How to Pay Your Mortgage with a Credit Card

Contents

Are you looking for a way to pay your mortgage with a credit card? If so, you’ll want to read this blog post. We’ll show you how to do it, and explain the pros and cons.

Checkout this video:

Introduction

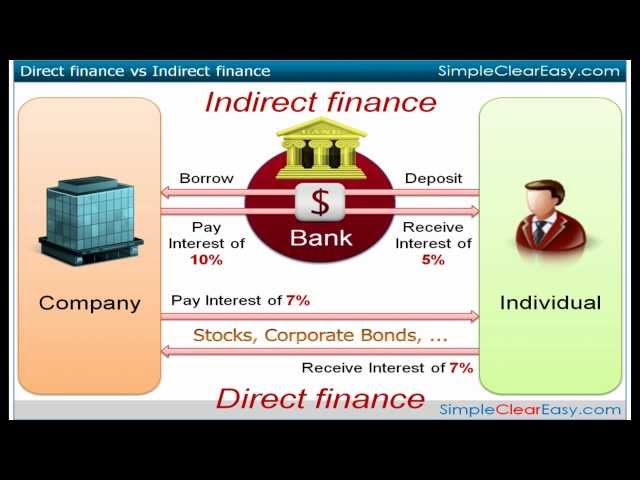

Paying your mortgage with a credit card may seem like a good way to earn rewards or rack up points, but there are some drawbacks. For one, most lenders charge a fee for credit card payments, usually around 2-3% of the payment amount. In addition, if you’re trying to pay down debt quickly, this method will only make it take longer since you’ll be paying interest on your credit card balance.

That said, there are still some situations where it makes sense to pay your mortgage with a credit card. If you have a 0% APR introductory offer on your card, for example, you could use it to make interest-free payments on your mortgage for the length of the intro period. Just be sure to pay off the balance before the intro period expires, or you’ll be stuck paying interest at the regular APR.

Another potential advantage of using a credit card to pay your mortgage is that you may be able to earn rewards like cash back or airline miles. Just make sure you compare the value of the rewards you’ll earn to the fees you’ll pay before deciding if this is the right move for you.

How to Pay Your Mortgage with a Credit Card

If you’re looking for a way to pay off your mortgage faster, you may be wondering if you can pay your mortgage with a credit card . The short answer is yes, you can! However, there are a few things you need to know before you do. We’ll go over everything you need to know about paying your mortgage with a credit card, including the pros and cons, so you can make the best decision for your situation.

Set up automatic payments

If you want to use a credit card to pay your mortgage, you’ll need to set up automatic payments. You can do this by contacting your credit card company and requesting that they set up an automatic payment for the amount of your mortgage each month. You’ll need to provide them with your account information, including your mortgage account number and the date of your monthly payment. Once you’ve set up automatic payments, you can pay off your mortgage as quickly as you’d like without having to worry about making a late payment.

Make a one-time payment

If you want to make a one-time payment on your mortgage with a credit card, you’ll need to contact your lender directly. Many lenders will accept credit card payments, but they may charge a fee for doing so. Be sure to ask about any fees before you make your payment.

If your lender doesn’t accept credit card payments, you may still be able to use a service like Plastiq to pay your mortgage with a credit card. Plastiq charges a fee of 2.5% for paying bills with a credit card, but it can be worth it if you’re trying to earn rewards or meet minimum spending requirements.

Pay your mortgage with a credit card

Paying your mortgage with a credit card can be a great way to earn rewards or take advantage of 0% APR offers. But there are a few things to keep in mind before you do:

• Be sure to make your payments on time. One late payment can damage your credit score, and that could offset any rewards or savings you’re earning.

• Watch out for fees. Some credit card companies charge a fee for using your card for a mortgage payment, and that could negated any rewards or savings you’re earning.

• Be aware of interest rates. If you carry a balance on your credit card, you’ll be charged interest on that balance. That could offset any rewards or savings you’re earning, so it’s important to pay off your balance in full each month.

If you keep these things in mind, paying your mortgage with a credit card can be a great way to save money or earn rewards.

Conclusion

Paying your mortgage with a credit card can be a great way to earn rewards, but it’s not for everyone. There are a few things to consider before you decide to pay your mortgage with a credit card, including the fees involved and the interest rates you’ll pay. You should also make sure you have a plan to pay off your credit card balance each month so you don’t end up paying more in interest than you would have with your regular mortgage payment.