How to Get Out of an FHA Loan

Contents

If you’re having trouble making your mortgage payments and you’re considering a loan modification or other foreclosure avoidance options, you may be wondering if you can get out of your FHA loan.

Checkout this video:

Introduction

If you have an FHA loan, you may be wondering how to get out of it. The good news is that you have a few options. In this guide, we’ll discuss how to get out of an FHA loan so that you can move on with your life.

What is an FHA Loan?

An FHA loan is a loan obtained through the Federal Housing Administration, a federal agency responsible for insuring residential mortgages. FHA loans are popular among first-time homebuyers because they require a lower down payment and credit score than many conventional loans. FHA loans are also assumable, meaning that if you sell your home, the new buyer can take over your loan.

There are several reasons why you might want to get out of your FHA loan. Maybe you bought more house than you can afford and now you need to sell it. Maybe you got a great job offer in another city and need to relocate. Maybe your financial situation has changed and you need to refinance into a conventional loan. Whatever the reason, there are a few things you need to know about getting out of an FHA loan.

How to Get Out of an FHA Loan

If you’re thinking about getting out of your FHA loan, there are a few things you should know. You’ll need to have a good reason for wanting to get out of the loan, and you’ll need to be prepared to pay a penalty. We’ll go over everything you need to know about getting out of an FHA loan.

Refinancing

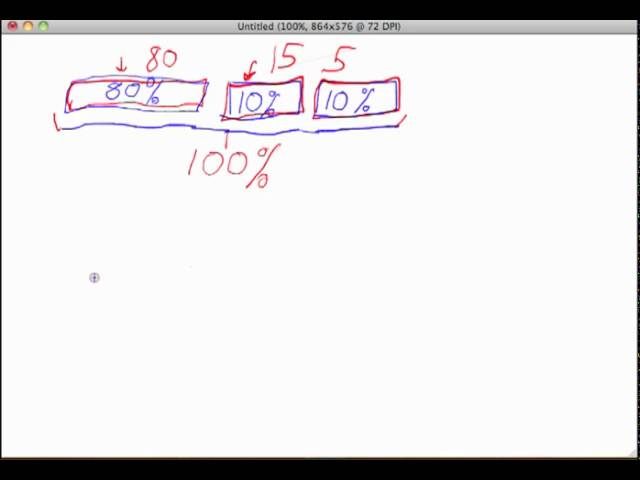

Refinancing is the only way to remove PMI from conventional loans. You’ll need at least 20 percent equity in your home to qualify for this type of loan. With PMI removal, you’ll pay a higher interest rate if you do an FHA streamline refinance. As of 2019, you can expect to pay 0.85 additional point on your mortgage interest rate if you have PMI.

Selling the Property

Your best option might be to sell the property. You’ll need to pay off the loan, but you might be able to sell it for enough to cover the payoff and have money left over. You’ll need to work with a real estate agent to determine whether this is a good option and, if so, how much you can expect to get for the sale.

Loan Assumption

Assuming someone else’s FHA loan is one way you can get out of your own FHA loan. To assume an FHA loan, you must be approved by the lender, and you must qualify financially for the loan. The process of assuming an FHA loan is generally much simpler than getting a new FHA loan, and can sometimes result in a lower interest rate and monthly payment.

Conclusion

In conclusion, while it’s possible to get out of an FHA loan before meeting the minimum five-year repayment period, doing so typically requires refinancing into a conventional mortgage. Borrowers who have not yet reached the five-year mark may be able to refinance into another FHA loan if they meet the credit score requirements and can prove that refinancing will reduce their monthly payments.