What is the Retirement Savings Contribution Credit?

Contents

The Retirement Savings Contribution Credit, also known as the Saver’s Credit, is a tax credit available to eligible taxpayers who contribute to a qualified retirement savings plan, such as a 401(k) or an IRA.

Checkout this video:

Overview of the Retirement Savings Contribution Credit

The Retirement Savings Contribution Credit, also known as the Saver’s Credit, is a tax credit for low- and moderate-income taxpayers who save for retirement. The credit is worth up to $1,000 for couples filing jointly and $500 for single filers.

How the Retirement Savings Contribution Credit Works

The Retirement Savings Contribution Credit, also called the Saver’s Credit, is a tax credit for low- and moderate-income taxpayers who contribute to a qualified retirement savings plan, such as a 401(k) or an IRA.

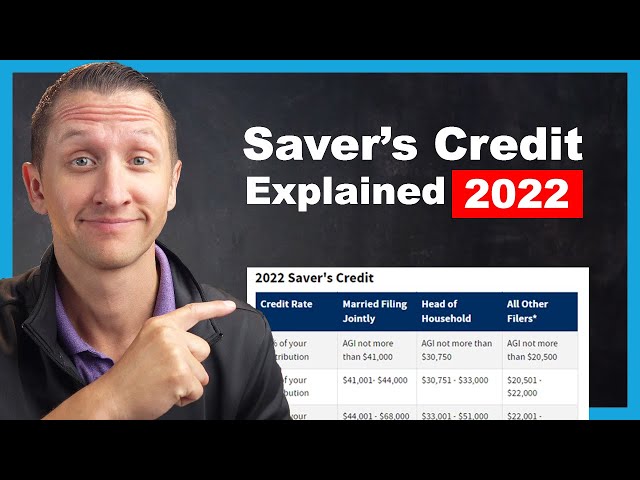

The credit is worth up to $1,000 for taxpayers who contribute $2,000 or more to a retirement savings plan. To be eligible for the full credit, taxpayers must have an adjusted gross income (AGI) of $30,750 or less for single filers, $46,125 or less for head of household filers, and $61,500 or less for joint filers.

The amount of the credit is based on the taxpayer’s AGI and filing status. For example, a single filer with an AGI of $20,000 would receive a credit of 50% of their contribution up to $1,000. Joint filers with an AGI of $40,000 would receive a credit of 20% of their contribution up to $1,000.

To claim the Retirement Savings Contribution Credit, taxpayers must file Form 8880 with their tax return.

Who is Eligible for the Retirement Savings Contribution Credit?

To be eligible for the Retirement Savings Contribution Credit, you must:

-Be age 18 or older

-Not be a full-time student

-Not be claimed as a dependent on another person’s tax return

In addition, your adjusted gross income must be less than:

-$32,000 if filing single or head of household

-$48,000 if filing as a qualified widow

How the Retirement Savings Contribution Credit Can Benefit You

The Retirement Savings Contribution Credit is a tax credit that is available to taxpayers who make contributions to a qualified retirement plan. The credit is worth up to $2000 for each tax year, and is available to taxpayers who make contributions to a qualified retirement plan. The credit is designed to encourage taxpayers to save for retirement, and can be a valuable tool for taxpayers who are trying to save for retirement.

The Retirement Savings Contribution Credit Can Maximize Your Savings

The Retirement Savings Contribution Credit, also called the Saver’s Credit, is a federal tax credit for low- and moderate-income workers who save for retirement. If you qualify, you can receive a credit worth up to $1,000 ($2,000 if you’re filing a joint return).

To qualify for the credit, you must be age 18 or older and cannot be a full-time student or claimed as a dependent on someone else’s tax return. For 2019, the income limits are $32,000 for single filers, $48,000 for heads of household, and $64,000 for married couples filing jointly.

If you qualify and contribute to a retirement account such as a 401(k) or an IRA, you can claim the credit when you file your taxes. The amount of the credit is based on your contribution and your income. The credit is generally worth 50%, 20%, or 10% of your contribution up to $2,000 ($4,000 if married filing jointly), depending on your income.

For example, if you’re single and your MAGI is $30,000, you would fall in the 50% bracket. This means that if you contribute $1,000 to a retirement account, you would receive a $500 tax credit.

If you’re married filing jointly and your MAGI is $60,000, you would fall in the 20% bracket. This means that if you contribute $2,000 to a retirement account between both spouses, you would receive a $400 tax credit.

You can claim the Retirement Savings Contribution Credit in addition to other tax credits and deductions you may be eligible for. If you’re not sure whether you qualify for the credit or how much it would be worth to you, consult a tax professional or use online tax preparation software.

The Retirement Savings Contribution Credit Can Help You Meet Your Retirement Goals

Saving for retirement is important, and the earlier you start, the better. But if you’re like many people, you may not be able to save as much as you’d like to on your own. The good news is, there’s a retirement savings contribution credit that can help make up the difference.

The Retirement Savings Contribution Credit is a tax credit that you can claim on your taxes if you make eligible contributions to a retirement savings account, such as a 401(k) or an IRA. The credit is worth up to $1,000 ($2,000 if married filing jointly), and it can help you reach your retirement savings goals.

To be eligible for the credit, you must be at least 18 years old and not a full-time student or claimed as a dependent on someone else’s tax return. You also must have earned income from wages, self-employment, or certain disability benefits.

If you’re eligible for the Retirement Savings Contribution Credit, be sure to take advantage of it. Every little bit helps when it comes to saving for retirement.

How to Claim the Retirement Savings Contribution Credit

The Retirement Savings Contribution Credit is a tax credit that encourages people to save for retirement. This tax credit is available to anyone who contributes to a retirement savings account, such as a 401(k) or an IRA. The credit is worth up to $2,000 for individuals and $4,000 for couples.

You Must File a Tax Return to Claim the Retirement Savings Contribution Credit

In order to claim the Retirement Savings Contribution Credit, you must file a tax return. This is because the credit is refundable, which means that it can reduce your tax bill or increase your tax refund.

To claim the credit, you must file IRS Form 8880. This form must be attached to your tax return. You will need to calculate your allowable contribution limit based on your income and filing status. For example, if you are married and filing jointly, you can contribute up to $4,000 per year.

The Retirement Savings Contribution Credit is not just for those who are already retired. It is also available to those who are saving for retirement. This includes those who are contributing to a traditional IRA or a Roth IRA. The credit is also available for those who are contributing to a 401(k) or other employer-sponsored retirement plan.

You Must Include the Retirement Savings Contribution Credit on Your Tax Return

To claim the credit, you must file a tax return that includes Form 8880, Credit for Qualified Retirement Savings Contributions. You can claim the credit for amounts you contributed to:

-A traditional IRA

-A Roth IRA

-A SIMPLE IRA

-A 401(k), 403(b), 457, SEP, or other qualified retirement plan

The credit is recalculated each year based on the contributions you made during the year. So, if you’re eligible for the credit in 2020, you’ll need to include Form 8880 with your 2020 tax return.

You Must Meet the Eligibility Requirements for the Retirement Savings Contribution Credit

To claim the Retirement Savings Contribution Credit, you must meet these requirements:

•You were age 18 or older at the end of the tax year

•You were not a full-time student at any time during the tax year

•You were not claimed as a dependent on another person’s return

In addition, your modified adjusted gross income (MAGI) must be less than:

$32,500 ($48,750 if married filing jointly) for single, head of household, or qualifying widow(er);

$65,000 ($97,500 if married filing jointly) for married filing separately.