What is the Easiest Credit Card to Get?

It can be difficult to get approved for a credit card , but there are a few that are easier to qualify for than others. Find out which credit cards are the easiest to get approved for.

Credit Card to Get?’ style=”display:none”>Checkout this video:

Credit Card Basics

A credit card allows you to borrow money from a lender and then pay that money back over time. Credit cards can be a helpful tool if used correctly, but can also lead to debt if you’re not careful. When you’re trying to decide which credit card is right for you, it’s important to consider a few things. In this article, we’ll discuss what the easiest credit card to get is and a few things you should keep in mind when you’re looking for a credit card.

What is a credit card?

A credit card is a plastic card that gives the cardholder a predetermined amount of credit, which can be used to purchase items or withdraw cash. Credit cards are issued by banks and other financial institutions, and they allow consumers to borrow money up to a certain limit in order to buy items or withdraw cash.

There are two main types of credit cards: unsecured and secured. Unsecured credit cards are the most common type of credit card, and they do not require the cardholder to have any collateral. Secured credit cards, on the other hand, require the cardholder to have some form of collateral, such as a savings account, in order to get the card.

How do credit cards work?

Credit cards are a type of loan, and like all loans, there is an element of risk involved for the lender. When you use a credit card, you are essentially borrowing money from the card issuer, and they charge interest on that loan. In order to offset the risk involved in lending money, most credit card issuers charge an annual fee for use of their cards.

What are the different types of credit cards?

There are many different types of credit cards available on the market, each with their own set of benefits and drawbacks. The most important thing to consider when choosing a credit card is what type of cardholder you are – do you pay off your balance in full every month, or do you carry a balance from month to month?

Here is a breakdown of the most common types of credit cards:

-Cash back credit cards: Cash back credit cards give you a percentage of cash back on all of your purchases, usually between 1-5%. Some cards have higher rates for specific categories like gas or groceries. The best cash back credit cards will have no annual fee and will offer a high rate of cash back.

-Balance transfer credit cards: Balance transfer credit cards offer a 0% APR introductory rate for a period of time (usually 12-18 months), which can save you a lot of money if you are carrying a balance on another card with a higher interest rate. Be sure to read the fine print on balance transfer offers, as some come with balance transfer fees that can negate the savings.

-Travel rewards credit cards: Travel rewards credit cards can give you points or miles for every purchase that you make, which can be redeemed for free travel or other perks like hotel stays or airport lounge access. These cards usually come with an annual fee, so they are best suited for frequent travelers who will be able to take advantage of the benefits.

-Student credit cards: Student credit cards are designed for college students who may not have established much credit history yet. These cards usually have low limits and high interest rates, so they should be used responsibly. Many student credit cards also offer cash back or other rewards programs.

-Secured credit cards: Secured credit cards require a security deposit in order to open an account, but can help build your credit history if used wisely. These card typically have low limits and high interest rates, so be sure to pay off your balance in full each month to avoid costly fees.

The Easiest Credit Cards to Get

There are a few things to consider when you’re looking for an easy credit card to get. The first is your credit score. If you have good or excellent credit, you’ll have a much easier time getting approved for a card. The second is what you’re looking for in a card. If you’re looking for a card with great rewards, you’ll likely have to put in a little more effort to get approved. Here are a few of the easiest credit cards to get.

Credit One Bank® Platinum Visa® for Rebuilding Credit

The Credit One Bank® Platinum Visa® for Rebuilding Credit is one of the easiest credit cards to get. It’s designed for people who are working to rebuild their credit, and it offers a number of features that make it easier to get approved for a credit card.

Here are some of the key features of the Credit One Bank® Platinum Visa® for Rebuilding Credit:

-No annual fee

-No security deposit required

-1% cash back on eligible purchases (terms apply)

-Access to your Experian credit score

-Flexible payment options

-Automatic review for a higher credit line

Capital One® Platinum Credit Card

The Capital One® Platinum Credit Card is a great option for people with average credit who are looking to build their credit history. This card has no annual fee and a decent APR, making it a good choice for people who are trying to avoid paying too much in interest. The Capital One® Platinum Credit Card also offers a few perks, like access to your credit score and no foreign transaction fees.

