What Are Tax Credit Apartments and How Do They Work?

Contents

Looking for an affordable place to live? You may have heard of tax credit apartments, but how do they work? We’ll explain everything you need to know about these types of housing, from how to qualify to where to find them.

Checkout this video:

Tax Credit Apartments Defined

A tax credit apartment is defined as an apartment that is set aside for people who earn a low to moderate income. The way it works is that the government gives a tax credit to the apartment complex, which in turn lowers the rent for the tenants. This makes it more affordable for people who are struggling to make ends meet.

What are tax credit apartments?

A tax credit apartment is a type of affordable housing that offers a tax break to the developer in exchange for renting units to low- and moderate-income households at below-market rates. The hope is that by making rent more affordable, families will have more money to spend on other necessities like food, child care, and transportation.

Tax credit apartments are also sometimes called Low Income Housing Tax Credit (LIHTC) apartments or Section 42 apartments. The Low Income Housing Tax Credit is a federal program that was created in 1986 to encourage the production of affordable rental housing. Developers who want to participate in the program apply for tax credits from their state housing finance agency. If they are awarded the credits, they then sell them to investors who provide the equity financing for the project.

In order to qualify for tax credits, projects must meet certain requirements. For example, at least 20% of the units must be rented to households with incomes below 60% of the area median income (AMI), and rents must be set at levels that do not exceed 30% of 60% of AMI. In addition, LIHTC properties must remain affordability-restricted for at least 30 years.

There are a few different types of tax credit apartments:

1) Project-based: Project-based tax credit apartments are units that are set aside specifically for low-income renters. The tenant’s income must fall below a certain amount (usually 60% of the area median income) in order to qualify for these units, and rent is usually capped at 30% of the tenant’s income.

2) Tenant-based: Tenant-based tax credit apartments are different from project-based units in that renters can use their voucher anywhere that accepts it, as long as their income qualifies them and the unit meets other HUD requirements. With this type of voucher, your rent is based on your income instead of a set amount.

3) Mixed-use: Mixed-use developments combine residential units with commercial space like retail stores or office space. Developers can receive tax credits for both the commercial and residential portions of mixed-use projects as long as they meet all eligibility requirements.

How do tax credit apartments work?

Tax credit apartments are affordable rental housing developments that are created through a partnership between the government and private developers. In exchange for providing low-cost housing to qualifying households, the developers receive federal tax credits.

The tax credits are then used to offset the cost of construction and make the apartments more affordable for low- and moderate-income households. To qualify for a tax credit apartment, households must meet income guidelines set by the government.

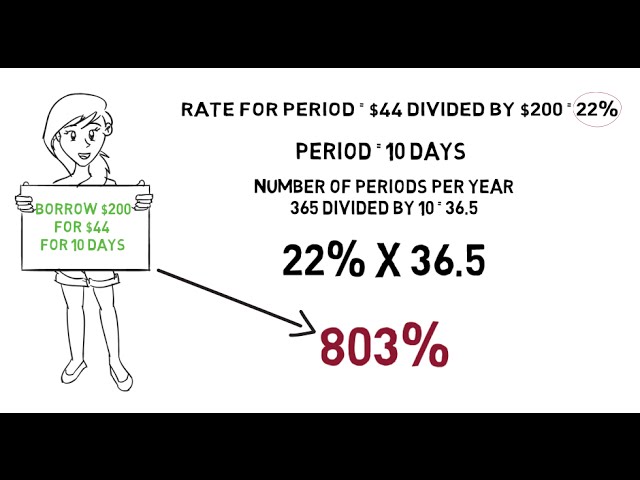

In most cases, rent for a tax credit apartment is set at 30% of the household’s adjusted gross income. This means that if your household’s adjusted gross income is $50,000, your rent would be $1,500 per month ($50,000 x 0.30 = $1,500).

If you are interested in renting a tax credit apartment, contact the apartment complex or management company directly to inquire about availability and Income qualifications.

The Advantages of Tax Credit Apartments

Tax credit apartments are a type of affordable housing that offers residents many benefits. Some of these benefits include lower rent, Utilities included, and access to on-site amenities. In addition, tax credit apartments often have income restrictions that make them available to a wider range of people.

