How to Avoid Paying Credit Card Interest

Contents

You can avoid paying credit card interest by following a few simple steps. Find out what they are in this blog post.

Checkout this video:

Understand how credit card interest works

Most people know that credit card companies charge interest on late payments, but few understand how credit card interest works. By understanding how credit card companies calculate interest, you can avoid paying interest on your credit card balances. In this article, we’ll explain how credit card companies calculate interest and what you can do to avoid paying it.

Interest is charged on a daily basis

Interest is charged on a daily basis, so the sooner you pay off your balance, the less interest you will pay. Most credit card companies have a grace period of 21 days, so if you pay your balance in full every month, you will never be charged interest. But if you carry a balance from one month to the next, interest will be charged on that balance from the date of purchase until the balance is paid in full.

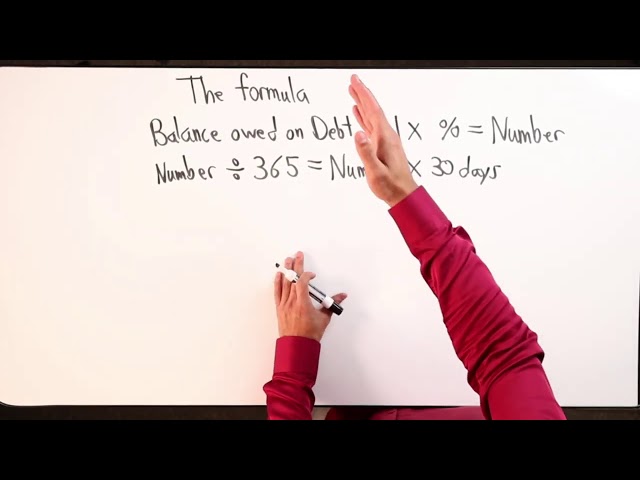

Interest is calculated based on your average daily balance

The amount of interest you pay is based on your average daily balance for the month. To calculate your average daily balance, we take the beginning balance of your account each day, add any new charges and adjustments posted during the day, and subtract any payments or credits posted during the day. We divide that by the number of days in the month (31), to get your average daily balance.

Here’s an example:

You have a balance of $1,000 on the first of the month. You don’t make any charges or payments during the month. Your average daily balance would be $1,000.

You have a balance of $1,000 on the first of the month. You make a $100 payment on the 15th and don’t make any other charges during the month. Your average daily balance would be $958.33 (($1,000 x 31 – $100) / 31).

## Title: The Different Types of Tea – (How to Choose Tea)

##Heading: Green tea

##Expansion: Green tea is made from unfermented leaves and is reported to contain high levels of antioxidants. Traditionally consumed in Asia, green tea has become popular all over the world for its health benefits. Green tea has a light and delicate flavor that is often described as grassy or vegetal.

## Title: The Different Types of Wine – (How to Choose Wine)

##Heading: Red wine

##Expansion: Red wine is made from dark-colored grape varieties and gets its color from contact with grape skins during fermentation. Red wines are usually full-bodied with flavors ranging from fruity to earthy to spicy. Popular red wine varieties include Cabernet Sauvignon, Merlot and Pinot Noir.

Know when interest is charged

Interest is charged on new purchases and cash advances

Interest is charged on your credit card account when you don’t pay the full balance by the due date. This applies to new purchases and cash advances.

The amount of interest you’re charged depends on:

-the type of card you have

-the interest rate on your card

-the amount of money you owe

-how long it takes you to pay off your debt

Interest is not charged on balance transfers and certain other transactions

Interest is not charged on balance transfers and certain other transactions if you pay your total balance (including any transferred balances) by the due date each month. Purchases and cash advances will begin to accrue interest at the transaction date. If you have a promotional 0% APR balance transfer offer, interest will not accrue during the promotional period. However, minimum monthly payments are required and may or may not pay off your promotional balance by the end of the promotional period.

Avoid paying interest by using a 0% APR credit card

A 0% APR credit card can help you avoid paying interest on your credit card debt. By using a 0% APR card, you can pay off your debt without accruing any interest. This can save you a considerable amount of money, especially if you have a large balance. There are a few things to keep in mind when using a 0% APR card, however. Let’s take a look.

0% APR credit cards offer a promotional period of time during which no interest is charged

0% APR credit cards can be a great way to save money on interest, but only if you are diligent about paying off your balance before the promotional period ends.

Most 0% APR credit cards offer a promotional period of time during which no interest is charged on balances transferred from other cards or on new purchases. This can be an excellent way to save money if you are able to pay off your balance before the promotional period ends.

However, if you carry a balance over into the next billing period, you will be charged interest on the entire amount from the date of purchase at the card’s standard APR, which can be quite high.

To avoid paying interest, make sure you understand the terms of your 0% APR credit card and make a plan to pay off your balance before the promotional period ends.

