What Does Pre Qualified Mean for a Credit Card?

Contents

Find out what pre-qualified means for a credit card and how you can increase your chances of being approved for one.

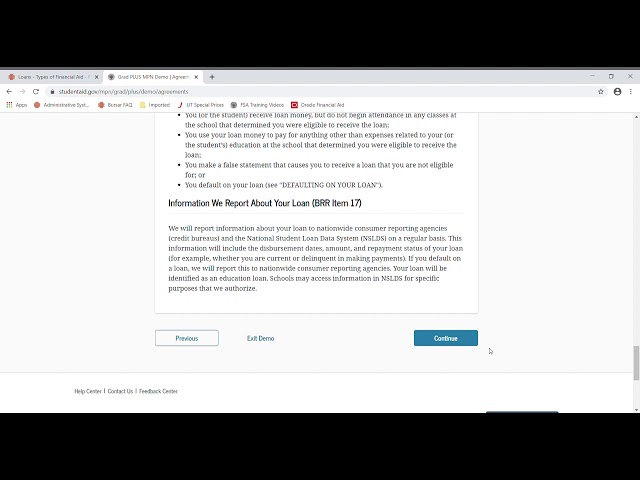

Checkout this video:

Understanding Pre-Qualification

Pre-qualification is when a person applies for a credit card and the credit card company checks their credit score to see if they are eligible for the credit card. If the person is pre-qualified, it means that they are likely to be approved for the credit card. However, being pre-qualified does not guarantee that the person will be approved for the credit card.

What is a pre-qualification?

A pre-qualification is a quick way to get an idea of how much you might be able to borrow for a personal loan or mortgage. It’s a soft inquiry on your credit—soSoft inquiries won’t affect your credit score, but hard inquiries will. you won’t be dinged for taking this initial step.

To get pre-qualified, you tell a lender some basic information about your finances, including your debt, income and assets. The lender reviews this information to give you an estimate of how much you might be able to borrow. This is what’s known as a soft pull or soft inquiry on your credit report—so doing this won’t lower your credit score.

You can get pre-qualified from multiple lenders at the same time without impacting your credit score—doing so is called rate shopping. The key is to submit all of your applications within 14 days of each other so they can be counted as just oneinquiryWhen a lender requests your credit report, it’s called an inquiry. Too many inquiries in a short period of time can hurt your credit score.. Once you select the best offer and move forward with the lender, that’s when the hard pull will occur.

What does pre-qualification mean for a credit card?

When you’re pre-qualified for a credit card, it means that the card issuer has reviewed your basic credit information and believes that you’re a good candidate for their card. Being pre-qualified is a soft inquiry on your credit report, so it won’t affect your credit score.

If you’re pre-qualified, you may receive an offer in the mail or see an ad online for the card. When you see a pre-qualification offer, it will include some basic terms of the deal, like the APR and credit limit you might be approved for. But remember, being pre-qualified is not the same as being approved—issuers will still need to run a hard inquiry on your credit report before they can extend an official offer.

If you’re interested in the card, go ahead and apply. If you’re not sure or want to compare your options, you can try using a tool like NerdWallet’s pre-qualification tool, which allows you to see multiple offers from multiple issuers with one soft inquiry on your report.

The Advantages of Pre-Qualification

When you are pre-qualified for a credit card, it means that the issuer has reviewed your credit report and determined that you meet their criteria for creditworthiness. This is different from pre-approval, which means that you have been approved for the credit card. Being pre-qualified for a credit card can give you a head start in the credit card application process.

You may be able to get a lower interest rate

Pre-qualifying for a credit card means that you have provided some information to the issuer about your credit history, income, and expenses. Based on this information, the issuer will give you an idea of what interest rate you would qualify for if you were to apply for the card.

This is different from pre-approval, which means that the issuer has looked at your credit report and decided that you are likely to be approved for the card if you apply.

There are a few advantages to pre-qualifying for a credit card:

1. You may be able to get a lower interest rate. If the issuer sees that you have good credit, they may offer you a lower rate than someone who doesn’t pre-qualify.

2. You can shop around without impacting your credit score. Unlike a hard inquiry, which is generated when you apply for a credit card, pre-qualifying does not impact your credit score. This means that you can shop around for the best deal without worrying about applying for too many cards and damaging your score.

3. You can compare offers from different issuers. By pre-qualifying for several cards, you can see which one offers the best interest rate and terms before you commit to anything. This can help you save money in the long run by ensuring that you get the best deal possible.

