How Long Does It Take to Get a Home Equity Loan?

Contents

If you’re considering a home equity loan, it’s important to know how long the process takes. Follow these steps to get a loan in as little as two weeks.

Checkout this video:

How Long Does It Take to Get a Home Equity Loan?

When you apply for a home equity loan, the process can take anywhere from a few weeks to a few months. The timeline depends on several factors, including the lender, your credit score and the type of loan you’re applying for.

Generally speaking, it takes longer to get a home equity loan than it does to get a personal loan or line of credit. This is because home equity loans are secured by your home, so the lender has more at stake if you default on the loan.

The good news is that there are things you can do to speed up the process. Here are a few tips:

-Choose a lender that offers pre-approval. This way you’ll know how much money you can borrow before you even start shopping for a home equity loan.

-Get your paperwork in order before you apply. This includes things like your tax returns, pay stubs and bank statements. Having all of this information ready will help the lender make a decision faster.

-Ask about the lender’s policy on co-signers. Some lenders allow co-signers on home equity loans, which can help you qualify for a larger loan amount or get approved with less-than-perfect credit.

The Application Process

The application process for a home equity loan can take anywhere from a few days to a few weeks. After you submit your application, the lender will order a property appraisal to determine the value of your home and how much equity you have. They will also check your credit score and review your financial history to determine your eligibility for the loan.

Once all of this information has been collected, the lender will make a decision on whether or not to approve your loan. If you are approved, you will then need to sign the loan documents and closed on the loan. The entire process can take anywhere from two weeks to a month or more.

The Loan Approval Process

It can take anywhere from 2-6 weeks to get approved for a home equity loan. The approval process can be longer if you have bad credit or a complex financial situation.

The first step is to submit an application with your chosen lender. You will need to provide information about your income, debts, and the value of your home. The lender will also look at your credit score to determine your eligibility.

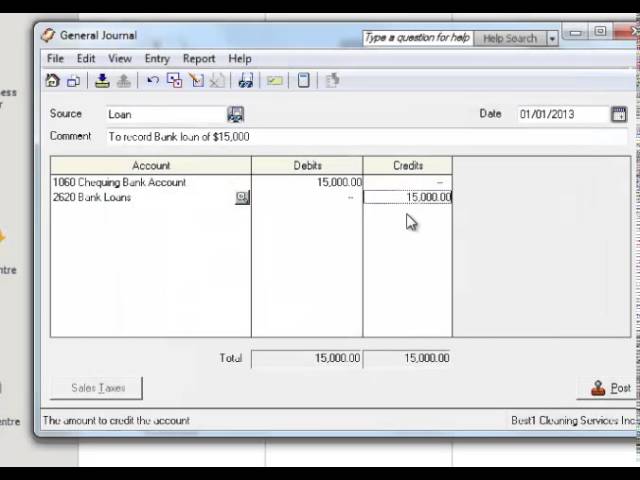

If you are approved, the next step is to complete the loan agreement. This document outlines the terms of your loan, including the repayment schedule and interest rate. Once you have signed the agreement, the money will be transferred to your bank account.

You will then make monthly payments on your home equity loan, just as you would with any other type of loan. It is important to stay current on your payments, as falling behind could put your home at risk of foreclosure.

The Closing Process

The closing process is the final step in getting a home equity loan. It usually takes about 30 days to close on a loan, but it can take longer. The length of time it takes to close on a loan depends on a few things:

-How complicated your financial situation is

-How quickly you can provide the required documentation

-How quickly the appraiser can appraise your home

-How quickly the lender can process your loan