After the promotional period ends, the standard APR applies

Most 0% APR credit cards have a promotional period during which you can avoid paying interest on your balance. Once the promotional period ends, the standard APR applies.

It’s important to make sure you understand how the promotional period works before you apply for a 0% APR credit card. Many cards have a “go-to” rate, which is the standard APR that applies after the promotional period ends. Some cards have a “penalty” APR, which is a higher rate that may apply if you make a late payment or go over your credit limit.

To avoid paying interest, you’ll need to pay off your balance in full before the end of the promotional period. If you don’t, you’ll be charged interest at the standard (or penalty) APR.

When comparing 0% APR credit cards, be sure to look at the length of the promotional period and the go-to (or standard) APR that will apply after the promotional period ends.

Avoid paying interest by paying your balance in full each month

Paying your credit card balance in full each month is the best way to avoid paying interest. By doing this, you will avoid paying any interest on your balance and will save money in the long run. There are a few things you can do to make sure you are able to pay your balance in full each month.

Your credit card issuer will send you a statement each month

Your credit card issuer will send you a statement each month, detailing your account activity and balance. If you’d like to avoid paying any interest on your credit card balance, be sure to pay the full balance shown on your statement before the due date. This is called the grace period, and it’s usually between 21 and 25 days.

Check your credit card terms or ask your issuer for more information about your particular grace period. Note that if you carry a balance from month to month, you will likely only have a grace period on new purchases if you paid off your previous balance in full. Otherwise, interest will accrue on your entire balance from the date each purchase is made.

Paying only the minimum amount due each month will cost you in interest and take much longer to pay off your debt. So, if you’re trying to get out of debt, it’s important to pay more than the minimum whenever possible.

You can avoid paying interest by paying your balance in full before the due date

If you’re ever unsure about whether you’ll be able to pay your credit card balance in full, it’s best to err on the side of caution and use another form of payment. That way, you can avoid paying interest altogether.

Paying your balance in full each month is the best way to avoid paying interest on your credit card debt. By doing so, you’ll only ever have to pay the original purchase price for whatever goods or services you charged to your card.

If you can’t swing paying your balance in full each month, that’s okay. Many credit card issuers offer grace periods on new purchases, which means you won’t be charged interest if you pay off your balance within a certain timeframe (usually 20-30 days). Just be sure to make your payment before the due date to avoid being charged a late fee, which can also incur interest charges.

Bottom line: Paying your credit card balance in full each month is the best way to avoid paying interest, but if you can’t do that, at least try to pay off your balance before the due date to take advantage of any grace period offered by your issuer.

Avoid paying interest by using a balance transfer credit card

A balance transfer credit card can help you avoid paying interest on your credit card debt. By transferring your balance to a card with a 0% intro APR, you can save money on interest and pay off your debt faster. In this article, we’ll show you how to find the best balance transfer credit card and how to use it to pay off your debt.

A balance transfer credit card allows you to transfer the balance of one credit card to another

A balance transfer credit card can be a great way to avoid paying interest on your credit card balance. By transferring the balance of one credit card to another, you can take advantage of 0% APR introductory offers and save on interest payments.

However, there are a few things to keep in mind before you sign up for a balance transfer credit card. First, most balance transfer offers come with a transfer fee, which is typically around 3%. This means that you’ll need to pay the fee when you transfer your balance.

Additionally, it’s important to make sure that you’ll be able to repay your balance before the introductory APR period ends. If you can’t repay your balance in full, you’ll start accruing interest at the regular APR rate, which could negate the savings from the introductory offer.

Finally, make sure you understand the terms and conditions of the balance transfer offer before you sign up. Some offers may have restrictions on how and when you can use them, so it’s important to be aware of these before you agree to anything.

By understanding these basics, you can be sure that you’re getting the best possible deal on a balance transfer credit card.

The new credit card will usually offer a 0% APR promotional period

If you have a credit card with a high interest rate, you may be able to avoid paying interest by transferring the balance to a new credit card that offers a 0% APR promotional period. This can be an effective way to save money, but it’s important to understand the potential risks and drawbacks before you make the switch.

One of the main risks of balance transfers is that you may end up paying more interest if you’re not able to pay off your debt during the promotional period. Most balance transfer offers require you to pay a fee of 3-5% of the amount being transferred, so you’ll need to factor that into your payment plan. Additionally, many cards will only allow you to transfer balances from other cards issued by the same bank.

Another potential downside is that your credit score may take a hit if you open a new line of credit and close an existing one. If you’re considering a balance transfer, be sure to do your research and compare offers from different issuers to find one that best suits your needs.

After the promotional period ends, the standard APR will apply

Once the promotional period ends, any remaining balance on the transfer will begin accruing interest at the card’s standard APR. For this reason, it’s important to pay off your balance before the end of the promotional period to avoid paying interest on your balance transfer.