How Does a Builders Loan Work?

Contents

If you’re thinking about building a new home, you may be wondering how a builders loan works. Here’s a quick overview to help you better understand this type of financing.

Checkout this video:

What is a builders loan?

A builders loan is a loan that is specifically designed to help people who are self-employed or have other income sources that may not be verified by a traditional lender. Builders loans can be used for a variety of purposes, including the purchase of a new home, the construction of a new home, the renovation of an existing home, or the purchase of land for future development.

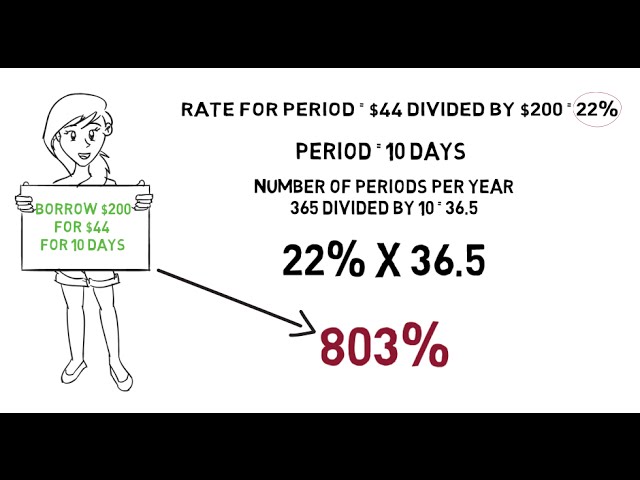

There are a few things to keep in mind when considering a builders loan. First, these loans tend to have higher interest rates than traditional mortgages. This is because the lender is taking on more risk by lending to someone who may not have a steady income. Second, builders loans are often short-term loans, which means that they will need to be paid back relatively quickly. This can make them more expensive in the long run if you do not carefully consider your repayment options.

If you are considering a builders loan, it is important to compare offers from multiple lenders to make sure you are getting the best deal possible. Be sure to compare interest rates, fees, and repayment terms before making your final decision.

How does a builders loan work?

A builders loan is a type of construction loan that is typically used to finance the construction of a new home or building. The loan is typically given to the builder by the bank or lender and is then used to finance the construction of the home or building. The loan is typically interest-only and is repaid when the home or building is sold.

The loan process

A builders loan is a type of construction loan that is typically used to finance the construction of a new home. Builders loans are typically interest-only loans, which means that you only need to make payments on the interest that accrues on the loan during the construction period. Once the home is completed, you will then need to begin making payments on the principle balance of the loan.

In order to qualify for a builders loan, you will need to have good credit and a down payment of at least 10%. You will also need to provide a detailed construction plan to the lender, as well as an estimate of the total cost of the project.

If you are approved for a builders loan, the construction process will begin and progress payments will be made to you as milestones are reached. Once the home is completed, you will then need to begin making regular monthly payments on the principle balance of your loan.

The loan agreement

The loan agreement will set out how much you can borrow, how the money will be repaid and when, what security the lender will take (e.g. a charge over your property) and any other conditions attached to the loan (e.g. that you must keep the property insured).

You should take independent legal advice on the loan agreement before you sign it. This is because the loan agreement is a legally binding contract and if you breach its terms, you could lose your home.

The loan disbursement

The loan is first disbursed as a line of credit. interest is only paid on the amount of money that is borrowed, and the line of credit can be used as needed throughout the construction process. As work progresses, the borrower provides the lender with documentation of completed work and request funds as needed.

Once the home is completed, the loan is converted into a conventional mortgage. The borrower then begins making regular payments on the mortgage, which typically have a higher interest rate than what was originally paid on the builders loan.

What are the benefits of a builders loan?

A builders loan is a specific type of loan that is given to people who are looking to build a property. The loan is given in order to help people with the finances that they need in order to build their dream home. There are a number of benefits that come with this type of loan.

The loan is interest-free

A builders loan from the government can help you finance your new build. The main benefit of a builders loan is that it’s interest-free. You can also spread the cost of your build over two years, which can help make your project more affordable.

Other benefits of a builders loan include:

-You won’t need a deposit

-You can get the money you need quickly

-You can (in most cases) choose how you spend the money

-You’ll only pay back what you borrow (plus any fees)

The loan is unsecured

An unsecured loan is a loan that is not backed by collateral. This means that if you default on the loan, the lender cannot take your home or car in order to recoup their losses. This type of loan is often more difficult to obtain because it is seen as a higher risk for the lender.

The loan can be used for any purpose

A builders loan is a type of short-term loan that is typically used to finance the construction of a new home or building. The loan is typically repaid when the construction is completed and the property is sold.

There are several benefits to using a builders loan, including the fact that the loan can be used for any purpose. This means that you can use the loan to finance the purchase of land, pay for construction costs, or even cover the cost of permits and fees.

Another benefit of a builders loan is that it can be paid back over time, making it easier to manage your finances during the construction process. Additionally, interest rates on builders loans are typically lower than those of other types of loans, such as personal loans or home equity loans.