How Long Can You Finance A Used Boat?

Contents

- How much boat can I afford based on income?

- What credit score is needed for a boat loan?

- What is a good APR for a boat loan?

- Is financing a boat a good idea?

- How long can you finance a $20000 boat?

- Can you mortgage a boat?

- Can you finance an outboard motor?

- What is a secured boat loan?

- How much does it cost to insure a boat in Florida?

- Does Suntrust do boat loans?

- Can you get a 20 year loan on a used boat?

- How long can you finance a bass boat?

- Is LightStream legitimate?

- Is it better to finance a new or used boat?

- What is calculated in your debt to income ratio?

- How much should you spend on a yacht?

- Can I get a boat loan with a 550 credit score?

- What is the debt-to-income ratio for a boat loan?

- Is a 700 a good credit score?

- Can you pay off a boat loan early?

- Can I get a boat loan with a 620 credit score?

- Can you have a cosigner on a boat loan?

- Is buying a boat a waste of money?

- Do dealers prefer financing or cash?

- Is Lending Tree legit?

- Can I get a boat loan with a 600 credit score?

- How long can you finance a camper?

- How long can you finance a car?

- Conclusion

Similarly, What’s the longest you can finance a used boat?

twenty years

Also, it is asked, Can you get a 10 year loan on a used boat?

Yes, you may have heard that boat loans are just for a brief period of time. It’s true that receiving a boat loan for ten years used to be a challenge, and loan terms greater than that were uncommon—but those days are long gone. Many lenders now will finance a yacht for up to 20 years.

Secondly, How long should I finance a used boat?

Anything less than 60 months – or five years – is considered a short loan term for boat financing. The typical loan period will be eight to twelve years, with a lengthy loan term of 12 to fifteen years.

Also, How long can you finance a boat?

People also ask, Can you finance a boat older than 10 years?

It might be difficult to be accepted for a boat loan on an older boat, but it is feasible. Used and refi loans for boats as old as 19 years are available from certain lenders (including one from our list above).

Related Questions and Answers

How much boat can I afford based on income?

In general, your monthly installment debt payments cannot exceed 38 percent of your total monthly income, which includes your mortgage, auto payment, credit card bills, and potential boat loan payment.

What credit score is needed for a boat loan?

700 words or more

What is a good APR for a boat loan?

4–5% of the population

Is financing a boat a good idea?

So, in response to the first question, we believe that taking out a boat loan is a fantastic option. You’ll not only go out to sea faster, but you’ll also receive fantastic prices and pay a little monthly fee. Always double-check that you’re obtaining credit from a trustworthy source.

How long can you finance a $20000 boat?

12 years: A boat loan of $20,000 to $24,000 may be financed for up to 12 years. 15 years: A boat loan ranging from $25,000 to $74,000 may be financed for up to 15 years. A boat loan of $75,000 or more may be financed for up to 20 years.

Can you mortgage a boat?

Put your money in your house. A home equity loan, sometimes known as a second mortgage, is one of the finest methods to finance a boat. For starters, the interest rates are often lower than those available on a traditional boat loan.

Can you finance an outboard motor?

For every $1,000 borrowed, the APR is 5.99 percent for 84 months at $14.60 per month. Offer valid on any new, unregistered Honda outboard engine with a $1,000 minimum loan amount and a $100 minimum monthly payment. For further information, contact one of the partnering dealers.

What is a secured boat loan?

Secured loans need the provision of collateral. The boat would be used as collateral in the event of a boat loan. If you do not return your loan, the lender has the right to seize control of the boat.

How much does it cost to insure a boat in Florida?

Between 2020 and 2021, the average yearly cost of a Progressive boat insurance coverage varied from $245 in Minnesota to $652 in Florida. Many variables influence boat insurance prices, including age, boat type, boating history, coverages, and location.

Does Suntrust do boat loans?

Loan for a ship Whether you’re searching for a new house at sea or simply want to refinance your present one, we can help. If you have a Truist account, you may apply over the phone. Call 844-487-8478 for more information.

Can you get a 20 year loan on a used boat?

Recap: A typical boat loan lasts between 5 and 20 years.

How long can you finance a bass boat?

For boat loans of $25,000 or more, lenders often reserve the lengthier periods of 180 or 240 months. For any given purchase price, longer periods equal cheaper monthly payments. However, bear in mind that the longer the period of the loan, the longer it will take for you to build equity in your home.

Is LightStream legitimate?

Is LightStream a genuine company? LightStream is a well-known online lender with low loan rates and a simple application procedure. While it does not specify credit standards, it is likely that many employed applicants with strong credit ratings will be approved.

Is it better to finance a new or used boat?

If you’re ready to buy a boat but don’t know where to start, you may want to look into buying a secondhand boat. According to LendingTree, this is generally a far better financial option than purchasing new since boats depreciate up to 10% in their first year.

