What is a Wrap Around Loan?

Contents

A wrap around loan is a type of mortgage loan that allows the borrower to use the equity in their home to secure the loan. The loan is then secured by the property itself. This type of loan can be helpful for people who are looking to buy a new home but don’t have the necessary down payment.

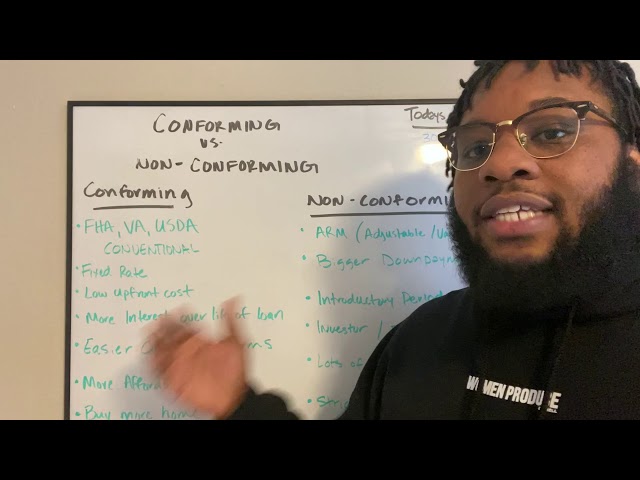

Checkout this video:

What is a Wrap Around Loan?

A wrap-around loan is a type of mortgage loan that can be used in owner-financing deals. This type of loan involves the seller’s mortgage on the home and adds an additional incremental value to secure the purchase price agreed upon between the buyer and the seller.

For example, let’s say John Doe is selling his home to Jane Smith for $200,000. The outstanding balance on John’s mortgage is $100,000. Jane could provide John with a wrap-around mortgage for $210,000 which would include the $100,000 that is still owed on John’s current mortgage plus an additional $10,000. In this scenario, Jane would make payments to John every month which would include her payment towards the $210,000 purchase price as well as the portion of John’s mortgage that is still owed.

Wrap-around mortgages can be helpful in situations where the buyer might not otherwise qualify for a new loan or might not be able to come up with a large enough down payment. It’s important to note that wrap-around loans are not without risk – if the property is sold or foreclosed upon, the original lender will be first in line to receive payment and any outstanding balance on the wrap-around loan will need to be paid by the borrower.

How Does a Wrap Around Loan Work?

In a wrap around loan, the lender takes out a new mortgage to finance the original loan plus an additional amount. The new loan covers the balance of the old mortgage plus an amount that the borrower agrees to pay the lender each month. The monthly payments on a wrap around loan usually include interest, principal, and escrow for taxes and insurance.

Wrap around loans are often used when the borrower has difficulty qualifying for a new mortgage or when the borrower wants to avoid paying private mortgage insurance (PMI). The additional monthly payment goes towards paying down the principal balance of the original loan. This can help the borrower build equity faster and avoid paying PMI.

Wrap around loans can be complicated, so it’s important to work with a lender who can explain how they work and help you decide if one is right for you.

The Pros and Cons of Wrap Around Loans

A “wrap around” loan is a type of mortgage loan that can be used in owner-financing deals. A wrap around loan involves the financing of a property by a seller using a second mortgage or trust deed. The seller then deeds the property to the buyer, who takes on the first mortgage, payments, and solicits his own financing for the balance of the purchase price not covered by the first mortgage.

Wrap around loans have their pros and cons for both buyers and sellers.

For buyers, wrap around loans may:

– Allow you to buy a property when you might not otherwise qualify for a loan.

– Be easier to qualify for than other types of loans.

– Offer lower interest rates than other types of loans.

For sellers, wrap around loans may:

– Help you sell your property more quickly.

– Allow you to sell your property for more money.

Alternatives to Wrap Around Loans

While a wrap around loan may be a good option for some people, there are several alternatives that may be a better fit for your needs. If you’re thinking about getting a wrap around loan, be sure to compare your options and choose the one that’s best for you.

Alternatives to Wrap Around Loans

If you’re thinking about getting a wrap around loan, there are several things you should consider first. Wrap around loans can be a good option for some people, but there are several alternatives that may be a better fit for your needs. Here are some things to think about before you decide if a wrap around loan is right for you:

1. Compare interest rates. Wrap around loans usually have higher interest rates than other types of loans. If you’re considering a wrap around loan, compare the interest rate to the interest rate of other loans to make sure you’re getting the best deal.

2. Consider the term of the loan. Wrap around loans are typically short-term loans, which means they have higher monthly payments. If you can’t afford the monthly payments on a short-term loan, you may want to consider another type of loan with lower monthly payments.

3. Think about the fees involved. Wrap around loans often have origination fees and other closing costs that can add up quickly. Be sure to factor these fees into your decision before you agree to take out a wrap around loan.

4. Compare the total cost of the loan. When you compare different types of loans, be sure to compare the total cost of the loan, not just the monthly payments. The total cost of the loan includes interest and fees, so it’s important to compare apples to apples when you’re looking at different options.

5. Consider your financial goals. Before you take out any type of loan, it’s important to think about your financial goals and what you hope to achieve by taking out a loan. If you’re not sure what your goals are, talk to a financial advisor or planner who can help you figure out what type of loan would be best for your needs.