Discover it® Secured

The Discover it® Secured is one of the easiest credit cards to get because it offers a relatively low minimum credit limit and does not require a security deposit. It also has a relatively low annual fee and offers a variety of rewards and perks, making it a good choice for people who are looking to build or rebuild their credit.

Wells Fargo Secured Credit Card

Wells Fargo Secured Credit Card is the easiest credit card to get. There is no minimum credit score required and you can get approved with bad credit. The only requirement is that you have a Wells Fargo checking account.

How to Get a Credit Card

There are a few things to consider when you’re trying to get a credit card. The first is your credit score. If you have a good credit score, you’ll have a better chance of getting approved for a credit card. Another thing to consider is the type of credit card you’re looking for. If you’re looking for a rewards card, you’ll need to have a good credit score to get approved.

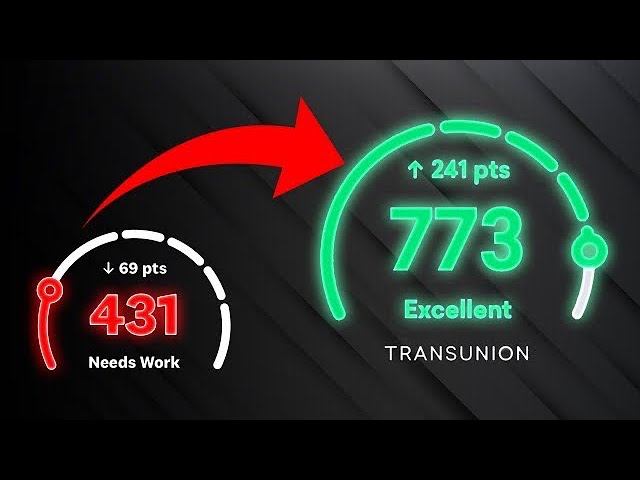

Check your credit score

The first step in getting a credit card is to check your credit score. This will give you an idea of what kind of credit card you may be eligible for. If you have a good credit score, you may be able to get a credit card with a low interest rate and a generous credit limit. If you have a bad credit score, you may still be able to get a credit card, but it will likely have a higher interest rate and a lower credit limit.

Once you know your credit score, you can start looking for credit cards that fit your needs. There are many different types of credit cards available, so it is important to compare offers and find the one that best suits your financial situation.

Some things to consider when choosing a credit card include the interest rate, annual fee, grace period, and Rewards program. It is also important to read the fine print carefully so that you are aware of any fees or charges that may apply.

Research credit card options

The first step in finding the best credit card for you is to research your options. There are many different credit cards available, and each has its own set of benefits and drawbacks. You’ll want to compare and contrast different cards to see which one best suits your needs.

Once you’ve narrowed down your options, you’ll need to consider a few other factors, such as your credit score. If you have good credit, you’ll likely be able to qualify for a better interest rate and more favorable terms. However, if you have bad credit, you may still be able to get a credit card, but it may come with some strict requirements.

Apply for a credit card

There are a few things to keep in mind when you are looking for the easiest credit card to get approved for. The first is your credit score. If you have a good credit score, you will likely be approved for most credit cards. However, if you have bad credit, you may only be approved for secured credit cards or cards with high interest rates.

Another factor to consider is your income. If you have a low income, it may be difficult to get approved for a credit card. This is because lenders want to make sure that you will be able to make your monthly payments on time.

Finally, you should consider the type of credit card that you are applying for. Some cards, such as balance transfer cards and rewards cards, tend to be easier to get approved for than others. If you are not sure which type of card is right for you, it is a good idea to speak with a financial advisor before you apply.

Use your credit card responsibly

To get a credit card, you need to be at least 18 years old and have a source of income. It’s also important to have a good credit history. If you don’t have any credit history, you can still get a credit card, but you may have to pay a higher interest rate.

Once you’ve found a card that fits your needs, it’s time to apply. When you apply for a credit card, the issuer will pull your credit report and score. This is called a hard inquiry, and it can temporarily lower your credit score by a few points.

If you’re approved for the card, the issuer will give you a credit limit, which is the maximum amount of money you can charge on the card. It’s important to use your credit card responsibly and stay within your credit limit. If you do, you’ll be able to improve your credit score and eventually qualify for a better card with a lower interest rate.