What is a Mezz Loan?

Contents

A mezzanine loan is a type of financing that is typically used by businesses when they are looking to expand. This type of loan is usually used in conjunction with a first mortgage and is structured as a second mortgage.

Checkout this video:

What is a Mezzanine Loan?

A mezzanine loan is a type of financing that is typically used by businesses to expand or make improvements to their operations. This type of loan is usually structured as a subordinated debt instrument that is senior to equity but subordinate to senior debt. Mezzanine loans are typically unsecured or have limited security.

What is Mezzanine Financing?

Mezzanine financing is a type of investment that is typically used to finance the expansion or acquisition of a company. Mezzanine financing can be provided by both equity investors and debt investors, but is typically structured as debt. This type of financing is usually senior to equity but subordinated to senior debt, such as a first mortgage.

Mezzanine financing is typically used by companies that are too large for small business loans but do not yet qualify for traditional bank financing. This type of financing can be helpful for companies that are growing quickly and need additional capital to fuel their growth. Mezzanine financing can also be used by companies that are seeking to acquire another company or expand into new markets.

Mezzanine financing is typically a higher-risk investment than senior debt, but offers a higher potential return. Equity investors usually seek a return of 30% or more on their investment, while debt investors usually seek a return of 10-15%. Mezzanine financing can be an attractive option for both types of investors when traditional bank financing is not available.

How Do Mezzanine Loans Work?

In a traditional mezzanine loan, the lender provides financing in the form of a subordinated debt, or juniorsecurity, in addition to an equity stake in the borrowing company. Mezzanine loans are typically made to companies that are too small to qualify for a bank loan or bond issuance but have enough equity to offer lenders a warrant, or an option to buy stock at a preset price.

The subordinate position of mezzanine debt gives lenders more protection than they would have if they provided only an equity investment. In the event of bankruptcy, mezzanine lenders are repaid before common shareholders but after senior secured creditors, such as banks.

Mezzanine loans are often used to finance leveraged buyouts, or LBOs, and other transactions in which a company is acquired with a significant amount of debt. The additional financing provided by a mezzanine loan can make it possible to complete an LBO with less equity and less risk for the buyers.

Mezzanine loans are also used to finance real estate transactions, such as the construction or renovation of office buildings, hotels, and shopping centers. In these cases, the mezzanine lender provides financing in the form of a loan that is secured by a mortgage on the property.

The Benefits of a Mezzanine Loan

A mezzanine loan is a type of loan that is typically used to finance the expansion of a business. The loan is typically unsecured, which means that it does not require collateral. Mezzanine loans can be a great option for businesses that are looking for growth capital. The loan can be used for a variety of purposes, including the purchase of new equipment, the expansion of a business, or the acquisition of another business.

Increased Leverage

One of the most significant advantages of a mezzanine loan is the increased leverage it provides. Leverage is the use of debt to finance the purchase of an asset. In real estate, leverage refers to the amount of money you borrow compared to the purchase price. The more money you borrow, the higher your leveragewill be.

Leverage is important because it allows you to purchase an asset with less money down. This means you can buy more property or buy more expensive property than you could if you were using all cash.

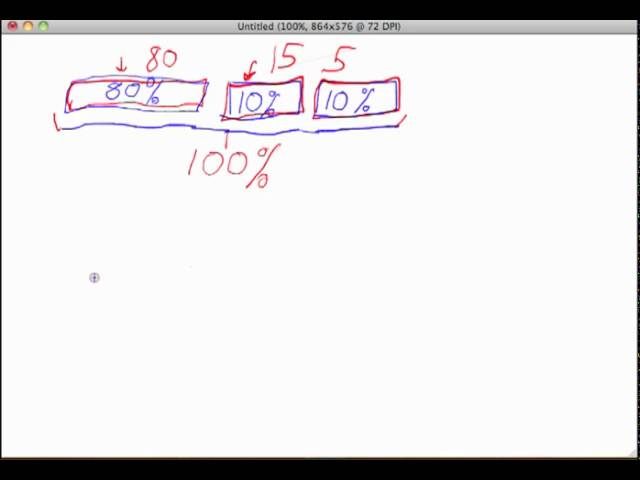

For example, let’s say you find a property that you want to purchase for $1 million. You have $200,000 cash available for a down payment. If you were to finance the remaining $800,000 with a traditional mortgage, your loan-to-value (LTV) ratio would be 80%. This means that your loan is 80% of the purchase price and your down payment is 20%.

Now let’s say you were able to get a mezzanine loan for $600,000. This would increase your LTV ratio to 90%. This means that your loan is now 90% of the purchase price and your down payment is only 10%.

The higher leverage provided by a mezzanine loan can be advantageous for several reasons:

-It allows you to buy more expensive property than you could with all cash or a traditional mortgage.

-It allows you to buy more property than you could with all cash.

-If the value of the property increases, your equity will increase at a faster rate because you have less money invested in the property.

Increased ROI

Mezzanine loans offer many potential benefits for borrowers, chief among them being the potential for increased ROI. Because mezzanine loans are typically used to finance high-growth projects, the increased revenue generated by the project can help to quickly repay the loan. Mezzanine loans can also help to reduce a company’s overall cost of capital, as they often have lower interest rates than equity financing.

Tax Benefits

One of the main benefits of a mezzanine loan is the potential tax deduction. The Internal Revenue Service (IRS) allows businesses to take a deduction for the “equity” portion of a mezzanine loan. For example, if a company has a $1 million mezzanine loan with an 80% debt-to-equity ratio, the company can deduct $800,000 of the loan as interest expense.

The Risks of a Mezzanine Loan

A mezzanine loan is a type of financing that is often used by businesses to get the capital they need for expansion. This type of loan is generally more expensive than other types of loans, and it can also be more risky. Before you take out a mezzanine loan, you should make sure that you understand the risks involved.

Interest Rate Risk

Interest rate risk is the biggest risk for mezzanine loans since they are generally floating-rate loans. This means that if market rates rise, the interest rate on the loan will rise as well. This will increase the payments that the borrower has to make, which could put stress on the company’s cash flow and make it difficult to service the debt.

Another risk with mezzanine loans is that they are often subordinated to other debt, which means that they are subordinate to senior debt in case of bankruptcy or liquidation. This makes mezzanine loans more risky than senior debt, and investors will often demand a higher return to compensate for this risk.

Lastly, mezzanine loans are often used to finance leveraged buyouts, which can be a very risky proposition. If the company being acquired is not successful, it could default on the loan and leave investors with nothing.

Default Risk

When companies take out mezzanine loans, they are usually doing so because they cannot secure traditional financing. This may be because they are start-ups with no track record or because they are expanding rapidly and need extra capital. In either case, the loan is considered to be higher risk than a standard loan, and the default rate is accordingly higher.

Structural Risk

When a company takes out a mezzanine loan, it is essentially taking on more debt in order to finance growth. This can be a risky proposition, as the company will be responsible for repaying the loan plus interest regardless of whether or not the growth plan pans out. If the company is unable to make its payments, it may be forced into bankruptcy.

In addition to the financial risks associated with taking on more debt, there are also structural risks to consider. Mezzanine loans are often used to finance expansion plans that involve opening new locations or adding new products or services. If these expansion plans do not succeed, the company may find itself saddled with unnecessary debt and struggling to keep up with its payments.

Mezzanine loans can be risky for both borrowers and lenders. Borrowers should carefully consider whether taking on more debt is the best way to finance their growth plans, and lenders should thoroughly assess a borrower’s financial situation before extending a loan.