How to Get Cash from Your Credit Card Without Any Charges

Looking to get some quick cash from your credit card without any charges? Here’s a step-by-step guide on how to do it.

Checkout this video:

Research cash advance options

Most people these days use credit cards for everyday purchases and for larger items as well. What many don’t realize is that you can get cash from your credit card without any charges. This can be a great way to get emergency cash or for other purposes. To get started, you’ll need to research cash advance options from your credit card issuer.

Research your credit card’s cash advance policy

Before you consider getting a cash advance from your credit card, it’s important to understand how cash advances work and the fees you may be charged.

Most credit cards will allow you to withdraw cash from an ATM or to get a “cash advance” at a bank or credit union. But just because you can doesn’t mean you should. Credit card companies typically charge high fees for cash advances, and they often charge interest on the amount of cash you withdraw immediately.

To avoid paying extra, it’s best to research your credit card’s cash advance policy before you need to withdraw cash. You can find this information in the cardholder agreement that came with your credit card or on your credit card issuer’s website.

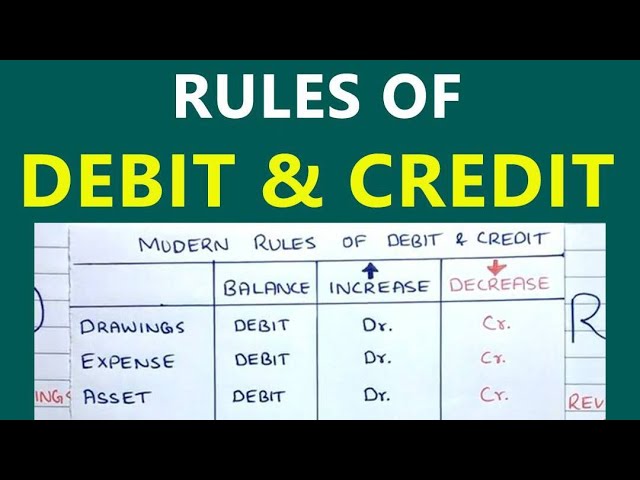

Generally, there are three things you should look for:

-The fee: Most credit cards charge a fee for cash advances, which is typically a percentage of the amount withdrawn (e.g., 3% for $100). This fee is in addition to any ATM fees you may be charged.

-The interest rate: Cash advances usually accrue interest from the date of the withdrawal, even if you pay off your balance in full each month. The interest rate for cash advances is often higher than the interest rate for purchases. For example, if the APR for purchases is 15%, the APR for cash advances may be 24%.

-The limit: There may be limits on how much money you can withdraw as a cash advance. For example, your credit card issuer may limit you to $500 per day or $2,000 per month. If you need more money than that, you may have to visit multiple ATMs or use multiple cards.

Find a credit card that doesn’t charge for cash advances

There are a few ways to get cash from your credit card without having to pay any fees. One way is to find a credit card that doesn’t charge for cash advances. This can be difficult, as most cards will charge some sort of fee for this service. However, there are a few cards that don’t charge any fees for cash advances. Another way to get cash from your credit card without having to pay any fees is to use a service like PayPal or Square Cash. These services allow you to link your credit card to your account and then withdraw money as needed. There are no fees associated with these services, so you can use them freely without having to worry about being charged.

Withdraw cash from your credit card

You can withdraw cash from your credit card at any ATM that displays the Visa or MasterCard logo. You’ll just need to enter your card number and PIN. The cash advance fee is either a percentage of the withdrawn amount or a flat fee, whichever is greater. For example, if you withdrew $100 from an ATM, your cash advance fee could be either $3 or 3%, whichever is greater.

Find an ATM that doesn’t charge fees

There are a few ways to get cash from your credit card without any fees, but it takes some planning ahead. The key is to find an ATM that doesn’t charge fees, and to have a backup plan in case you can’t find one.

Here are a few tips to help you get cash from your credit card without any fees:

1. Find an ATM that doesn’t charge fees: There are a few banks that don’t charge fees for using their ATMs, so it’s worth checking to see if your bank is one of them. If not, there are a few ways to find an ATM that doesn’t charge fees. You can use a site like Bankrate.com to find the nearest fee-free ATM, or you can download the mobile app Fee-Free ATMs™ which will show you the nearest fee-free ATM no matter where you are.

2. Have a backup plan: Even if you find an ATM that doesn’t charge fees, there’s always a chance that it could be out of order or out of cash. So it’s always good to have a backup plan. One option is to get cash back when you make purchases at stores that offer it. Another option is to get cash advances from your credit card issuer, but be aware that most credit card issuers charge high interest rates and fees for cash advances, so this should only be used as a last resort.

3. Bring enough cash: It’s always good to have some cash on hand in case of emergencies, so make sure you bring enough with you to cover all eventualities.

Withdraw cash from your credit card

If you need to withdraw cash from your credit card, there are a few ways to do it without being charged any fees. One way is to use a cash advance from an ATM. This will usually involve a fee, but it can be worth it if you need the cash urgently. Another way to withdraw cash from your credit card is to use a convenience check that your credit card issuer sends you. These checks can be used to withdraw cash from your credit card account, but they will often come with fees and interest charges. You can also transfer money from your credit card to your checking account, and then withdraw the money from your checking account. This will usually involve some fees, but it can be a good option if you need to withdraw a large amount of cash.

Use a cash advance service

There are a few ways that you can get cash from your credit card without any charges. You can use a cash advance service or you can use a credit card cash advance.

Find a cash advance service that doesn’t charge fees

There are a few different ways to get cash from your credit card without paying any fees. The first is to find a cash advance service that doesn’t charge fees. These services are becoming more common, and they’re usually offered by online lenders.

Another option is to use a credit card that doesn’t charge fees for cash advances. These cards are becoming more common as well, and they usually have lower interest rates than cards that do charge fees.

Finally, you can use a prepaid debit card. These cards can be used to withdraw cash from ATMs, and you’ll only be charged the ATM fee.

Use the cash advance service to get cash from your credit card

If you have a credit card, you can often get cash from your card issuer through a cash advance. This is a service that allows you to withdraw cash from your credit card account, either through an ATM or by borrowing against your credit limit.

There may be fees associated with a cash advance, and the interest rates on cash advances are usually higher than the rates on purchases. However, if you need cash quickly and don’t have another source of funds, a cash advance can be a helpful option.

To get a cash advance from your credit card, you will first need to know your credit limit. Your credit limit is the maximum amount that you can borrow on your credit card account. Once you know your credit limit, you can withdraw cash from an ATM or request a cash advance from your card issuer.

When using an ATM to get a cash advance, you will typically be charged a fee of around 3% of the total amount that you withdraw. For example, if you withdrawal $500 from an ATM, you may be charged a fee of $15. You will also likely be charged interest on your cash advance starting from the date of the transaction.

If you borrow against your credit limit to get a cash advance, you will usually be charged interest on the full amount of the loan from the date of the transaction. In addition, most card issuers charge a fee for taking out a cash advance, typically around 5%. For example, if you take out a $500 cash advance on your credit card with a 5% fee, you will owe $525 in total – $500 for the amount borrowed plus $25 in fees.