Why Is My Child Tax Credit Pending?

If you’re wondering why your child tax credit is pending, there are a few potential reasons. The IRS may need additional information from you in order to process your claim, or there may be an issue with your tax return. In either case, it’s important to stay in communication with the IRS to ensure that your claim is processed as quickly as possible.

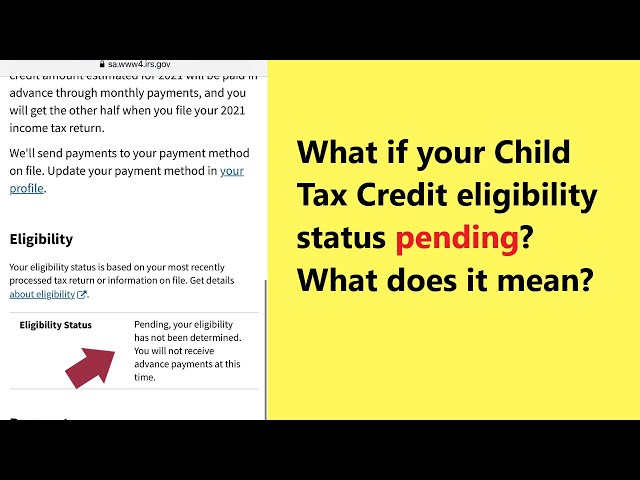

Checkout this video:

Pending Status

If you e-filed your taxes and are expecting to receive the Child Tax Credit (CTC), you may be wondering why the status of your return is “pending.” The IRS has a backlog of returns claiming the CTC and other tax credits, and is currently processing returns filed in mid-February. According to the IRS, if your return was filed on or before February 15, you can expect to receive your CTC by the end of February. If your return was filed after February 15, you can expect to receive your CTC by the end of March.

Reasons for a pending status

The most common reasons for a pending status are:

-The IRS is verifying your eligibility. If you recently had a change in income, family size, or filing status, the IRS may need to verify that you are still eligible for the credit.

-You did not provide all the required information.If any of the required information is missing from your return, the IRS will put your return in pending status. This includes missing or incomplete forms, such as Form W-2 or Schedule C.

-You did not sign your return.If you e-filed your return and did not include a signature, the IRS will put your return in pending status.

-There is a discrepancy on your return.If the information on your return does not match what the IRS has on file, they will put your return in pending status. This includes discrepancies with social security numbers and birthdates.

How to check the status of your claim

If you filed your taxes electronically, you can check the status of your refund by visiting the IRS website. You’ll need to enter your Social Security number, filing status, and the exact amount of your refund.

If you filed a paper return, you can check the status of your refund by calling the IRS Refund Hotline at 1-800-829-1954.

Backlogs

If you have recently filed your taxes and are wondering why your child tax credit is pending, it could be because of a backlog. The IRS is currently processing a large number of tax returns and it may take longer than usual to receive your refund.

What causes backlogs?

The IRS processes millions of pieces of tax-related correspondence each year. During peak processing times, such as early spring when taxpayers are filing their annual returns, the number of items the IRS receives can overwhelm its ability to promptly process them all. This can result in a backlog of correspondence.

The IRS has taken steps to address processing delays, including hiring additional seasonal staff and prioritizing the most time-sensitive correspondence, such as refund checks. However, taxpayer patience is still often required.

There are many reasons why your child tax credit payment may be pending. Some common causes of delays include:

-Incorrect or incomplete information on your tax return

-Math errors on your return

-Failure to sign and date your return

-Failure to enclose required documentation

-Processing delays due to high volume

How to check the status of your claim if there is a backlog

If you filed a paper return, we will process it in the order we received it. It usually takes about 6 to 8 weeks from the date we receive your return to process it and issue any refund due.

If you e-filed your return, we usually issue most refunds in less than 21 days. If your refund is delayed, check Where’s My Refund? for personalized information about your refund. You can start checking on the status of your return within 24 hours after you e-file. You can also check the status of your return by calling the IRS Refund Hotline at (800) 829-1954.

Resolving Issues

If you’re wondering why your child tax credit is pending, there are a few things that could be causing the delay. The IRS may need additional information from you in order to process your claim, or there may be an error on your return. In some cases, the IRS may simply be behind on processing claims. Here’s what you can do to resolve the issue and get your child tax credit.

What to do if your claim is denied

The first step is to find out why your claim was denied. You can call the IRS helpline for individuals with limited English proficiency at 1-800-829-3676.

If you don’t understand why your claim was denied, you can ask for a “notice of deficiency” from the IRS. This notice will explain the reason for the denial and tell you what you need to do to resolve the issue.

If you still disagree with the IRS after receiving a notice of deficiency, you can file a petition with the Tax Court.

How to appeal a decision

If you disagree with the decision made about your Child Tax Credit, you can ask for a review of the decision.

You should get a notice telling you why your claim has been rejected or your payment has been stopped. If you don’t get this, contact the Tax Credit Office.

The notice will tell you how to appeal – usually by writing to the office that made the decision.

Common mistakes

If you are wondering why your child tax credit is pending, it is likely because of one of these common mistakes. One common mistake is failing to provide all the required documentation. Another common mistake is not providing enough information or providing inaccurate information. Either of these can result in a delay in processing your child tax credit.

Incorrect or missing information

If the IRS has sent you a notice stating that your child tax credit is pending or denied because of incorrect or missing information, there are a few things you can do to try to resolve the issue.

First, make sure that you have provided all of the required information on your tax return. If you are missing any forms or schedules, attach them to your return and resubmit it.

If you have already submitted your return and believe that you provided all of the necessary information, you can check the IRS website to see if they have received your return. If they have not received it, resubmit it as soon as possible.

If the IRS has received your return but has not processed it yet, you can call them at 1-800-829-1040 to inquire about the status of your refund. Be sure to have your social security number and filing status handy when you call.

Failure to report changes

One of the most common reasons for a Pending status is that the IRS needs more information from you. The easiest way to provide this information is to log in to your online account and use the Make a Payment feature. You can also visit the nearest IRS office or mail in your payment.

If you did not report a change that could affect your eligibility for the Child Tax Credit, this could also cause your payment to be pending. For example, if you had a baby during the tax year, you need to report this change so that the IRS can recalculate your payment amount.

If you’re not sure why your payment is pending, you can contact the IRS directly for more information.