How to Get Something Off Your Credit Report

Contents

If you’re trying to get something removed from your credit report , you’ll need to follow a few specific steps. Here’s what you need to know.

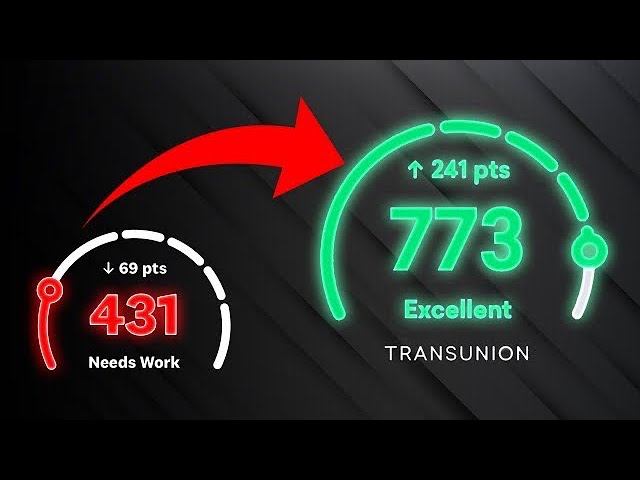

Checkout this video:

Request a credit report from the three major credit bureaus

The first step to take is to request a credit report from the three major credit bureaus: Experian, TransUnion, and Equifax. You’re entitled to one free report from each bureau every 12 months, so take advantage of that right. You can request your reports all at once, or space them out throughout the year.

Once you have your reports, comb through them carefully. Look for any errors, such as closed accounts that are still listed as open, late payments that were actually made on time, or incorrect balances. If you find any errors, file a dispute with the credit bureau in question.

If everything on your credit report is accurate, don’t despair. There are still things you can do to improve your credit score. Start by paying down your debts, and make sure you make all your payments on time from now on. You can also try to get a debt consolidation loan or line of credit to help you better manage your debt load. And finally, be patient — it takes time to rebuild your credit history

Review your credit report for errors

It’s important to review your credit report regularly to ensure accuracy and catch any potential errors that could be dragging down your score. You’re entitled to one free credit report from each of the three major credit bureaus — Equifax, Experian and TransUnion — every 12 months. You can get yours by visiting annualcreditreport.com or by calling 1-877-322-8228. Be sure to review all three reports, as they may contain different information.

If you find an error on your credit report, contact the creditor directly to dispute it. If the creditor agrees that the error is incorrect, they will notify the credit bureau, who will then make the necessary corrections on your report. You can also file a dispute with the credit bureau directly; however, this process can take longer to resolve.

Dispute any errors with the credit bureau

If you find an error on your credit report, you can dispute it with the credit bureau. The credit bureau will then investigate and, if they find that the information is inaccurate, they will remove it from your report. You can do this yourself or hire a professional to help you.

If you have negative information on your credit report that is accurate, you can still work to improve your credit score by paying off debts, making payments on time, and maintaining a good credit history.

Follow up with the credit bureau

If you’ve disputed an item on your credit report and the credit bureau agrees that it’s inaccurate, they’ll contact the lender or collection agency and ask them to verify the information. If the creditor can’t verify the information, they have to remove it from your credit report.

The credit bureau will send you a notice letting you know the results of their investigation and whether or not the item has been removed from your report. If you still don’t agree with the outcome, you can file another dispute.

Monitor your credit report

The best way to get something off your credit report is to dispute it with the credit bureau. However, if you don’t have proof that the information is inaccurate, the credit bureau may not remove it from your report.

Here are some other things you can do to improve your credit score:

-Pay your bills on time

-Keep balances below 30% of your credit limit

-Apply for new credit only when necessary

-Check your credit report regularly for errors