How the Interest Rate on a Payday Loan is Calculated

Contents

How the Interest Rate on a Payday Loan is Calculated: The interest rate on a payday loan is calculated based on the amount of the loan, the term of the loan, and the borrower’s credit history.

Checkout this video:

What is a payday loan?

A payday loan is a type of short-term borrowing where a lender will extend high interest credit based on a borrower’s income and credit profile. A payday loan’s principal is typically a portion of a borrower’s next paycheck. These loans charge high interest rates for short-term immediate credit. They are also called cash advances, because that is essentially what they are – an advance on your next paycheck.

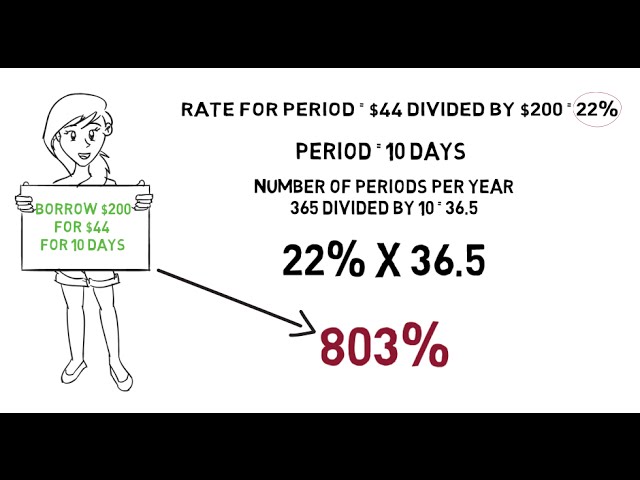

How the interest rate is calculated

The interest rate on a payday loan can be very high, sometimes as high as 700%! This is because the loan is meant to be repaid in a short amount of time, usually within two weeks. The lender wants to make sure they make a profit off of the loan, so they charge a higher interest rate.

The amount of the loan

The amount of the loan is one factor that determines the interest rate on a payday loan. The higher the amount of the loan, the higher the interest rate will be. This is because lenders view loans for larger amounts of money as being riskier than loans for smaller amounts of money. As such, they charge a higher interest rate to offset this risk.

The length of the loan

The interest rate on a payday loan is calculated based on the length of the loan, the amount of money borrowed, and the fees charged by the lender. The longer the loan, the higher the interest rate will be. The amount of money borrowed also affects the interest rate, with larger loans having higher rates. Finally, the fees charged by the lender also play a role in determining the overall interest rate.

The fees associated with the loan

When you take out a payday loan, you will be charged a fee for the loan. This fee is typically a percentage of the total loan amount, and it is typically around 15%. So, if you borrow $100 from a payday lender, you will be charged a fee of $15. This fee is generally paid to the lender when you receive your paycheck on your next payday.

How to avoid high interest rates

The interest rate on a payday loan is calculated based on the amount of money you borrow, the length of time you borrow it for, and the fees the lender charges. You can avoid high interest rates by only borrowing what you need, and by repaying the loan as soon as possible. Let’s take a look at how the interest rate is calculated so you can be prepared.

Shop around for the best rates

The best way to avoid high interest rates is to shop around for the best rates. There are a few things you should keep in mind when you are shopping for a payday loan. The first thing you should do is make sure that you have a good credit score. The better your credit score is, the lower the interest rate will be.

Next, you should try to find a lender who offers the lowest interest rate possible. You can do this by searching online or by asking friends and family for recommendations. Once you have found a few lenders who offer low interest rates, you should compare their terms and conditions. Make sure that you understand all of the fees and charges associated with each loan before you agree to anything.

Finally, remember that the interest rate is not the only thing you should consider when you are looking for a payday loan. You should also consider the fees and charges associated with each loan, as well as the repayment terms and conditions. By keeping all of these factors in mind, you should be able to find a payday loan with low interest rates that meets your needs and budget.

Compare the total cost of the loan

When comparing lenders, it’s important to compare the total cost of the loan, not just the interest rate. The total cost of the loan includes the interest rate plus any other fees charged by the lender. Payday loans typically have very high interest rates, so even a small difference in the total cost of the loan can make a big difference in your payments.

Most payday loans have a term of two weeks, which means you have to repay the loan in full within two weeks or you will be charged additional fees. If you can’t repay the loan in full within two weeks, you may be able to roll over the loan into a new loan with a new term and a new set of fees. This can get expensive quickly, so it’s important to compare the total cost of the loan before you agree to anything.

Read the fine print

When you take out a payday loan, you agree to pay back the principal and finance charge by your next payday. However, if you don’t have enough money to pay back the loan by your next payday, you may be charged additional fees and your lender may start withdrawing money from your checking account to cover the unpaid balance.

The interest rate on a typical payday loan is about 400% APR, which is much higher than the interest rates on other types of loans. To avoid paying high interest rates, make sure you read the fine print before taking out a payday loan. Compare the interest rates and fees of different lenders and choose the one that offers the best terms.