What is Consumer Credit?

Contents

If you’re considering taking out a loan or using a credit card, it’s important to understand what consumer credit is and how it works. In this blog post, we’ll explain what consumer credit is and how it can impact your finances.

Checkout this video:

Introduction

Consumer credit is a form of revolving credit that can be used for retail purchases, borrowing money from a financial institution, or using a service such as PayPal Credit. It usually entails making monthly payments to the creditor, but some types of consumer credit may not require this. Consumers can use their credit to make large purchases, such as a car or a television, and then pay for these items over time. Many people use consumer credit to finance their day-to-day living expenses, such as groceries and gas.

There are many different types of consumer credit, including credit cards, lines of credit, retail store cards, and gas station cards. Each type of consumer credit has its own terms and conditions, so it’s important to understand the differences before you apply for any type of credit.

Credit cards are one of the most common types of consumer credit. A credit card allows you to borrow money up to a certain limit in order to make purchases or withdraw cash. You will need to make monthly repayments on your outstanding balance, plus any interest and fees that may apply.

Lines of credit are another common type of consumer credit. A line of credit is an arrangement between you and a financial institution that allows you to borrow money up to a certain limit. Unlike a loan, you only pay interest on the money you actually borrow from your line of credit—plus any applicable fees.

Retail store cards are another option for consumers who want to finance their purchases. Many retail stores offer their own store-branded credit card that can only be used at that particular store. These cards often come with special financing offers, such as 0% interest for a certain period of time on purchases made with the card. However, retail store cards typically have high interest rates once the promotional period ends, so it’s important to understand the terms before you apply.

Gas station cards are another type of consumer credit that can be used to finance fuel purchases. Gas station cards are typically branded with the logo of a specific gas station chain and can only be used at that chain’s locations. Like retail store cards, gas station cards often come with special financing offers—such as 0% interest for a certain number of months on fuel purchases—but they also typically have high interest rates once the promotional period ends.

There are many different types of consumercredit available to consumers today. It’s important to understand the terms and conditions of each type before you apply so that you can choose the best option for your needs.”

What is Consumer Credit?

Consumer credit is a type of financing that is extended to consumers for the purchase of goods or services. It is a form of borrowing that allows consumers to make purchases on credit and then pay for those purchases over time. Consumer credit can be used for a variety of purchases, including appliances, furniture, cars, and even vacations.

Types of Consumer Credit

There are two types of consumer credit: installment credit and revolving credit.

Installment credit is when you borrow a set amount of money from a lender and agree to pay back the debt, plus interest and fees, in regular installments over a set period of time. The most common form of installment credit is a car loan, but it also includes mortgages, home equity loans, and personal loans.

Revolving credit is when you have an open line of credit that you can borrow against up to a certain limit. The balance is due in full each month, but you can carry over any unpaid balance and continue to borrowing against the line of credit. The most common form of revolving credit is a credit card.

The Benefits of Consumer Credit

There are many benefits to having consumer credit. For one, it can help you build your credit history and improve your credit score. Additionally, it can give you the opportunity to make large purchases that you may not be able to afford outright. And finally, it can provide you with a safety net in the event of an emergency.

Consumer credit can be a great tool if used responsibly. But it’s important to remember that Credit is a Loan, and any loan must be repaid with interest. So always be sure to read the terms and conditions of your loan carefully before making any decisions.

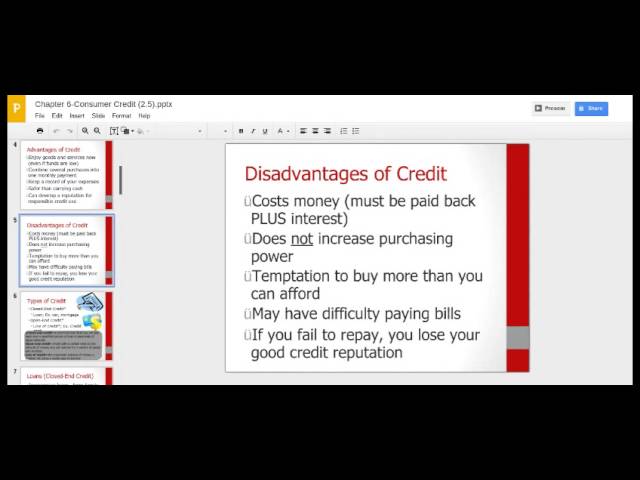

The Risks of Consumer Credit

When used responsibly, consumer credit can be a useful tool to help you manage your finances. However, there are also risks associated with using consumer credit, which can lead to expensive financial problems.

