What Are Loan Disclosures and Why Are They Important?

Contents

Loan disclosures are an important part of the loan process. They provide borrowers with information about the terms and conditions of their loan, and they give borrowers a chance to ask questions and get clarification from their lender.

While loan disclosures may seem like a lot of paperwork, they’re an important part of the loan process and can help borrowers understand their loan and make informed decisions about their financing.

Checkout this video:

What are loan disclosures?

A loan disclosure is a document that outlines the terms and conditions of your loan, as well as the costs associated with it. Loan disclosures are required by law and must be provided to you within three days of applying for a loan.

Why are loan disclosures important?

Loan disclosures are important because they give you the opportunity to understand the true costs of your loan and compare offers from different lenders. Be sure to read your loan disclosure carefully and ask questions if you don’t understand something.

What should I look for in my loan disclosure?

Here are some things to look for in your loan disclosure:

-The amount of the loan

-The interest rate

-The term of the loan (how long you have to repay it)

-The monthly payment amount

-The total cost of the loan (interest + principal)

-Any prepayment penalties (fees charged if you pay off the loan early)

-Other fees associated with the loan

What is their purpose?

Loan disclosures are documents that provide borrowers with key information about their loan, including the loan’s terms, conditions, and fees. Disclosures also help borrowers compare different loans and make informed decisions about which loan is right for them.

Lenders are required by law to give borrowers certain disclosures at specific times during the loan process. For example, lenders must provide a Truth-in-Lending Disclosure Statement within three days of receiving a borrower’s loan application. This disclosure provides information about the annual percentage rate (APR), finance charges, and other costs associated with the loan.

Other disclosures that lenders may be required to provide include:

· A Good Faith Estimate of Settlement Costs: This disclosure must be provided within three days of receiving a borrower’s loan application. It provides an estimate of the costs the borrower will need to pay at closing, such as appraisal fees, title insurance, and recording fees.

· A Special Information Booklet: This disclosure must be provided to borrowers who are considering adjustable-rate mortgages (ARMs). The booklet explains how ARMs work and the risks associated with them.

· A Mortgage Servicing Disclosure Statement: This disclosure must be provided to borrowers before they close on their loan. It provides information about the servicing of the loan after closing, including who will handle customer service inquiries, how to reach customer service, and what type of loss mitigation options may be available if the borrower falls behind on their payments.

It is important for borrowers to review all disclosures carefully and ask questions if they have any concerns or do not understand something. Borrowers should also keep copies of all disclosures for their records.

What information do they contain?

Loan disclosures contain a wealth of important information for borrowers. They provide details about the loan terms, the total cost of the loan, and information about the lender’s policies and procedures. Borrowers should review their loan disclosures carefully before signing any loan documents.

The information in loan disclosures can be divided into three main categories:

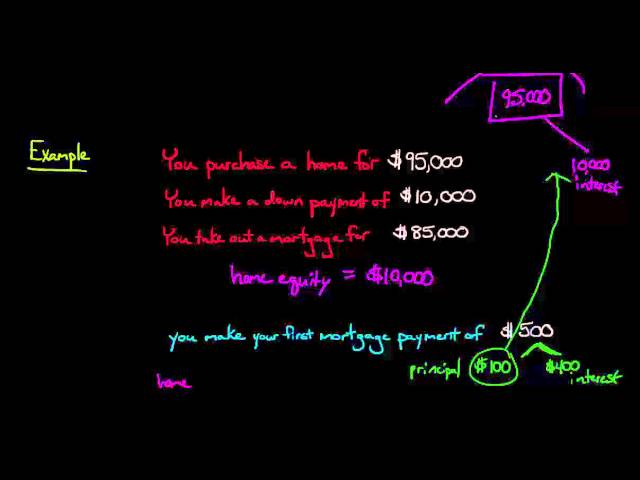

1. Terms and conditions: This section includes information about the interest rate, term length, repayment schedule, and any fees or charges associated with the loan.

2. Total cost of the loan: This section includes information about the total amount borrowed, the total interest charged, and the total amount due at maturity.

3. Lender’s policies and procedures: This section includes information about the lender’s rights and responsibilities, as well as important borrower rights under federal law.

How can borrowers use them to their advantage?

Loan disclosures are documents that provide key information about a loan. They are required by law to be given to borrowers at least three days before they close on a loan. Disclosures can be complicated, but they don’t have to be. Here are some tips on how to use them to your advantage.

The first step is to make sure you understand thedisclosures. Read them carefully and ask questions if you don’t understand something. You should pay special attention to the interest rate, monthly payments, and total amount you will repay over the life of the loan. These are important factors that can affect your finances for years to come.

Next, compare the terms of different loans before you decide which one is right for you. The disclosures can help you compare apples to apples by laying out the terms of each loan side-by-side. This is especially important if you are considering an adjustable-rate mortgage (ARM). With an ARM, your interest rate could change after the initial fixed-rate period, and that could affect your monthly payment and the total amount you repay over time. Be sure to look at the “what if” scenarios in the disclosures so you know how much your payments could increase (or decrease) if rates go up (or down).

Finally, use thedisclosures as a negotiating tool. If you find a better deal from another lender, you can use that offer to negotiate with your current lender. They may be willing to match or beat the offer in order to keep your business.

Loan disclosures are required by law for a reason – they are designed to help borrowers make informed decisions about their loans. Take advantage of them by reading them carefully and using them to compare different loans before you make a decision.