How Much Will My Credit Score Go Up?

Contents

Wondering how much your credit score will go up if you pay off your credit card balance? Check out this blog post for more info!

Checkout this video:

How credit scores are determined

Your credit score is determined by a number of factors, including your payment history, credit utilization, credit history, and credit mix.

What is a FICO score?

FICO® Scores are the credit scores most lenders use to determine your credit risk. You have three FICO® Scores, one for each of the three credit bureaus – Experian, TransUnion and Equifax. Each score is based on information the credit bureau keeps on file about you. As this information changes, your FICO® Score also changes.

Credit scores are calculated based on your past credit history. The information in your credit report is used to create a credit score, which is a numerical representation of your creditworthiness. Lenders use this score to decide whether or not to give you a loan and at what interest rate.

Your FICO® Score is influenced by five key factors:

-Payment history (35%)

-Amounts owed (30%)

-Length of credit history (15%)

-New credit (10%)

-Credit mix (10%)

What are the five factors that make up a FICO score?

There are five factors that make up a FICO score: payment history (35%), credit utilization (30%), length of credit history (15%), credit mix (10%), and new credit (10%).

Payment history is the most important factor, so it’s important to always pay your bills on time. Credit utilization is also important – you’ll want to keep your balances low relative to your credit limits.

Length of credit history and credit mix are less important, but still relevant. Length of credit history shows how responsible you’ve been with borrowing in the past, while credit mix demonstrates your experience with different types of loans.

Finally, new credit is a measure of how often you’ve applied for credit recently. If you’ve been applying for a lot of loans or lines of credit, it could be a red flag to lenders.

How much your credit score will go up

If your credit score is currently low, you may be wondering how much it will go up if you start paying your bills on time and maintaining a good credit history. The answer varies depending on your situation, but generally speaking, you can expect your credit score to increase by a few points each month as you continue to make on-time payments and manage your credit responsibly.

How many points will my credit score increase if I…

If you’re trying to improve your credit score, it’s important to know how various actions will affect your score. Here are some common scenarios:

Paying off collection accounts: If you have collection accounts on your credit report, your score will improve once you pay them off. The amount of Points your score will increase depends on how much debt you had, your payment history, and the type of account.

Closing old accounts: If you close an old account that has been in good standing, your score may dip slightly. This is because closing an account can shorten your average credit history (one of the factors that makes up your score). But if you have other positive information on your credit report, the dip should be temporary.

Opening a new account: If you open a new credit card or loan, your score may dip temporarily because you now have more debt. But if you make sure to keep balances low and make payments on time, the effect should be minimal. In fact, having a mix of different types of account ( installment loans like mortgages or car loans, revolving loans like credit cards) can actually improve your score.

Pay off my credit card balance?

The impact to your credit score of paying off your credit card balance will depend on a few factors, including how much debt you’re carrying and how long you’ve been making payments.

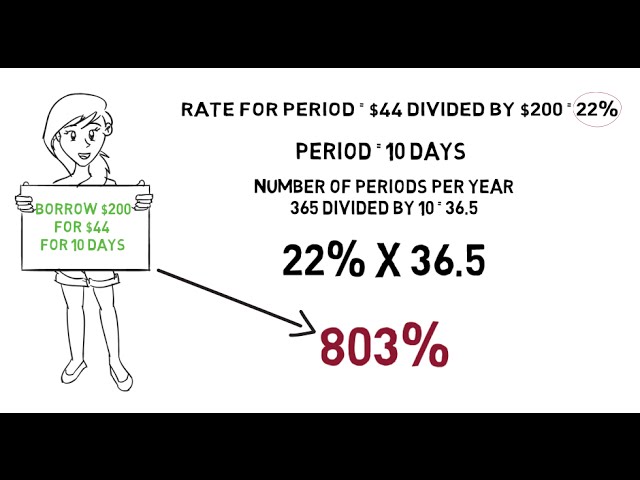

If you’re carrying a lot of debt, paying off your credit card balance can have a big impact on your score. This is because your credit utilization ratio (the amount of debt you’re carrying compared to your credit limit) makes up 30% of your FICO® Score. So, if you’re carrying a balance of $3,000 and your credit limit is $10,000, your credit utilization ratio is 30%. If you pay off that balance and still have a $10,000 credit limit, your utilization ratio would drop to 0%. That could give your score a boost of up to 100 points*, depending on the other information in your credit report.

Paying off a long-standing debt can also result in a score increase. This is because the average age of your accounts makes up 15% of your FICO® Score, and paying off an old account can make it look like you’ve managed debt responsibly for longer.

*Based on FICO internal data as of July 2019

Get a credit limit increase?