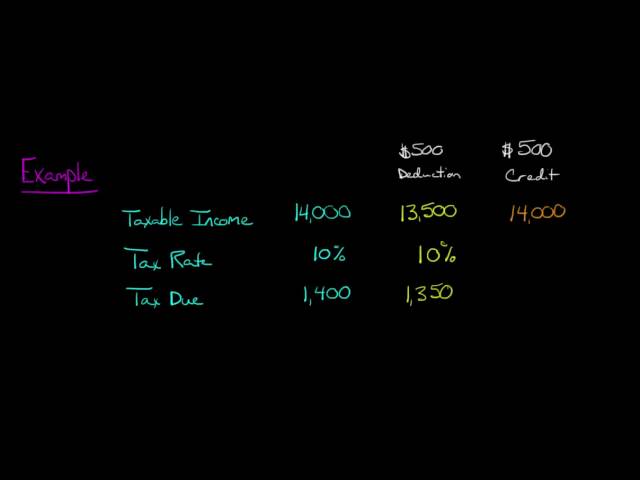

What is calculated in your debt to income ratio?

Add together all of your monthly debt payments and divide them by your gross monthly income to get your debt-to-income ratio. Your gross monthly income is the amount of money you make before taxes and other deductions are taken into account.

How much should you spend on a yacht?

Annually, you can expect to spend about 20% or more of the initial price of your yacht to keep it running. So, for a boat worth $10 million, the annual operating costs will be about $2 million, which includes gasoline, insurance, dock fees, maintenance and repairs, personnel, and so on.

Can I get a boat loan with a 550 credit score?

Even if you have a 550 credit score, a terrible credit boat loan might help you receive the money you need to purchase a boat. However, you’ll almost certainly have to pay a higher interest rate. Borrowers with bad credit boat loans should anticipate an APR of roughly 17%.

What is the debt-to-income ratio for a boat loan?

Many lenders want a debt-to-income ratio of 40 to 45 percent, which includes payments on the boat loan you’re seeking for. Your financial worth and liquidity will also be considered by lenders.

Is a 700 a good credit score?

A credit score of 700 technically qualifies you as having a decent credit score, however it is somewhat below the national average. The average FICO score was stated as 716 in April 2021, reflecting a general rising trend in typical credit scores over the previous ten years.

Can you pay off a boat loan early?

Late payments, as well as additional penalties and fees, may raise the cost of your fixed rate loan. Repaying a debt early does not incur any fees or penalties.

Can I get a boat loan with a 620 credit score?

Although it is possible to qualify for a boat loan with a FICO credit score in the 500s, you will most likely need a credit score of 600 or above, as well as a low debt-to-income ratio. You may apply for a loan online right now if you believe you qualify. What is the minimum down payment for a poor credit boat loan?

Can you have a cosigner on a boat loan?

If you’re having trouble getting accepted, try applying with a cosigner. On a boat loan, not all lenders accept cosigners, but some do. Even if you don’t need a cosigner to qualify, having one may help you receive a better interest rate than you would otherwise.

Is buying a boat a waste of money?

A yacht may be a fantastic investment, perhaps not in the concrete sense that real estate or mutual funds can, but definitely in the non-material sense. The pursuit of pleasure or adventure, of connecting with family and friends, and of a yearning for freedom that many people only discover on the water are all reasons to own a boat.

Do dealers prefer financing or cash?

So dealers favor financing customers because they can benefit from the loan, you should never tell them you’re paying cash. You should try to gather quotes from at least ten different dealerships. You want to lure them into a bidding war since each dealer is selling a commodity.

Is Lending Tree legit?

LendingTree is a fully licensed and regulated company. LendingTree connects you with lenders and is a 100% free service. One of the most common critiques about LendingTree is the possibility of lenders doing “hard pulls” on your credit.

Can I get a boat loan with a 600 credit score?

Is it possible to receive a boat loan with a credit score of 600? Yes, a boat loan may be obtained with a credit score of 600. To apply for and get accepted for a boat loan, Southeast Financial does not have a minimum credit score requirement. Instead, we evaluate your credentials based on characteristics such as the amount you want to borrow and the item you are purchasing.

How long can you finance a camper?

What is the term of an RV loan? Financing a new or used RV or camper has very comparable terms and features. RV loans typically last between 10-15 years, however for loans of $50,000 or more secured by qualifying collateral, many banks, credit unions, and other financial institutions will extend the duration up to 20 years.

How long can you finance a car?

How long can you finance a vehicle for? While the average auto loan period is 72 months, lenders may provide terms as low as 12 months and as long as 96 months, however not all lenders will offer the shortest or longest choices.

Conclusion

The “boat loan calculator” is a tool that allows users to find the total cost of financing their boat. The site also has tools for finding the monthly payments and interest rates.

This Video Should Help:

The “boat loan terms and rates” is a question that many people are asking. The answer to the question is different for each boat, but in general it will be about how long you can finance a used boat.

Related Tags

- how long can you finance a bass boat

- can you finance a boat for 30 years

- 20 year boat loan calculator

- how long can you finance a pontoon boat

- used boat loans