If you decide to use consumer credit, it’s important to understand the risks involved so that you can make informed decisions about how much credit to use and how to manage your debt.

One of the biggest risks of using consumer credit is that it can lead to debt problems. If you charge more on your credit cards than you can afford to pay back in full each month, you will start accruing interest charges on your debt. This can quickly increase the amount of money you owe, making it difficult to get out of debt.

Another risk of using consumer credit is that it can damage your credit score. If you miss payments or max out your credit cards, your credit score will suffer. This can make it difficult to get approved for loans or new lines of credit in the future, and can even lead to higher interest rates on those products.

Finally, using too much consumer credit can put you at risk for financial scams. If you give out your personal information to someone who claims they can help you consolidate your debt or improve your credit score, you could end up being a victim of identity theft or fraud.

If you decide to useconsumer credit, it’s importantto be aware of the potential risks so thatyoucan make informed decisionsabout howto best use and manage it.

How to Use Consumer Credit

Consumer credit is a type of loan that is given to an individual for the purchase of goods or services. The terms of the loan are set by the lender and the borrower is responsible for paying back the loan with interest. There are many different types of consumer credit products available, including credit cards, personal loans, and lines of credit.

How to Get Consumer Credit

There are a few things you can do to get consumer credit. One is to get a credit card. You can use a credit card to make purchases and build up your credit history. Another thing you can do is to take out a loan. You can use a loan to buy a car or a house, or you can use it for other purposes. You can also get consumer credit by borrowing money from friends or family.

How to Use Consumer Credit

There are many types of consumer credit, each with its own terms and conditions. It’s important to understand how to use consumer credit responsibly before you apply for any type of loan or credit card.

Here are a few tips on how to use consumer credit responsibly:

– Make sure you can afford the payments. Before you apply for any type of credit, make sure you can afford the payments. factor in the interest rate and other fees, as well as your regular monthly expenses, to make sure you can comfortably make the payments.

– Pay on time. One of the most important things you can do to maintain a good credit score is to pay your bills on time. Set up automatic payments if necessary to make sure you don’t miss a payment.

– Keep your balances low. Another factor that affects your credit score is your credit utilization ratio, or the amount of your available credit you are using. To keep your ratio low, try to keep your balances below 30% of your available credit limit.

– Monitor your accounts regularly. Check your credit report at least once a year to make sure there are no errors that could impact your score. You can also set up alerts with your lender so you know if there are any changes to your account.

How to Repay Consumer Credit

Consumer credit is a type of borrowing that is meant for personal, rather than business, use. You can use consumer credit to finance large purchases, such as a new car or a vacation, or to cover expenses in times of need, like during a job loss or medical crisis.

There are two main types of consumer credit: revolving credit and installment credit. Revolving credit is a type of credit that allows you to borrow up to a certain amount and then repay the debt over time, as you are able. This type of credit typically comes with a line of credit, like a credit card, that you can use up to your limit and then pay down as you are able. Installment credit is a type of credit that allows you to borrow a set amount of money and then repay the debt over time in fixed payments. This type of credit typically comes in the form of loans, like auto loans or home loans.

If you decide to use consumer credit, it is important to be aware of the terms of your agreement and to make payments on time. If you do not make your payments on time, you may be charged late fees or your interest rates may increase. Additionally, if you default on your debt, your creditor may pursue legal action against you or report the debt to the major credit reporting agencies, which could damage your credit score.

If you are struggling to repay your consumer debt, there are options available to help you get back on track. You can contact your creditors directly to discuss payment plans or renegotiated terms. You can also seek assistance from a nonprofit financial counseling service. These services can help you create a budget and provide guidance on how to get out of debt.

Conclusion

Consumer credit is simply a type of credit that is extended to individuals for personal use. It can be used for a variety of purposes, including but not limited to, buying a car, financing a vacation, or covering unexpected expenses. Consumer credit can be in the form of both revolving credit (such as credit cards) and installment loans (such as auto loans).

While consumer credit can be extremely helpful in times of need, it’s important to remember that it should be used responsibly. This means only borrowing what you can afford to repay and making sure you make your payments on time. If you’re not careful, consumer credit can become very expensive – so make sure you understand the terms before you borrow!