What Was the First Credit Card?

Contents

- The first credit card was introduced in 1950 by Diner’s Club.

- It was created by Frank McNamara, who was inspired by a incident where he forgot his wallet while out to dinner.

- Diner’s Club was originally a charge card, meaning that the balance had to be paid in full each month.

- In 1951, American Express introduced the first charge card that could be used for travel.

- In 1958, Bank of America introduced the first credit card that could be used for general purchases.

- Today, there are many different types of credit cards available, with different features and benefits.

A credit card is a plastic card that gives the cardholder a line of credit with which to make purchases. The first credit card was introduced in 1950 by Diner’s Club.

Checkout this video:

The first credit card was introduced in 1950 by Diner’s Club.

The Diner’s Club card was created by Frank McNamara, who was reportedly inspired by a forgetful moment at a lunch with business colleagues. After leaving his wallet at home, McNamara had to ask his wife to bring him some cash so that he could pay for the meal. He realized that there must be a better way for people to pay for goods and services without having to carry around large amounts of cash.

Diner’s Club issued cards that could be used at a variety of restaurants in New York City. Cardholders would simply present their card to the waiter or waitress at the end of the meal, and then they would receive a monthly bill from Diner’s Club that they would be required to pay. The concept of paying for goods and services with a credit card quickly caught on, and within a few years, other companies began issuing their own credit cards.

It was created by Frank McNamara, who was inspired by a incident where he forgot his wallet while out to dinner.

While out to dinner one night in 1949, Frank McNamara forgot his wallet and had to ask his wife to pay the bill. The experience was so embarrassing that he decided there needed to be a better way to pay for things. He came up with the idea of a credit card, which would allow people to borrow money from a bank to pay for purchases.

He began working on the concept and by 1950 had developed the Diners Club card, which could be used at select restaurants in New York City. The card quickly became popular and by 1951 was accepted at over 100 restaurants. After that, other businesses began accepting it, such as hotels, airlines, and gas stations.

The Diners Club card was the first true credit card, but it was not the first plastic card. That honor goes to the Charga-Plate, which was introduced in 1928 and was used primarily by businesses.

Diner’s Club was originally a charge card, meaning that the balance had to be paid in full each month.

In 1950, Diner’s Club issued the first “general purpose” charge card. It could be used at a variety of establishments, from gas stations to hotels. Customers could either pay their balance in full each month or carry a balance and be charged interest. In 1958, American Express followed suit with the first credit card that could be used anywhere. Unlike Diner’s Club, American Express cards could also be used for cash advances.

In 1951, American Express introduced the first charge card that could be used for travel.

In 1951, American Express introduced the first charge card that could be used for travel. The card allowed customers to make charges and then pay them off over time. This was a revolutionary idea at the time, and it quickly caught on. Within a few years, other companies began offering similar cards, and the credit card industry was born.

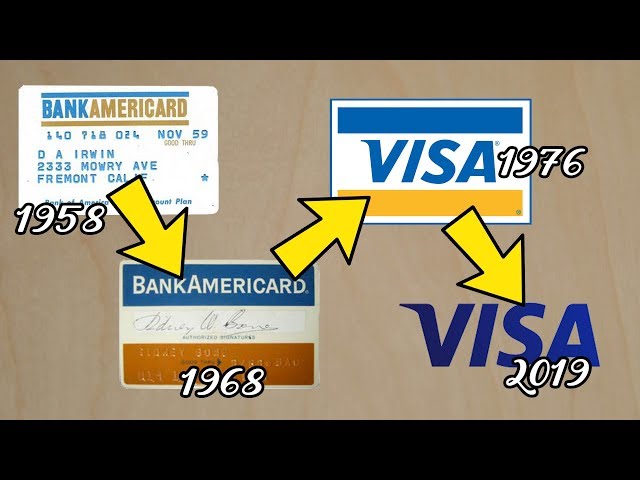

In 1958, Bank of America introduced the first credit card that could be used for general purchases.

Bank of America’s initial card, called BankAmericard, had to be manually imprinted with the customer’s name, account number and the merchant’s name and location. In 1966, a group of California banks joined forces to form the Interbank Card Association (now known as Mastercard) and began issuing cards that could be used at multiple locations. The following year, several New York banks formed the separate NYCE brand.

Today, there are many different types of credit cards available, with different features and benefits.

But what was the first credit card? The first credit card was introduced in 1950 by Diners Club, and it could only be used at select restaurants. This was followed by the introduction of the American Express Card in 1958, which could be used for a wider range of purchases. It wasn’t until 1970 that MasterCard and Visa came on the scene, introducing the credit cards that we know today.