How to Calculate APR on Your Credit Card

Contents

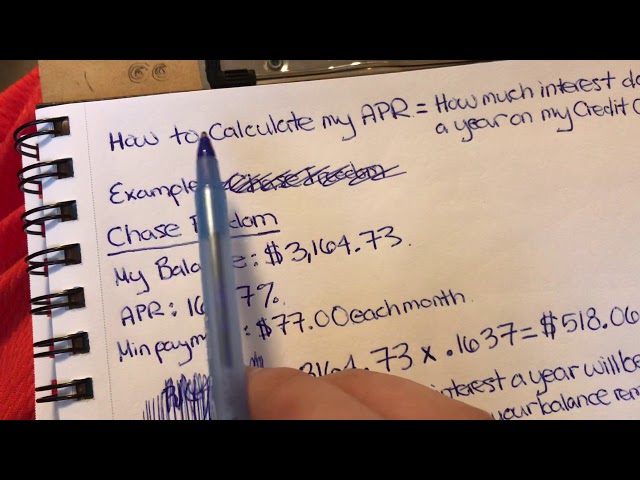

How to Calculate APR on Your Credit Card

Learn how to calculate APR on your credit card so that you can make informed choices about which card is right for you.

Checkout this video:

What is APR?

APR is the Annual Percentage Rate that you’re charged on your credit card. It includes your interest rate plus any additional fees, and is the rate you’re charged for borrowing money. Your APR can be different from your interest rate, and it’s important to understand how it works so you can avoid paying more than you have to.

Annual Percentage Rate

The Annual Percentage Rate (APR) is the yearly rate of interest that is charged on an outstanding credit card balance. In other words, it’s the price you pay for borrowing money on your credit card.

APR is expressed as a percentage and is calculated by adding together the interest rate charged by the credit card issuer and any additional fees that may apply (such as annual fees, balance transfer fees, or cash advance fees).

The APR can vary depending on the type of credit card you have, and different issuers may charge different APRs for the same type of card. For example, a student credit card from one issuer may have a higher APR than a regular credit card from another issuer.

APR is important to keep in mind when you’re considering a new credit card because it can have a big impact on how much your debt will cost you over time. A higher APR means you’ll end up paying more in interest charges if you carry a balance on your card from month to month.

Fortunately, there are ways to avoid paying interest on your credit card balance. One way is to make sure you always pay your balance in full and on time every month. Another way is to look for a credit card with a 0% introductory APR offer, which can give you a period of time (usually between 12 and 21 months) during which you won’t be charged any interest on your balances.

The cost of borrowing money

Annual Percentage Rate (APR) is the cost of borrowing money, expressed as a percentage of the amount borrowed.

For example, if you borrow $1,000 at an APR of 20%, you’ll owe $200 in interest after one year. The APR is the annual rate of interest charged by the lender, plus any fees that may be charged (such as an origination fee).

APR is a widely used metric for evaluating the cost of borrowing money, whether it’s for a credit card, personal loan, mortgage, or auto loan. By law, credit card issuers must prominently display the APR on statements and marketing materials. And when you’re shopping for a loan, lenders must provide you with an APR quote before you agree to the terms of the loan.

The APR can be helpful when comparing different types of loans, but it’s important to remember that it’s not the only factor to consider. The terms of the loan (such as the repayment period) can also have a big impact on the overall cost of borrowing.

How is APR Calculated?

APR is the annual percentage rate that is charged for borrowing, and it is expressed as a yearly rate. This rate is usually applied to credit cards, loans, and mortgages. The APR is calculated by taking the average daily balance and multiplying it by the daily periodic rate, which is then multiplied by the number of days in the year.

The daily periodic rate

The daily periodic rate (DPR) is the APR divided by 365, which is the number of days in a year. To calculate your DPR, divide your APR by 365. For example, if your APR is 15%, your DPR would be 0.0410%.

Now that you know how to calculate DPR, you can use it to estimate how much interest you’ll accrue on a daily basis. To do so, simply multiply your current balance by your DPR. So, if you have a balance of $1,000 and a DPR of 0.0410%, you would accrue $0.41 in interest per day.

Keep in mind that this is just a simple estimation—your actual interest charges may differ based on the type of APR you have (e.g., variable vs. fixed), changes in your balance, or other factors.

The average daily balance

To calculate your APR, your credit card issuer will start with the average daily balance of your account during the billing cycle. For example, let’s say that you had a balance of $1,000 on Monday, $1,500 on Tuesday and $2,000 on Wednesday. Your average daily balance would be $1,666.67 ((1,000 + 1,500 + 2,000) ÷ 3).

If you made no other transactions during the billing cycle and your APR was 15%, your interest charge for the cycle would be $25 ((1,666.67 x 15%) ÷ 365 days).

How to Calculate APR

APR, or annual percentage rate, is the amount of interest you’ll pay annually on any outstanding balances on your credit card. To calculate your APR, simply divide your interest rate by the number of days in the year. For example, if your interest rate is 18%, your APR would be 0.05% (18%/365).

APR formula

To calculate APR, start by finding the monthly interest rate. To do this, divide your annual percentage rate by 12. Then, add any fees you’re being charged to that number. Finally, multiply that number by your balance to find your monthly interest charge.

APR example

The formula for calculating APR is actually very simple:

APR = (Interest rate/100) / (Number of days in the year/Number of days the interest is applied)

For example, if you have a credit card with a 20% annual interest rate and you are being charged interest daily, your APR would be:

APR = (20/100) / (365/30) = 0.056 or 5.6%

If you were being charged interest monthly, your APR would be:

APR = (20/100) / (12/30) = 0.167 or 16.7%

How to Avoid Paying Interest on Your Credit Card

If you have a credit card, you probably know that you’re technically paying interest on your balance from the moment you make a purchase until you pay it off in full. But there are a few ways you can avoid paying interest on your credit card balance. In this article, we’ll show you how to calculate APR on your credit card so that you can avoid paying interest on your balance.

Pay your balance in full each month

To avoid paying interest on your credit card, you need to pay your balance in full each month. This means that you need to pay the full amount that you owe on the card before the due date. If you do not pay the full amount, then you will be charged interest on the unpaid balance.

To calculate your monthly payment, you need to know your APR (annual percentage rate). This is the interest rate that you will be charged if you do not pay your balance in full each month. To calculate your monthly payment, you divide your APR by 12 (this is because there are 12 months in a year).

For example, if your APR is 18%, then your monthly payment would be 1.5% (18% divided by 12). This means that if you have a balance of $1000 on your credit card, then you would need to pay $15 per month in interest if you do not pay off the entire balance.

To avoid paying interest, make sure that you pay off your entire balance each month before the due date.

Use a 0% APR credit card

There are a few ways to avoid paying interest on your credit card balance. One way is to use a 0% APR credit card. These cards offer a 0% introductory APR period, which means you won’t be charged any interest on your balance for a set period of time. This can be a great way to save money if you need to carry a balance on your card for a few months.

Another way to avoid interest is to pay off your balance in full each month. This way, you’ll never be charged any interest. If you can’t pay off your balance in full, try to at least pay more than the minimum payment each month. This will help you pay off your balance faster and avoid paying interest.

You can also avoid interest by using a balance transfer credit card. These cards offer 0% introductory APRs on balance transfers, which can help you save money if you need to transfer a balance from another card. Just be sure to pay off your balance before the intro period ends, or you’ll be charged interest on the remaining balance.