How Does a Balloon Loan Work?

Contents

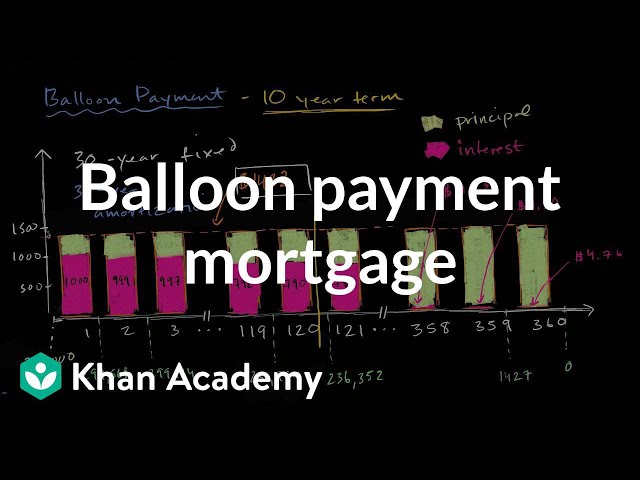

A balloon loan is a type of mortgage where you make regular payments for a set period of time, usually five to seven years, and then pay off the remainder of the loan in one lump sum.

Checkout this video:

What is a Balloon Loan?

A balloon loan is a type of loan that requires the borrower to make periodic, usually annual, payments based on a lower interest rate for a set period of time, followed by a single “balloon” payment of the entire remaining principal balance. The balloon payment is typically equal to the original principal balance of the loan.

How Does a Balloon Loan Work?

A balloon loan is a type of loan where you make monthly payments for a certain period of time, and then you make a lump sum payment for the remaining balance. This type of loan can be beneficial if you know you will have the money to make the lump sum payment at the end of the loan term.

The Basics

A balloon loan is a type of loan that requires you to make regular payments for a set period of time, usually five to seven years, and then pay off the remainder of the loan in one lump sum. This lump sum, called a balloon payment, is usually equivalent to the remaining principal on the loan.

The Pros

A balloon loan is a type of loan that requires borrowers to make regular payments for a set period of time, typically five to seven years, and then pay off the remainder of the loan in one lump sum.

Balloon loans offer borrowers a lower monthly payment than a traditional mortgage because they don’t have to pay for the entire loan amount up front. However, borrowers are responsible for the entire balloon payment at the end of the loan term, which can be a challenge if they haven’t been able to save.

Balloon loans can be a good option for borrowers who are confident they will be able to sell or refinance their property before the end of the loan term. These loans can also be attractive to investors who are looking to purchase property at a lower price and then sell it for a profit when the market improves.

The Cons

The biggest disadvantage of a balloon loan is that it might leave you “upside down” on your mortgage, meaning you owe more than your home is worth. If you have to sell your home before the end of the loan term, you’ll likely have to bring cash to the closing table to pay off the balloon balance. If you don’t have extra cash on hand, you might have to sell your home at a loss or go into foreclosure.

How to Get a Balloon Loan

A balloon loan is a type of mortgage where you make monthly payments for a set period of time (usually five to seven years) and then pay off the remaining balance in one lump sum. This lump sum is usually twice the size of your regular monthly payment.

The Application Process

To get a balloon loan, you’ll need to go through the same application process as you would for any other loan. This will involve submitting financial information such as income, debts, and assets. The lender will also look at your credit score to determine your eligibility.

Once you’ve been approved for the loan, you’ll need to make sure that you have the down payment required. With a balloon loan, this is typically a larger amount than with other types of loans. The reason for this is that the balloon payment at the end of the loan term can be quite large, so the lender wants to make sure that you have the ability to pay it back.

Once you have made your down payment and signed the loan agreement, the money will be disbursed to you. You’ll then have a set period of time to repay the loan, with your final payment being the balloon payment.

The Qualifications

In order to qualify for a balloon loan, you will need to have a good credit score. This is because the lender will want to make sure that you are able to make the payments on the loan. The interest rate on the loan will also be higher than a traditional loan, so you will need to be able to afford the payments.

You will also need to have a down payment for the balloon loan. This is because the lender wants to make sure that you have some skin in the game. The down payment is typically 10% of the purchase price of the home.

You will also need to have a job that pays enough so that you can afford the payments on the loan. This is because the lender wants to make sure that you can make the payments on time and in full.

Alternatives to a Balloon Loan

Alternatives to a Balloon Loan

A balloon mortgage is not the only type of loan that offers lower rates up front followed by a lump sum payment. Here are a few alternatives:

Fixed-rate mortgage: With a fixed-rate mortgage, your interest rate will remain the same for the life of the loan. You’ll have consistent monthly payments, which can make budgeting easier.

Adjustable-rate mortgage (ARM): An ARM typically has a lower interest rate than a fixed-rate mortgage for the first five years or so of the loan term. After that, your interest rate will adjust annually, based on market conditions at that time. This means your monthly payments could go up or down over time.

Home equity loan: With a home equity loan, you borrow against the value of your home and make fixed monthly payments. These loans usually have shorter terms than first mortgages and can be a good option if you need cash for a one-time expense, such as home repairs or improvements. Be sure to consider the total cost of the loan, including interest and fees, when you compare loans.