumers worldwide.

Experian’s credit reports are used by lenders to make decisions about loan approvals, interest rates, and other terms. Experian also provides other services to businesses and consumers, such as fraud protection and ID verification.

There are a few ways to get your Experian credit report. You can request a copy of your report from Experian directly, or you can order your report from another source such as a credit monitoring service or a financial website.

If you order your report from Experian, you will have the option to receive your report online, by mail, or through a mobile app. You can also choose to receive your report with or without a credit score.

It’s important to review your Experian credit report regularly to ensure accuracy and to catch any signs of identity theft or fraud. You can get free annual copies of your Experian credit report from AnnualCreditReport.com.

Equifax

Equifax is one of the three major credit bureaus in the United States, along with Experian and TransUnion. It is a for-profit company headquartered in Atlanta, Georgia. Equifax collects and maintains information on over 800 million consumers and more than 88 million businesses worldwide.

One of the main ways Equifax makes money is by selling its data. This includes data on individual consumers, such as credit scores, credit history, and other financial information. Businesses can also purchase access to Equifax’s data so they can screen applicants, make lending decisions, and set prices for goods and services.

Equifax has been the subject of several high-profile data breaches. In 2017, the company announced that hackers had accessed the personal information of 145 million consumers, including social security numbers, addresses, and driver’s license numbers. In 2018,Equifax agreed to pay up to $700 million to settle federal and state investigations into the 2017 data breach.

TransUnion

TransUnion is one of the three major credit bureaus in the United States, along with Experian and Equifax. TransUnion maintains a database of consumer credit information that includes information on everything from credit card balances to bankruptcies. This information is then used by lenders to make decisions about loans and lines of credit.

If you’re looking to get a loan or line of credit, your lender will likely check your TransUnion credit report. That’s why it’s a good idea to stay on top of your TransUnion credit report and be aware of your TransUnion credit score. You can check your TransUnion credit report for free once every year, and you can get your TransUnion credit score for free through some financial institutions or by using a service like Credit Karma.

Factors to Consider

When you’re looking for the best credit bureau, there are a few factors you should consider. The first is the reputation of the bureau. You can check this by reading online reviews or talking to people you know who have used the bureau in the past. The second factor is the fees the bureau charges. You should make sure you know what the fees are before you sign up for anything. The last factor is the amount of time it takes for the bureau to update your credit report. You want to make sure that the bureau you choose is one that updates their reports regularly.

Credit Score

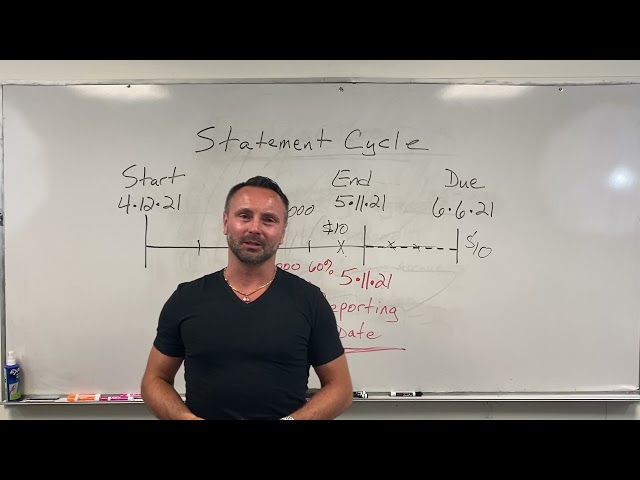

Your credit score is one of the most important factors in determining your creditworthiness. The higher your score, the better your chances of getting approved for a loan or line of credit. There are three main credit bureaus in the United States — Experian, Equifax and TransUnion — and each one uses a different scoring system.

Experian scores range from 330 to 830, with a higher score indicating a lower risk of default. Equifax scores range from 300 to 850, with a higher score signaling a lower risk of default. TransUnion scores range from 300 to 850 as well, with 850 being the best possible score.

When you’re considering which credit bureau to use, it’s important to consider all three of your options. Some lenders will only pull from one bureau, while others will pull from all three. You can request your free credit report from each bureau once per year at AnnualCreditReport.com.

Type of Loan

There are different types of loans available from different lenders. You should research and compare the different types of loans before you decide which one is right for you. Some common types of loans are:

-Personal Loans: You can use a personal loan for almost anything, from consolidating debt to paying for a vacation. Personal loan terms are usually between two and five years, and you can usually borrow up to $100,000.

-Mortgages: A mortgage is a loan that you use to buy a home. Mortgage terms are usually long-term, between 10 and 30 years, and you usually have to put down a large down payment (usually 20% of the home’s value).

-Auto Loans: An auto loan is a loan that you use to finance the purchase of a car. Auto loan terms are usually between two and seven years, and the amount you can borrow depends on the value of the car.

-Student Loans: A student loan is a loan that you use to pay for your education. Student loan terms are usually between five and 20 years, and the amount you can borrow depends on your school’s cost of attendance and your financial need.

Loan Amount

When you’re considering which credit bureau to use, one of the factors you’ll want to take into account is the loan amount. The higher the loan amount, the more important it is to get a loan with a good interest rate. If you have a low loan amount, you may be able to get away with a higher interest rate.

The Bottom Line

The best credit bureau is the one that will provide you with the most accurate and up-to-date information about your credit history. However, all three major credit bureaus (TransUnion, Experian and Equifax) are required by law to provide you with a free copy of your credit report once every 12 months. So, if you want to get a copy of your credit report more than once a year, you will have to pay a fee.