What Is A Finance Charge On A Loan?

Contents

- What is the difference between APR and finance charge?

- Does finance charge mean interest?

- What are some examples of finance charges?

- Is the finance charge the interest?

- How do you calculate the finance charge on a loan?

- How do you get a finance charge waived?

- Is 1.9 percent interest rate good?

- Is it better to have a lower interest rate or APR?

- Does 0 APR mean no interest?

- Are finance charges legal?

- How do finance charges work on credit cards?

- Why is my APR so high with good credit?

- How does APR financing work?

- What is a good APR on a 30-year mortgage?

- What is today’s APR?

- Do you pay APR if you pay on time?

- Is 10 APR on a car good?

- Why did I get charged interest on my credit card after I paid it off?

- What is excluded from the finance charge?

- Conclusion

The total amount of interest and loan fees you’ll pay over the course of your home loan is what we call a “finance charge.” This covers all pre-paid loan expenses, assuming you hold the loan until maturity (when the final payment is due). In the month of September, 2020

Similarly, Do I have to pay the finance charge on a loan?

If you don’t pay the whole amount back during the grace period, you’ll be charged a financing fee. It’s not uncommon to get hit with a finance fee even if you pay off your credit card cash advance in full on the agreed-upon due date.

Also, it is asked, How do you avoid finance charges on a loan?

How to stay out of debt. When you pay your debts in whole and on time each month, you will avoid interest costs. In the grace period (the time between the end of your billing cycle and the payment due date), no interest will be charged on your outstanding debt as long as you pay it in full each month

Secondly, What is a finance charge on a personal loan?

As compensation for lending money or extending credit, lenders levy finance fees. Some of these expenses are one-time, like a loan origination fee, while others are recurring, like interest payments.

Also, Why am I getting charged a finance charge?

In the absence of a promotional 0% APR period, you will be charged financing charges depending on your card’s APR and the remaining amount if you fail to pay your balance in full by the due date each month

People also ask, Where do finance charges come from?

All costs you incur when receiving, utilizing, and repaying a loan are considered finance charges. 1 Any kind of credit, whether a credit card, a business loan, or a mortgage, often includes a finance fee. A finance charge is a fee added to the principal balance of a loan.

Related Questions and Answers

What is the difference between APR and finance charge?

If you borrow money and pay interest on it, your annual percentage rate (APR) indicates the percentage of your total cost of borrowing that you pay each year, while your note rate shows the annual percentage rate (APR) of the total cost of borrowing that you pay (i.e. your amount financed). 8.9.2020

Does finance charge mean interest?

If you owe money on your credit card, you’ll have to pay finance charges to cover the interest and/or extra costs. When you use your credit card to make a transaction, you incur finance charges, which are the cost of borrowing money.

What are some examples of finance charges?

Annual costs for credit cards, account maintenance fees, late fees for overdue loan or credit card payments, and account transaction fees are all examples of financial charges.

Is the finance charge the interest?

The phrase “finance charge” is used in accounting and finance to refer to the total costs you pay to borrow the amount of money in question. In other words, the financing charge covers all of the costs you’ll incur in repaying the loan, not just the principal.

How do you calculate the finance charge on a loan?

The entire amount of interest, fees, taxes, and other costs incurred over the course of a loan is referred to as a finance charge. The whole amount of interest, fees, taxes, and charges on your loan must be subtracted from the principle (the total amount borrowed) in order to compute your interest rate.

How do you get a finance charge waived?

It’s better to contact customer support and describe the scenario that triggered the interest charges to have them waived. It’s possible to be hit with an interest penalty for late payments or for merely paying the minimal amount. april 9th, 2020

Is 1.9 percent interest rate good?

1.9 percent might be a decent bargain in certain cases, despite the fact that lower interest rates are available. A 1.9 percent APR interest rate may not add much to the total cost of your new automobile. We estimate that a five-year loan at 1.9 percent APR on a $30,000 SUV would cost $1,471. 7th of February, the year 2022

Is it better to have a lower interest rate or APR?

It all comes down to this. When it comes to borrowing money, the APR (annual percentage rate) offers a more realistic depiction of the entire cost since it takes into account other charges, such as the mortgage.