You may be able to get a higher credit limit

There are several potential advantages to being pre-qualified for a credit card. One of the main advantages is that you may be able to get a higher credit limit. If you have a good credit score, the issuer may be willing to offer you a higher credit limit than if you had not been pre-qualified. This can be helpful if you are planning to make a large purchase or need to have a backup source of funds in case of an emergency.

Another potential advantage of pre-qualification is that it can help you get approved for a card even if you have less-than-perfect credit. issuers are more likely to approve applicants who have been pre-qualified because it shows that the applicant has been vetted by the issuer and is less likely to default on their payments.

Pre-qualification can also help you compare different offers from different issuers. By being pre-qualified, you will know exactly how much each issuer is willing to lend you and what their terms are. This can save you time and effort when applying for multiple credit cards.

You can find out if you’re likely to be approved

Pre-qualification is when a lender checks your credit score and asks you questions about your income, debts and assets. They then give you an estimate of how much you may be able to borrow and what interest rate you may qualify for. This is all done without a hard pull on your credit report.

Pre-qualification is not the same as pre-approval. Pre-approval is when a lender gives you a letter stating that you will be approved for a loan up to a certain amount, with a certain interest rate, as long as nothing changes in your financial situation before closing. A hard pull on your credit report will be done at this time.

Pre-qualification can be a useful tool if you’re not sure whether you’ll be approved for a loan or if you don’t know what interest rate you may qualify for. It can also help you compare offers from different lenders.

The Disadvantages of Pre-Qualification

Pre-qualification for a credit card is when a card issuer checks your credit report and gives you an idea of what APR you would be offered if you were to apply for a credit card with that issuer. While this may sound like a good thing, there are actually a few disadvantages to be aware of.

You may not be able to get the best offer

A pre-qualification is when a lender gives you an idea of what kind of terms you could get for a personal loan or mortgage. They’ll tell you how much money you could borrow, what the interest rate and monthly payments would be, and what kind of credit score you need to qualify. A pre-qualification is not a guarantee that you’ll get the loan.

The main disadvantage of pre-qualification is that it’s not binding. That means the lender could change the terms of the loan before you actually apply, based on your credit score, employment history, or other factors. You might not get the interest rate or monthly payment that you were expecting. And, if your credit score has changed since you got the pre-qualification, you might not even qualify for the loan at all.

You may not be able to get the card you want

If you’re pre-qualified for a credit card offer, it means the issuer has reviewed your credit report and believes you meet its criteria for the card. But it’s not a guarantee that you will be approved for the card when you apply.

And even if you are approved, you may not get the terms — such as the annual percentage rate, credit limit or welcome bonus — that were advertised in the pre-qualification offer.

It’s important to know that just because you’re pre-qualified for an offer doesn’t mean you have to apply for that specific card. If you’re not interested in the terms of the offer, simply discard it and continue your search for the perfect credit card.

You may not be able to get a 0% APR

Even if you have good credit, there’s no guarantee you’ll be offered a 0% APR on your pre-qualified credit card. If you carry a balance on your credit card, a higher APR will increase the amount of interest you pay.

How to Pre-Qualify for a Credit Card

Pre-qualifying for a credit card means that you have a good chance of being approved for the card when you apply. To pre-qualify, a credit card issuer will do a soft pull of your credit, which will not impact your credit score. This is different from a hard pull, which is when an issuer does a full credit check and can impact your score.

Check your credit score

The first step in pre-qualifying for a credit card is to check your credit score. You can get a free credit report from each of the three major credit bureaus — Experian, Equifax and TransUnion — once per year at AnnualCreditReport.com. Checking your own credit score does not hurt your credit, but you should beware of sites that promise free scores in exchange for your personal information.

Once you have your reports, check them carefully for errors. If you find any, file a dispute with the corresponding credit bureau. You can do this online, and it’s important to do it as soon as possible because inaccuracies could lower your score and negatively impact your ability to pre-qualify for a credit card.

Compare credit card offers

You’ve seen the ads that tell you to “pre-qualify” for a credit card. But what does pre qualified mean? When you pre-qualify for a credit card, it means that the issuer has looked at your credit report and decided that you are a good candidate for their card.

Pre-qualifying for a credit card is different from being approved for a credit card. When you are approved for a credit card, the issuer has decided that you will be given the credit card. When you pre-qualify, the issuer is still making a decision about whether or not to give you the credit card.

The best way to compare credit card offers is to use a pre-qualified tool like the one below. This will allow you to compare offers from multiple issuers without affecting your credit score.

Apply for a credit card

The best way to get prequalified for a credit card is to apply for one. When you apply, the issuer will check your credit history and give you a decision. If you’re approved, the issuer will provide you with an offer that outlines the terms of the card, including the APR, credit limit, and any rewards or benefits that come with it.