What Does Tax Credit Mean?

Contents

Tax credits are subsidies that the government provides to eligible taxpayers. The subsidy comes in the form of a credit that can be applied to reduce the amount of tax owed.

Checkout this video:

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have earned from the total taxes they owe. The net effect is that the tax credit reduces the amount of tax that the taxpayer owes.

What is a tax credit?

A tax credit is a dollar-for-dollar reduction in the income tax you owe. For example, if you owe $1,000 in taxes and you have a $1,000 tax credit, your net tax liability is zero.

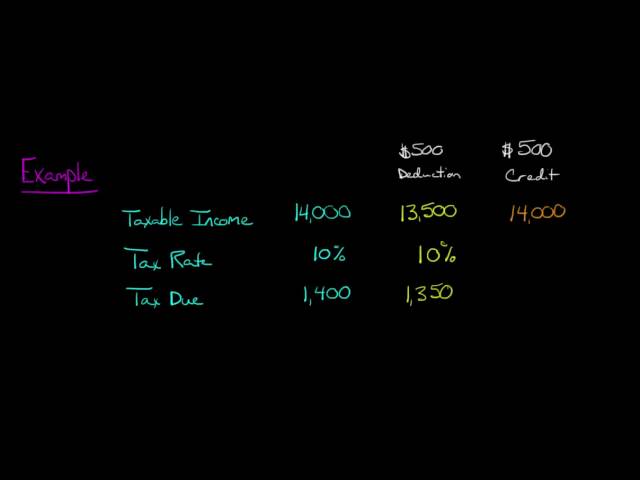

How is a tax credit different from a tax deduction?

A tax deduction reduces the amount of income taxes you owe by decreasing your taxable income. A tax credit does this as well, but it does so dollar for dollar. So, for example, if you owe $1,000 in taxes and are eligible for a $500 tax credit, your tax liability would be reduced to $500.

A tax deduction only reduces the amount of income taxes you owe; it does not reduce them dollar for dollar. So, for example, if you owe $1,000 in taxes and are eligible for a $500 tax deduction, your taxable income would be reduced by $500, and your tax liability would be reduced by a portion of that—say, $250—depending on your marginal tax rate.

What are the most common tax credits?

The three most common types of tax credits are theEarned Income Tax Credit, the Child Tax Credit, and the American Opportunity Tax Credit.

The Earned Income Tax Credit is a refundable credit for low- and moderate-income workers. To qualify, you must have earned income from employment or self-employment during the year. The amount of the credit varies depending on your income and how many children you have.

The Child Tax Credit is a non-refundable credit that can be worth up to $2,000 per child under age 17. To qualify, the child must be your dependent and must have lived with you for more than half the year. The credit is reduced or eliminated if your income is above certain thresholds.

The American Opportunity Tax Credit is a refundable credit worth up to $2,500 per eligible student. To qualify, the student must be enrolled in an eligible educational institution for at least half of the academic year. The credit is available for students in their first four years of post-secondary education and can be claimed for tuition, fees, and course materials.

Child Tax Credit

The Child Tax Credit is a tax credit available to taxpayers who have children under the age of 17. The credit is worth up to $2,000 per child. To qualify, the child must be a U.S. citizen, resident alien, or national of the United States. The child must also be claimed as a dependent on the taxpayer’s federal income tax return.

What is the child tax credit?

The child tax credit is a credit that provides a tax break for people who have children. The credit is worth up to $1,000 per child, and it can be used to offset the cost of raising a child. The credit is available to both married and single parents, and it can be claimed for each child under the age of 17.

The child tax credit is different from the child care tax credit, which provides a tax break for parents who pay for child care. The two credits are not interchangeable, and they have different eligibility requirements.

How much is the child tax credit?

The child tax credit is worth up to $2,000 per qualifying child. If the tax credit brings the amount of taxes you owe to zero, you may receive up to $1,400 of the credit as a refund.

How do I claim the child tax credit?

The child tax credit is a tax credit worth up to $2,000 per qualifying child. To claim the credit, you must have qualifying children who meet certain criteria and file a federal income tax return.

To claim the child tax credit, you must have a qualifying child who is under the age of 17 and meets certain other criteria. You must also file a federal income tax return to claim the credit.

Earned Income Tax Credit

The Earned Income Tax Credit, EITC for short, is a tax credit for certain people who work and have low to moderate incomes. To qualify, you must meet certain requirements and file a tax return, even if you do not owe any tax. If you qualify, the EITC reduces the amount of tax you owe and may give you a refund.