Does 0 APR mean no interest?

An APR of zero percent indicates that you pay no interest on specific transactions for a certain amount of time. For new credit card accounts, 0% APR is generally related with the interest rate you’ll be charged for the first few months. A card’s purchase APR or balance transfer APR may be eligible for a 0% promotional APR.

Are finance charges legal?

Depending on the state and federal regulations, interest rates might be controlled. A maximum financing charge rate may be established by state legislation. Financial charges are primarily governed by the Federal Truth-in-Lending Act (FTLA).

How do finance charges work on credit cards?

A financing fee is nothing more than the interest you pay on a loan you have taken out. A financing charge, often known as interest, is assessed on a credit card amount that is carried over from one billing period to the next.

Why is my APR so high with good credit?

As Lindeen pointed out, “[the issuers] need to balance the cost with income,” an increase in the rate might be linked to additional benefits. Another possible explanation is that their cash advance portfolio has become more volatile.

How does APR financing work?

The term “interest rate” refers to the monetary value of a loan. It accounts for factors like as monthly payments when figuring out what proportion of the principal you’ll pay each year. Without taking into account compounding, the APR is also a measure of interest paid on an investment each year.

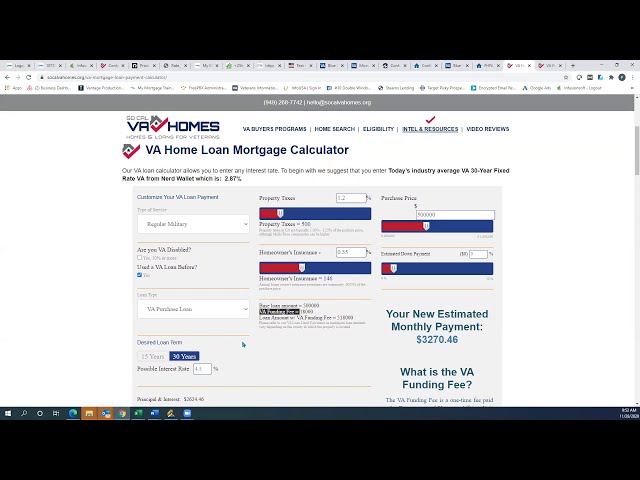

What is a good APR on a 30-year mortgage?

15-year fixed loan rates may be as low as 3 percent right now, while 30-year fixed loan rates may be as low as 4 percent right now

What is today’s APR?

The 30-year fixed national average APR was 5.300 percent on Thursday, Ap. For the 15-year fixed-rate mortgage, Bankrate has found that the average interest rate is 4.470 percent.

Do you pay APR if you pay on time?

APR is not required if you pay your bill on promptly and in full each month. In addition, there’s a grace period on your card. After the conclusion of your billing cycle, you have a grace period in which you may pay off your amount and avoid accruing interest.

Is 10 APR on a car good?

A 10 percent annual percentage rate is too high for car loans. Auto loan APRs may vary from 4% to 10%, depending on whether you purchase a new or a used vehicle

Why did I get charged interest on my credit card after I paid it off?

To put it another way, this implies that you’ll be charged interest from the moment you get your statement until it arrives at your card issuer, which is commonly referred to as “residual interest.” You should read your cardholder agreement to learn about the regulations of your card issuer 2016-08-03

What is excluded from the finance charge?

Finance Charges Excluded: 1) application fees for all applicants regardless of credit approval; 2) late fees for exceeding credit limits; 3) delinquent or defaulted penalties; and 4) fees for exceeding credit limits. The costs imposed on a credit plan’s participants; pointers from the vendor 5) Fees associated with real estate: a) the title

Conclusion

The “what is the finance charge on a car loan” is an interest rate that can be charged on a loan. Finance charges are often calculated as a percentage of the outstanding balance.

This Video Should Help:

A finance charge is an additional amount of money that a lender charges for the use of their loan. Finance charges are typically applied to mortgages and loans. Reference: what is a finance charge on a mortgage loan.

Related Tags

- what is a finance charge on a student loan

- is finance charge the same as interest

- what is a finance charge on a credit card

- what is the average finance charge on a car loan

- finance charge calculator