Low income families have an easier time qualifying

Tax credit apartments are rental properties that offer reduced rent to qualified low-income renters. The reduced rent is made possible by a federal tax credit that the property owner receives for providing affordable housing.

To qualify for a tax credit apartment, you must first meet the income requirements. Income requirements vary from property to property, but generally speaking, you must earn less than 60% of the area median income to qualify.

The Advantages of Tax Credit Apartments

There are several advantages of tax credit apartments for both low-income renters and property owners.

For low-income families, the most obvious advantage is that it makes housing more affordable. When you’re only paying a portion of your income towards rent, you have more money available to cover other expenses such as food, clothing, and transportation.

Another advantage of tax credit apartments is that they tend to be located in safe, well-maintained neighborhoods. This is because the property owners are required to meet certain standards in order to receive the tax credit.

Lastly, tax credit apartments often have amenities that other affordable housing options do not have. For example, many tax credit properties include on-site laundry facilities, playgrounds, and community rooms.

For property owners, the advantage of offering a tax credit apartment is that it allows them to receive a federal tax credit. The amount of the tax credit depends on a number of factors such as the location of the property and the number of units that are designated as affordable housing.

Another advantage for property owners is that they can charge higher rents for market-rate units in order to offset the lower rents charged for tax credit units. This allows them to keep their properties well-maintained without having to raise rents across the board.

If you’re a low-income renter in search of affordable housing, a tax credit apartment may be right for you.

Rents are often lower than market rate

Rents for tax credit apartments are set by the government, and they are often lower than market rate. This can be a great option for people who are looking for an affordable place to live.

Another advantage of tax credit apartments is that they often have more amenities than other types of apartments. For example, many tax credit apartments have on-site laundry facilities and swimming pools.

Utilities may be included in the rent

When you live in a tax credit apartment, your rent is based on your income. A portion of your rent goes towards taxes, and the rest is used to cover the cost of the apartment. utilities may be included in the rent, or you may be responsible for a portion of the utilities.

The Disadvantages of Tax Credit Apartments

Tax credit apartments come with a few disadvantages. The first is that they are often in lower income areas. This means that the schools and other amenities in the area may not be up to par. The second disadvantage is that you may have to pay more rent. This is because the government is giving the landlord a tax credit for renting to low-income tenants.

There may be a waiting list

The first thing to know about tax credit apartments is that there is usually a waiting list. This is because the units are very popular and there are often more people who want to live in them than there are units available. The good news is that the waiting lists usually move pretty quickly, so you should not have to wait too long to get into one of these units.

Another disadvantage of tax credit apartments is that they are often located in areas that are not very desirable. This is because the government wants to encourage people to live in certain areas in order to help with urban renewal. So, if you are looking for an apartment in a specific area, you may not be able to find one of these units.

Finally, tax credit apartments often have income restrictions. This means that you can only qualify to live in one of these units if your income falls below a certain amount. This can be problematic for people who want to live in these units but do not make enough money to qualify.

The unit may have income restrictions

If you’re considering a tax credit apartment, there are a few things you should know before signing a lease. For starters, tax credit apartments are reserved for low- and moderate-income renters, so your household may need to meet certain income requirements to qualify. Additionally, these units usually come with income restrictions, meaning that your rent will be based on a percentage of your household income (usually 30%). This means that if your income changes during the course of your lease, your rent could go up or down accordingly.

Another downside of tax credit apartments is that they can be difficult to find. While there are millions of tax credit units across the country, the demand for these units often outpaces the supply. This can make it tough to find an available unit in your desired location, and you may have to put your name on a waiting list.

Finally, keep in mind that tax credit apartments are not necessarily “affordable” by definition. While rents are usually lower than market-rate units, they’re still subject to change and increases over time. If you’re looking for truly affordable housing, you may want to consider other options such as public housing or Section 8 vouchers.

The unit may be located in a high crime area

There are a number of disadvantages to tax credit apartments, which are also known as low income housing. One of the biggest disadvantages is that the apartment may be located in a high crime area. This can pose a safety risk for residents, especially if they are not familiar with the area. Additionally, tax credit apartments tend to be in poorer neighborhoods where there are fewer job opportunities and other resources. This can make it difficult for residents to find work and access quality education and healthcare. Another downside to these types of apartments is that they tend to have more Maintenance and management problems than other types of housing. This can include issues such as vermin infestations, leaks, and mold growth.