How to Refinance Your Auto Loan

Contents

If you’re looking to lower your monthly car payments, you may be considering refinancing your auto loan. Although it can be a great way to save money, it’s important to understand the process before you jump in.

In this blog post, we’ll walk you through everything you need to know about how to refinance your auto loan, including how to shop for the best rates and what to watch out for. By the end, you’ll be ready to make a decision about

Checkout this video:

Introduction

If you’re looking to save money on your auto loan, you may want to consider refinancing. Refinancing your auto loan can help you secure a lower interest rate and save you money on your monthly payments. In order to refinance your auto loan, you’ll need to have good credit and a strong financial history. You’ll also need to compare rates from multiple lenders to find the best deal. Follow the steps below to learn how to refinance your auto loan.

How to Refinance Your Auto Loan

Check Your Credit Score

If your credit score has improved since you took out the loan, you may be able to get a lower interest rate by refinancing. Check your credit score for free on Bankrate to see where you stand.

Research Lenders

When you’re ready to begin the refinance process, the first step is to research your options. You can start with your current lender, but it’s also a good idea to compare rates and terms from other lenders. Keep in mind that the best rate isn’t always the only factor to consider. You’ll also want to compare things like loan terms, fees, and customer service.

Once you’ve found a few lenders that you’re interested in working with, it’s time to start the application process. This usually involves completing an online form and providing some basic information about yourself and your finances. The lender will then pull your credit report and use this information to determine if you prequalify for a loan and, if so, what interest rate you’ll be offered.

Get Pre-Approved

The first step is to get pre-approved for an auto loan with a lender. This will give you an idea of how much money you can borrow and at what interest rate. It’s important to compare rates from multiple lenders before refinancing your auto loan.

Get Pre-Approved

The first step is to get pre-approved for an auto loan with a lender. This will give you an idea of how much money you can borrow and at what interest rate. It’s important to compare rates from multiple lenders before refinancing your auto loan.

Get quotes from multiple lenders

Be sure to compare rates from multiple lenders before refinancing your auto loan. It’s important to shop around and compare offers to get the best deal possible.

Consider the length of the loan

When you refinance your auto loan, you may be able to choose a different loan term. A longer loan term could mean lower monthly payments, but it will also mean you pay more in interest over time. A shorter loan term could mean higher monthly payments, but you’ll pay less in interest over time. Choose the loan term that makes the most sense for your budget and financial goals.

Calculate your break-even point

If you plan on refinancing your auto loan, it’s important to calculate your break-even point first. This is the point at which the savings from refinancing equals the cost of refinancing. To calculate your break-even point, divide the total cost of refinancing by the monthly savings from refinancing. The result is the number of months it will take for you to break even on the refinance.

Compare Loan Offers

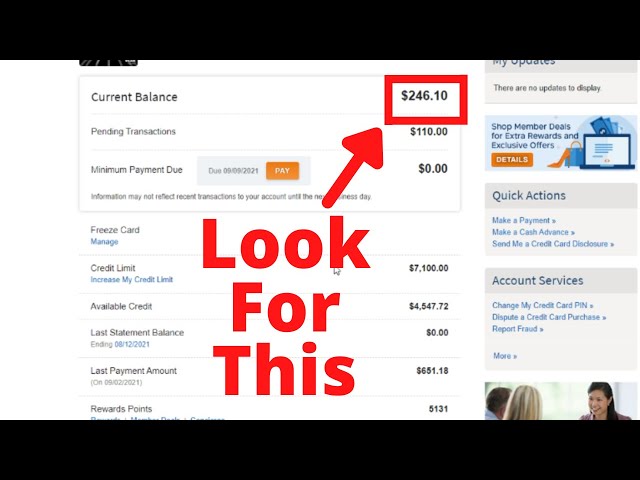

When you’re ready to compare loan offers, look at more than just the monthly payment amount. Make sure you compare the total cost of the loan, which includes the interest rate, length of the loan, and any fees associated with the loan.

You’ll also want to make sure that you can afford the monthly payments. If your goal is to lower your monthly payments, you’ll want to make sure that you don’t extend the life of your loan in doing so. You may end up paying more in interest over the life of the loan if you do this.

Finally, make sure that you shop around for loans. Don’t just go with the first offer that you get. Talk to multiple lenders and compare their offers before making a decision.

Choose the Best Loan

When you refinance your auto loan, you are essentially taking out a new loan to pay off your existing loan. This new loan will have different terms than your current loan, which may include a lower interest rate, different monthly payment, or both. Refinancing can save you money if you qualify for a lower interest rate, but it’s not always the best option.

Before you decide to refinance your auto loan, it’s important to compare offers from multiple lenders to make sure you are getting the best deal possible. It’s also important to consider the cost of refinancing, which may include an origination fee and other closing costs.

When you compare offers, be sure to compare the Annual Percentage Rate (APR) rather than just the interest rate. The APR includes the interest rate as well as any fees charged by the lender, so it’s a more accurate representation of the total cost of the loan.

Once you’ve compared offers and chosen the best loan for you, it’s time to apply for pre-approval. By getting pre-approved for a loan, you’ll know exactly how much money you can borrow and at what interest rate. This can help you budget for your new monthly payment and avoid being surprised by hidden fees or unexpected costs.

Conclusion

When you refinance your auto loan, you are essentially taking out a new loan to pay off your existing loan. This can be a great way to save money on interest or lower your monthly payments. However, it is important to understand the process before you dive in. Here are a few things to keep in mind when considering how to refinance your auto loan:

– Make sure you understand the terms of your new loan before you sign anything.

– Keep in mind that refinancing may extend the term of your loan, which could mean paying more in interest over the long run.

– Be sure to shop around for the best rates and terms before committing to a new loan.

– Keep in mind that there may be fees associated with refinancing, so be sure to factor that into your decision.