How to Calculate APR on a Loan

Contents

How to Calculate APR on a Loan. You can use this simple APR calculator to find out the effective interest rate on your loan.

Checkout this video:

What is APR?

The real APR is not the same as the quoted rate. The real APR includes both the interest rate and the fees, so it’s a more accurate representation of the true cost of borrowing.

To calculate the real APR on a loan, you’ll need to know four things:

1. The interest rate

2. The upfront fees

3. The length of the loan

4. The amount being borrowed

With this information, you can use an online calculator or do the math yourself using the following formula:

real APR = ({interest rate} + {upfront fees}) x ({length of loan} / {amount being borrowed}) x 100%

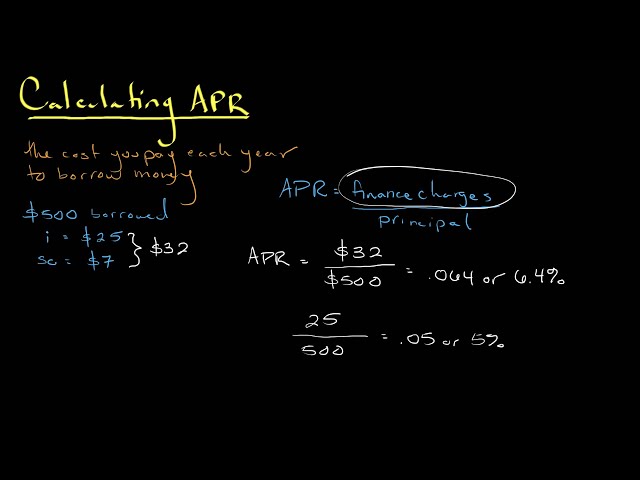

How to calculate APR

The Annual Percentage Rate (APR) is the true cost of borrowing money. It includes the interest rate plus any other fees or charges. When you’re comparison shopping for a loan, making sure you compare APRs is the best way to make sure you’re getting the best deal.

APR formula

The APR formula is:

Total interest paid on the loan/loan amount x 100 = APR

For example, if you take out a $500 loan with a 10 percent interest rate and have to pay $50 in interest at the end of the year, your APR would be 10 percent. If you took out the same loan but had to pay $60 in interest, your APR would be 12 percent.

APR example

When you’re taking out a loan, it’s important to understand the Annual Percentage Rate (APR), which is the annual cost of borrowing. This includes the interest rate as well as any fees that are charged for the loan. The APR can help you compare different loans to see which one will cost you less in the long run.

To calculate the APR on a loan, you’ll need to know the interest rate and any fees that are charged. You can then use this information to figure out the APR using the following formula:

APR = (Interest rate/100) / ((1-(1/(1+Interest rate/100)^Loan term in years)))*12) + Fees/Loan amount *1200

For example, let’s say you’re taking out a loan for $10,000 with an interest rate of 5% and a loan term of 5 years. The fee for the loan is $100. Using the formula above, we can calculate the APR as follows:

APR = (5/100) / ((1-(1/(1+5/100)^5)))*12) + 100/10000 *1200

= 0.05 / ((1-(0.9999)))*12) + 0.01

= 0.05 / (0.0001)*12 + 0.01

= 2,500 + 0.01

= 2.51%

How to use APR

APR stands for Annual Percentage Rate and is the amount of interest you will pay on a loan over the course of one year. APR is calculated by taking the interest rate and adding any additional fees that may apply. To calculate APR, you will need to know the interest rate, loan amount, and term of the loan.

APR for short-term loans

The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate. Those terms have formal definitions in Regulation Z, which implements the Truth in Lending Act. 22 CFR 1002.4.

There are also two types of APRs that might be quoted to you when you’re shopping for a loan: “simple” and “compound.” With simple interest, the APR is exactly equal to the periodic interest rate multiplied by the number of periods in a year (usually 12). With compound interest, periodic interest is first paid into your account, and then that interest starts earning more interest — so the effective APR will be higher than the stated APR. For example: If you’re quoted an APR of 10% on a loan with monthly payments, that’s actually a compound rate of 1% per month; so if you make all your payments on time, at the end of 12 months you’ll have paid 1% × 12 = 12% in total interest. In contrast, if your loan has a simple interest rate of 10%, then you’ll pay 1/12 of 10%, or 0.83%, each month; so at the end of 12 months you’ll have paid 10% total interest.

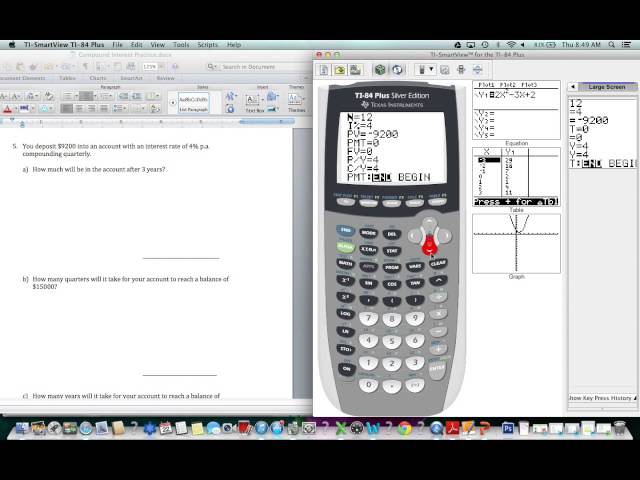

APR for long-term loans

The APR for long-term loans is different from the APR for credit cards because it includes both the interest rate and the fees charged by the lender.

To calculate the APR for a long-term loan:

1. Add the interest rate and the fees charged by the lender.

2. Divide this amount by the number of payments you’ll make over the life of the loan.

3. Multiply this amount by 12 (the number of months in a year) to get your monthly APR.

4. Multiply your monthly APR by the number of payments you’ll make over the life of the loan to get your total APR.

Pros and cons of APR

The Annual Percentage Rate (APR) is the true cost of a loan. It includes the interest rate, points, fees and other charges associated with the loan. Because all these costs are rolled into one number, the APR is generally higher than the interest rate. Nevertheless, it is still a very important number. The APR can help you compare the cost of different loans and choose the best one for you.

Pros

There are a few key reasons that make APR attractive for borrowers.

The most obvious reason is that it’s a lower interest rate. If you qualify for a low APR, you can save a significant amount of money in interest charges over the lifetime of your loan.

Another big advantage is that APR gives you the true cost of borrowing. With some loans, such as credit cards, the interest rate is variable. That means your payments can go up or down based on market conditions. With APR, you always know how much your loan will cost.

Lastly, APR can help you comparison shop for loans. Lenders are required by law to disclose the APR when they advertise loan rates. That makes it easy to see which lender is offering the best deal on a loan.

Cons

An annual percentage rate (APR) is a broader measure of the cost to you of borrowing money, also expressed as a percentage rate. In general, the APR reflects not only the interest rate but also any points, mortgage broker fees, and other charges that you pay to get the loan. For that reason, your APR is usually higher than your interest rate.

The main disadvantage of an APR is that it includes fees and other costs in addition to interest, so it makes it more difficult to compare loans from different lenders. For example, one lender may charge a higher interest rate than another but have lower fees and points, resulting in a lower APR. To make an accurate comparison, you would need to calculate the total cost of each loan.