Who Provides and Records Loan Documents?

Contents

If you’re taking out a loan, you’ll need to sign a bunch of documents. But who actually provides and records these documents?

Checkout this video:

The Mortgage Process

The loan process starts with the borrower applying for a loan with a lender. The lender will then order a property appraisal to determine the value of the collateral for the loan. The borrower will also provide the lender with loan documentation, which the lender will use to determine the borrower’s creditworthiness. The lender will then record the loan documents with the county recorder’s office.

Applying for a mortgage

The mortgage process can seem intimidating, but if you do your homework and ask the right questions, you’ll find the process isn’t nearly as bad as it seems. We’ve put together a quick rundown of what you can expect when applying for a mortgage.

One of the first things you’ll need to do is determine how much house you can afford. The best way to do this is by using a mortgage calculator to figure out what your monthly payments will be. Once you have a good idea of what you can afford, you can start looking for a home.

Once you’ve found a home you like, the next step is to get pre-approved for a mortgage. This means that a lender has looked at your financial information and decided how much they are willing to lend you. Getting pre-approved for a mortgage will make the actual process of getting a mortgage much easier.

The next step is to find a lender and submit an application. The lender will then order a credit report and an appraisal of the property. Once these things are done, the lender will give you an estimate of what they are willing to lend you. If everything looks good, they will give you a list of documents they need from you in order to finalize the loan.

These documents will include things like tax returns, pay stubs, bank statements, and more. Once the lender has all the necessary documentation, they will work on finalizing the loan and getting all the paperwork in order.

Once everything is finalized, the last step is to sign all the paperwork and close on the loan. At this point, the lender will provide you with all the necessary paperwork and explain everything in detail so that there are no surprises down the road.

Mortgage pre-approval

Pre-approval is when a potential mortgage lender gives you an estimate of how much they are willing to lend you, based on an assessment of your financial history. This gives you a better idea of the price range you should be looking at for a new home. Mortgage pre-approval typically lasts for 60 to 90 days, so it’s important to only apply for pre-approval when you’re seriously considering buying a home within that timeframe.

Mortgage underwriting

Mortgage underwriting is the process a lender uses to determine if the risk of offering a mortgage loan to a particular borrower is acceptable. Most of the rules and guidelines for underwriting are determined by investors, and not all lenders follow them to the letter.

Lenders begin the underwriting process by reviewing the information on the loan application. They then order a credit report and an appraisal of the property. The underwriter will also verify employment and income information.

After reviewing all of this information, the underwriter will make a decision: to approve, approve with conditions, or deny the loan. If approved, the lender will provide a commitment letter to the borrower and begin work on finalizing the loan documents. The loan process is not complete until all documents are signed by both parties and funds have been dispersed.

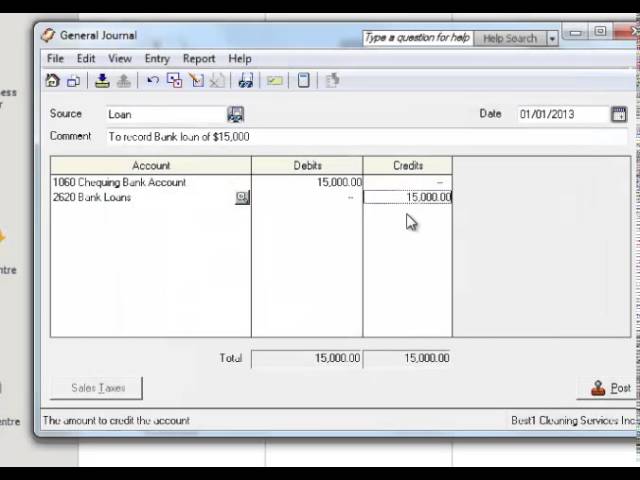

Who provides loan documents?

The three primary players in the field of loan documentation are the borrower, the lender, and the notary. The borrower is the party who is taking out the loan and is therefore obligated to repay the debt. The lender is the party who is extending the loan and is therefore entitled to receive repayment. The notary is a neutral third party who witnesses the signing of the loan documents and attests to their validity.

Mortgage lender

A mortgage lender is a financial institution that makes loans to borrowers to purchase real estate. The mortgage lender may be a bank, credit union, or other type of financial institution. The borrower must repay the loan over a period of time, usually 15 or 30 years. The borrower makes periodic payments to the lender, and the lender uses the payments to pay off the principal and interest on the loan.

Mortgage broker

A mortgage broker is a professional who can help you find a loan that fits your needs. A broker will work with a variety of lenders to find the best rates and terms for your mortgage.

Mortgage servicers

A mortgage servicer is a company that collects monthly mortgage payments and manages the day-to-day operations of a mortgage loan. The mortgage servicer may also be the company that originated your loan.

Your loan documents will list your mortgage servicer’s name and contact information. If you have questions about your loan, or need to request copies of your documents, you should contact your servicer.

The mortgage servicer is also responsible for maintaining accurate records of your loan payments and for protecting these records from loss, damage, or destruction.

Who records loan documents?

The process of recording loan documents is handled by the county recorder in the county where the property is located. The county recorder is usually located in the county courthouse. The loan document will be recorded with the county recorder’s office and a copy will be sent to the lender. The original loan document will be returned to the borrower.

County recorder

The county recorder is responsible for recording and maintaining Records of Deeds, Mortgages, Liens and other documents pertaining to real estate in the county.

The recorder’s office is generally located in the county courthouse or at a site designated by the county commissioners. The office hours and days of operation are set by the recorder, but are generally during normal business hours.

Most recorder’s offices now have document recordings available online. To use this service, you will need to set up an account with the recorder’s office and agree to their terms of service. There typically is a fee for this service.

Mortgage lender

The mortgage lender provides the loan documents to the borrower at the closing of the loan transaction. The mortgage lender is responsible for recording the loan documents with the appropriate governmental authority.

Mortgage broker

Mortgage brokers act as an intermediary between you and the lender. They don’t provide the money for your loan, but they can help you find the best deal and complete all the necessary paperwork. You’ll likely have to pay the broker a fee, but it’s usually rolled into the loan.

When you’re ready to apply for a loan, the broker will submit your application to a lender or multiple lenders. The lenders will then provide the broker with a list of cash call documents that they require in order to consider your application. The broker will collect these documents from you and submit them to the lender (or multiple lenders, if necessary).

The lender will then review your loan application and supporting documentation. If everything looks good, they’ll issue a loan commitment letter that outlines the terms of your loan. Once you’ve signed this letter and paid any required fees, the lender will provide the funds for your loan.

The last step is for the mortgage broker to record the loan documents with your local county recorder’s office. This step is important because it protects you (and the lender) in case there are any problems with the property in the future.