How to Read a Credit Report

Contents

How to Read a Credit Report – Understanding a credit report and what it means for your financial future is vital. Here’s a guide to reading and interpreting your credit report.

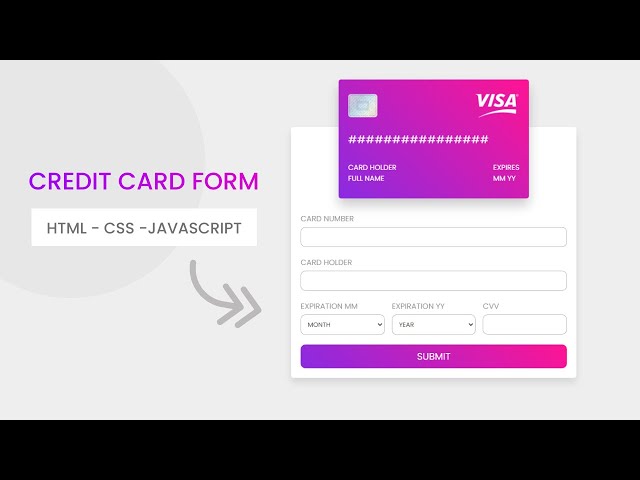

Checkout this video:

What is a Credit Report?

Your credit report is a record of your credit history and activity. It includes information about the loans you’ve taken out, the credit cards you use, your bill-paying history, and whether you’ve been sued or have filed for bankruptcy.

Most lenders look at your credit report before approving a loan or line of credit. That’s because your credit report is a good indicator of how likely you are to repay a loan. If you have a history of paying your bills on time and managing your debt responsibly, lenders will see you as a good risk and are more likely to approve your loan.

Your credit report also is used by landlords, employers, and utility companies to decide whether to do business with you. So it’s important to keep tabs on your credit report and make sure it is accurate.

How to Read a Credit Report

A credit report is a document that contains information about your credit history. It includes information about your credit accounts, late payments, bankruptcies, and more.

Personal Information

Your credit report will begin with your personal information including your name, current and previous addresses, date of birth, Social Security number, and employment information. This is followed by a list of your credit accounts including the type of account, the date you opened the account, your credit limit or loan amount, the account balance, and your payment history.

Accounts

Accounts are sectioned into two distinct types: open and closed. Open accounts are currently being used (think: your mortgage or your credit card), while closed accounts have been paid off or are no longer active (like a car loan you just paid off).

The account table also includes the date the account was opened, the type of account (installment loan, revolving credit, etc.), the credit limit or loan amount, your current balance and your payment history. Any late payments will be listed here as well.

Inquiries

soft inquiries and hard inquiries. Soft inquiries won’t affect your credit score, while hard inquiries can ding your score for up to a year. So, if you’re trying to improve your credit score, you want to avoid hard inquiries whenever possible.

Inquiries are categorized asand. Soft inquiries won’t affect your credit score, while hard inquiries can ding your score for up to a year. So, if you’re trying to improve your credit score, you want to avoid hard inquiries whenever possible.

Hard Inquiries: A hard inquiry is generated any time a lending institution pulls your credit report with the intention of extending you some form of credit. Applying for a credit card, auto loan, mortgage or student loan will all result in a hard inquiry being placed on your report. Too many hard inquiries in a short period of time can have a negative effect on your credit score (generally speaking, six or more in 12 months will start to look bad to lenders).

Soft Inquiries: A soft inquiry is generated when someone other than a lending institution requests your report — such as when an employer checks your credit or you check it yourself. These requests are not tied to any kind of credit extension and will not have an effect on your score no matter how many times they occur.

Public Records

Public Records: This section includes items such as bankruptcies, tax liens, and judgments. These items will stay on your credit report for 7-10 years, and will have a serious negative impact on your credit score. If you have any public records on your credit report, it is important to know the date they were filed, as well as the date they are scheduled to fall off your report.

How to Get a Credit Report

Free Annual Credit Report

You are entitled to one free credit report from each of the three major credit reporting agencies every twelve months. You can request your free report online, by phone, or through the mail.

Online: Visit www.annualcreditreport.com to request your free report.

Phone: Call 1-877-322-8228.

Mail: Download and complete the Annual Credit Report Request Form available at www.ftc.gov/bcp/conline/pubs/credit/freqcr.htm and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

Other Ways to Get a Credit Report

There are other ways to get a credit report besides going through a credit bureau. Some companies, such as credit card companies, mortgage companies, and auto loan financiers, may give you a free copy of your credit report if you are their customer. In addition, potential employers or landlords may give you a copy of your credit report if they use it as part of their decision-making process.

How to Dispute Credit Report Errors

If you find an error on your credit report, you have the right to dispute it. You can do this by contacting the credit reporting agency directly. The agency will then investigate your claim and make any necessary corrections.

If you don’t agree with the results of the investigation, you can also file a complaint with the Consumer Financial Protection Bureau (CFPB).

Credit Report FAQs

What is a credit report?

A credit report is a record of your credit history that includes information about your loans, credit card balances, payment history, and any collection actions that have been taken against you. Credit reports are maintained by the three major credit reporting agencies—Equifax, Experian, and TransUnion—and they are used by lenders to help make decisions about loan approvals and interest rates. You are entitled to one free credit report from each of the agencies every 12 months.

What information is included in a credit report?

Your credit report will include your personal information, such as your name, address, Social Security number, and date of birth. It will also include information about your credit accounts, such as your account balances, payment history, and any derogatory information that has been reported about you (such as late payments or collections activity).

How do I get my free annual credit report?

You can get your free annual credit report from each of the three major credit reporting agencies—Equifax, Experian, and TransUnion—by visiting AnnualCreditReport.com or by calling 1-877-322-8228. You will need to provide your name, address, Social Security number, and date of birth in order to request your report.

What if I find inaccuracies on my credit report?

If you find inaccurate or incomplete information on your credit report, you can file a dispute with the respectivecredit reporting agency. The agency will then investigate the disputed items and remove them from your report if they cannot be verified.