What is a Credit Card Closing Date?

Contents

- What is a credit card closing date?

- How is a credit card closing date determined?

- What are the benefits of having a credit card with a closing date?

- What are the drawbacks of having a credit card with a closing date?

- How can I avoid paying interest on my credit card balance?

- How can I make the most of my credit card closing date?

If you’re like most people, you probably have at least one credit card. And if you’re like most people, you probably don’t know what a credit card closing date is.

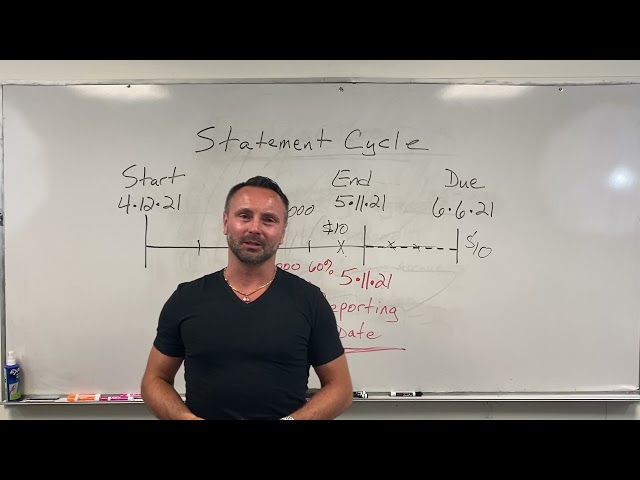

A credit card closing date is the last day of your billing cycle. Your billing cycle is usually about a month long, so your closing date is usually around the same time each month.

Your closing date is important because it’s the date that your credit card issuer reports your balance to the

Checkout this video:

What is a credit card closing date?

A credit card closing date is the last day of your billing cycle. Your billing cycle is typically 21-25 days long. So, if your billing cycle ends on the 15th of every month, your closing date would be the 15th of every month.

Your credit card issuer will send you a monthly statement on or around your closing date. This statement will show you all of the transactions that you made during that billing cycle, as well as any interest or fees that you may owe.

It’s important to pay attention to your credit card closing date because it can affect when your payments are due. For example, if you make a purchase on the first day of your billing cycle, it may not show up on your statement until the next month. But, if you wait until just before your closing date to make a purchase, it will show up on your current month’s statement and be due right away.

Some credit card issuers allow you to choose your own closing date, while others will assign one to you. You may be able to find this information in the terms and conditions of your credit card agreement, or by contacting customer service.

How is a credit card closing date determined?

Your credit card closing date is the last day of your billing cycle. It’s the day your credit card issuer calculates your balance for the month. Any transactions you make on or after your closing date will be included in next month’s billing cycle and won’t start accruing interest until then.

Most people’s closing dates fall on the same day each month, but sometimes they can vary. If you’re not sure when your credit card issuer closes your account each month, you can find out by reading through your credit card agreement or checking your most recent statement.

What are the benefits of having a credit card with a closing date?

There are a few benefits to having a credit card with a closing date. First, it can help you keep track of your spending. By knowing when your statement will close, you can better budget your spending for the month. Second, it can help you stay within your credit limit. If you know your statement will close on the first of the month, you can avoid over-spending and incurring late fees or over-the-limit fees. Finally, a closing date can help you build positive credit history. Payment history is one of the most important factors in determining your credit score, so by paying off your balance in full and on time each month, you can improve your score over time.

What are the drawbacks of having a credit card with a closing date?

The most significant drawback of having a credit card with a closing date is that it can affect your credit score. This is because the closing date is used to calculate your credit utilization, which is the amount of available credit you are using. If you have a high credit utilization, it can hurt your credit score.

How can I avoid paying interest on my credit card balance?

Your credit card closing date is the last day of your billing cycle. It’s important to know your closing date because it determines when your payment is due.

Your closing date is also the last day that any activity on your account will be considered for that billing cycle. So, if you make a purchase on the day after your closing date, it won’t show up on your bill until the next billing cycle.

Paying attention to your credit card closing date can help you avoid paying interest on your balance. If you pay off your balance before the closing date, you won’t be charged any interest for that billing cycle. However, if you don’t pay off your balance before the closing date, you’ll be charged interest on the entire balance from the previous billing cycle.

You can find your credit card’s closing date by logging into your account online or by checking your most recent statement. If you have any questions about your closing date or how to avoid paying interest on your balance, be sure to contact your credit card issuer for more information.

How can I make the most of my credit card closing date?

Your credit card closing date is the day your current billing cycle ends and your new one begins. It’s also when your credit card company reports your balance and payment activity to the credit bureaus.

Ideally, you want to pay your balance in full before your closing date so you can avoid paying interest on your purchases. But if you can’t, there are still things you can do to minimize the damage.

Here are three ways to make the most of your credit card closing date:

1. Pay more than the minimum payment.

Even if you can’t pay your balance in full, try to pay as much as you can. The more you pay now, the less interest you’ll have to pay later. And the less interest you have to pay, the more of your money will go toward actually paying off your debt.

2. Pay on time.

Paying on time is important for two reasons: It shows that you’re responsible with credit, and it helps keep your interest rates low. Most credit card companies offer a grace period of 21 days after your closing date, so as long as you pay before that, you’ll be fine.

3. Keep an eye on your balance.

Your credit card company will report your balance to the credit bureaus at the end of each billing cycle, including your closing date. So if you want to keep your debt-to-credit ratio low (which is a good thing), make sure you keep track of your balance and try to keep it below 30% of your total credit limit.