How Much Does a Loan Origination Fee Cost?

Contents

How much does a loan origination fee cost?

The average loan origination fee is 1% of the loan amount. So, on a $200,000 loan, the origination fee would be $2,000. This fee is paid at closing and is generally rolled into the loan.

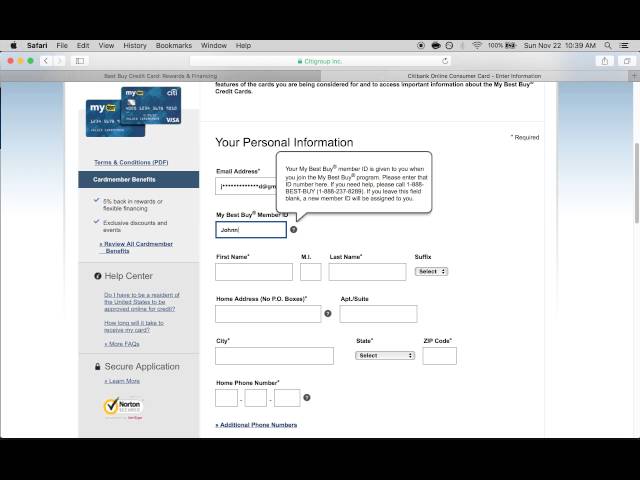

Checkout this video:

What is a loan origination fee?

A loan origination fee is a charge by a lender for evaluating and processing a loan application. This fee is generally expressed as a percentage of the total loan amount, and may be charged upfront at the time of application or added to the loan’s balance.

Loan origination fees are just one of several costs associated with taking out a loan. Other common fees include appraisal fees, title insurance, and closing costs.

How much does a loan origination fee cost?

The amount you pay for a loan origination fee will depend on the size and type of loan you’re applying for. For example, Federal Housing Administration (FHA) loans typically have lower origination fees than conventional loans.

For loans with an origination fee, you can expect to pay between 0.5% and 5% of the total loan amount. So, on a $200,000 loan, you would pay between $1,000 and $10,000 in origination fees.

Some lenders may offer “no-fee” loans, but these products often come with higher interest rates to make up for the lack of an upfront fee. You should compare the total cost of the loan — including interest rates, origination fees, and other costs — before deciding which product is right for you.

How is the loan origination fee calculated?

The loan origination fee is calculated as a percentage of the loan amount. For example, if you’re taking out a $200,000 loan with a 1% origination fee, you’ll pay $2,000 in fees. This fee is paid at closing and is usually rolled into your loan balance, so you don’t have to pay it out of pocket.

How much does a loan origination fee cost?

A loan origination fee is a fee charged by a lender for processing a loan application. This fee can be charged as a percentage of the loan amount or as a flat fee. origination fees vary by lender and type of loan, but they typically range from 0.5% to 5% of the loan amount. For example, on a $200,000 mortgage, an origination fee of 1% would cost the borrower $2,000.

Loan origination fees are negotiable, so it’s important to compare offers from multiple lenders before agreeing to any terms. Some lenders may offer lower interest rates in exchange for a higher origination fee, while others may charge lower fees but require a higher down payment. Be sure to compare all aspects of the loan before making a decision.

How can I avoid paying a loan origination fee?

While most lenders charge a loan origination fee, there are some ways to avoid this charge. One way is to find a lender that does not charge this fee. Another way is to negotiate with the lender to have the fee waived. Finally, you can try to get the fee reduced.