What is the earned income tax credit?

The earned income tax credit, or EITC, is a tax credit for low- to moderate-income working taxpayers. The amount of the credit is based on income and family size. To qualify, taxpayers must have earned income from employment or self-employment and meet certain other requirements.

The EITC reduces the amount of taxes owed and may result in a refund for eligible taxpayers. The credit is available to both workers with children and workers without children. The maximum credit amount for workers without children is $538, and the maximum credit for workers with children is $5,460.

The earned income tax credit has been shown to reduce poverty and encourage work among low-income households. Studies have also found that the EITC results in improved health outcomes for children in low-income households.

How much is the earned income tax credit?

The earned income tax credit is a tax credit for working people with low to moderate incomes. The amount of the credit is based on your income and how many children you have. The credit can be as high as $6,431 for a family with three or more children.

How do I claim the earned income tax credit?

To claim the earned income tax credit, you must file a tax return, even if you do not otherwise have to file. You will need to fill out Form 1040 or Form 1040A and include Schedule EIC.

If you are claiming the credit for the first time, you will need to provide proof of your identity, such as a copy of your drivers license or passport. You will also need to provide proof of your income, such as W-2 forms from your employer or 1099 forms if you are self-employed.

Education Tax Credits

The American opportunity tax credit and the lifetime learning tax credit are two education tax credits that can help offset the cost of tuition and other eligible expenses. The American opportunity tax credit is worth up to $2,500 per eligible student, and the lifetime learning tax credit is worth up to $2,000 per eligible student. There are income limits that apply to both credits.

What are education tax credits?

Education tax credits are a type of tax incentive that can help offset the cost of higher education. There are two main types of education tax credits: the American Opportunity Tax Credit and the Lifetime Learning Credit.

The American Opportunity Tax Credit is worth up to $2,500 per year for each eligible student, and it can be used for up to four years of undergraduate education. The Lifetime Learning Credit is worth up to $2,000 per year, and it can be used for any type of post-secondary education, including graduate school.

To qualify for either credit, you must be enrolled in an eligible educational institution and you must be paying tuition and other eligible expenses. There are also income limits that apply to both credits.

Education tax credits can help reduce your overall tax bill, and they may even make it possible for you to get a refund if you owe no taxes. If you’re eligible for both credits, you can claim both on your tax return, but you can only claim one credit per student.

How do I claim education tax credits?

Most people claim the American Opportunity Tax Credit or the Lifetime Learning Credit based on their educational expenses. You (or your dependent) must be enrolled at least half-time in a degree or credential program at an eligible college, university, or other postsecondary educational institution to claim either tax credit. The school should provide you with a 1098-T form by January 31 of the year following the tax year. You’ll use information from the form to calculate the amount of your education tax credit.

Charitable Donations Tax Credit

The Charitable Donations Tax Credit is a federal tax credit that allows eligible donors to claim a tax credit on donations made to registered charities. The credit is non-refundable, which means that it can only be used to reduce your taxes owing.

What is the charitable donations tax credit?

The charitable donations tax credit is a non-refundable tax credit that can be claimed by an individual or a corporation on eligible donations of money or certain property made to a qualifying donee. The credit is equal to the lowest personal income tax rate, currently 15%, multiplied by the total of all eligible donations made in the year.

How much is the charitable donations tax credit?

donations tax credit is a non-refundable tax credit that can be claimed by individuals and corporations who make eligible donations to registered charities in Canada. The credit is calculated based on the amount of the donation, and the donor’s tax rate.

Individuals claiming the credit can claim up to 75% of the first $200 of eligible donations, and 50% of any amount over $200. The maximum tax credit that can be claimed by an individual in a single year is $300.

Corporations claiming the credit can claim 35% of eligible donations, up to a maximum of $10,000 per year.

How do I claim the charitable donations tax credit?

The charitable donations tax credit is a non-refundable tax credit that you can claim if you make eligible donations and gifts to a qualified donee.

To claim the credit, you have to complete Form T1040, Schedule 9 and attach it to your income tax return.

The credit is calculated by multiplying the total of your eligible donations and gifts by the highest federal tax rate for the year. For 2020, the federal tax rate is 15%.

You can choose to claim the charitable donations tax credit for either 5% of your net income or $200, whichever is less.

The provincial or territorial government may offer a similar tax credit.