If you have a credit card, you might be able to increase your credit limit by asking your issuer for a credit limit increase. Keep in mind that this will result in a hard inquiry on your credit report, which can temporarily lower your score by a few points. But if your issuer approves the request, your score could go up because you’ll have access to more available credit (assuming you don’t max out your new limit).

Have a late payment removed from my credit report?

If you have a late payment on your credit report, you may be wondering how much your credit score could go up if it was removed.

According to FICO, the credit scoring company, 35% of your credit score is based on your payment history. This means that a late payment could be having a significant negative impact on your score.

If you have a late payment that is accurate and up-to-date, there is not much you can do to remove it from your report. However, if the late payment is inaccurate or more than seven years old, you may be able to get it removed by disputing it with the credit bureau.

If you are able to get the late payment removed, you could see a significant jump in your credit score. According to MyFICO, a late payment could drop your score by as much as 110 points. If you are able to get the late payment removed, your score could potentially increase by that same amount.

How to improve your credit score

A credit score is a number that is used to measure your creditworthiness. It is based on your credit history, which is a record of your borrowing and repayment activity. The higher your credit score, the more likely you are to be approved for a loan or credit card. There are a number of things you can do to improve your credit score.

Pay your bills on time

One of the most important things you can do to improve your credit score is to pay your bills on time, every time. Payment history is the biggest factor in calculating your credit score, accounting for 35% of your total score. That’s why it’s so important to make sure you pay all your bills — including your mortgage, car loan, and credit card payments — on time, every time.

If you have a history of late or missed payments, it’s going to take some time and effort to improve your credit score. But if you start paying all your bills on time from now on, your payment history will start to improve and your credit score will start to go up.

It may take a few months or even a few years for your credit score to recover from late or missed payments, but if you stick with it and keep making all your payments on time, eventually your score will rebound and you’ll be back on track.

Keep your credit card balances low

One factor that makes up your credit score is credit utilization, which is the ratio of your credit card balances to your credit limits. For example, if you have a $1,000 balance on a card with a $5,000 limit, your credit utilization would be 20%.

Ideally, you want to keep your credit utilization below 30%, but the lower it is, the better. If you’re trying to improve your credit score, paying down your balances is one of the quickest and most effective things you can do.

Use a mix of credit products

When it comes to credit, using a mix of credit products is one of the best things you can do for your credit score. That’s because it shows that you can manage different types of credit responsibly. So, if you have a mixture of revolving credit (like credit cards) and installment loans (like car loans), that’s generally going to be good for your credit score.

Check your credit report for errors

The first step is to check your credit report for any errors. You can get a free copy of your credit report from each of the three major credit bureaus — Experian, Equifax and TransUnion — once a year at AnnualCreditReport.com.

If you find any errors, you should dispute them with the credit bureau. This can be done online, by mail or by phone. The credit bureau will then investigate the error and make any necessary corrections to your report.

If you don’t find any errors on your credit report, that’s great! You can move on to the next steps in improving your credit score.

How to check your credit score

Checking your credit score is a good way to see how your financial habits are impacting your credit. You can check your credit score for free with a variety of websites and apps. Checking your credit score regularly can help you catch errors and identify potential fraudulent activity. Additionally, monitoring your credit score can help you track your progress as you work to improve your credit.

Get your free credit report

You’re entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

If you’ve been denied credit, employment, insurance, or a rental dwelling because of information in your credit report within the past 60 days, you can also request a free report.

By law:

-You have the right to get a free copy of your credit report every 12 months from each of the nationwide consumer credit reporting companies: Equifax®, Experian®, and TransUnion®.

-You should check your credit report from each company at least once a year to make sure it is accurate and complete. You will want to look for any errors that might be helping to bring down your score unnecessarily and correct them!

-If you find mistakes, contact the consumer credit reporting company in writing and ask that they correct the information in your file. Include copies (NOT originals) of any documents that support your position; in addition, include a copy of your credit report with the items in question circled. Send your letter by certified mail with “return receipt requested So that you can document what the consumer credit reporting company received. Keep copies of all correspondence in case you need to refer to it later

Check your credit score for free with Credit Sesame

Your credit score is an important number that lenders look at when they’re considering whether or not to give you a loan. If you have a good credit score, you’re more likely to get approved for a loan with a low interest rate. A low interest rate could save you thousands of dollars over the life of the loan.

If you’re not sure what your credit score is, you can check for free with Credit Sesame. Credit Sesame is a website that allows you to view your credit score and credit report for free. They’ll also give you personalized recommendations on how to improve your credit score.

To check your credit score for free with Credit Sesame, just click here and sign up for an account. Once you’re signed up, they’ll show you your credit score and credit report. They’ll also give you tailored recommendations on how to improve your credit score.