Whose Credit Score Is Used When Co-Signing?

Contents

If you’re co-signing for a loan, find out whose credit score the lender will use during the application process.

Checkout this video:

What is a co-signer?

A co-signer is someone who agrees to sign for a loan with another person. The co-signer is responsible for the loan if the other person cannot make the payments. Co-signing is a way to help someone get a loan who might not otherwise be able to get one.

The risks of being a co-signer

Becoming a co-signer on someone else’s loan or credit card account is a serious responsibility. By co-signing, you are agreeing to be equally responsible for the debt if the other person fails to make payments. This means the debt will show up on your credit report and could damage your credit score if it’s not paid as agreed.

It’s important to understand the risks before you agree to co-sign. If you decide to go ahead, make sure you trust the person you’re co-signing for and that you’re comfortable with the level of risk.

What is a credit score?

A credit score is a number that lenders use to help them decide how likely it is that they will be repaid on time if they lend you money. The higher your score, the more likely you are to get a loan with a lower interest rate.

The importance of credit scores

Credit scores are extremely important because they are one of the main factors that lenders look at when considering a loan. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on a loan. A low credit score could lead to a higher interest rate and could mean you won’t be approved for a loan at all.

Credit scores are also used by landlords, utility companies, cell phone providers, and insurance companies. A good credit score could mean you get approved for an apartment, get discounts on your insurance premiums, or qualify for a cell phone plan with no deposit. A bad credit score could mean you get denied for an apartment, pay higher insurance rates, or have to make a deposit for your cell phone plan.

Bottom line: Credit scores are important because they affect your ability to borrow money and the interest rates you’ll pay on loans.

Whose credit score is used when co-signing?

Your credit score is important. It is used to determine whether or not you will be approved for loans, credit cards, and other financial products. But what if you are co-signing for someone else? Whose credit score is used in this situation?

The primary borrower

The primary borrower is the person whose credit score is used when co-signing. This is because the primary borrower is the one who will be responsible for repaying the loan. The co-signer is only responsible for repaying the loan if the primary borrower does not.

The co-signer

Co-signing is when two people agree to be jointly responsible for repaying a debt. This usually happens when someone with bad credit or no credit history applies for a loan and needs someone with good credit to vouch for them. The co-signer agrees to make payments on the loan if the primary borrower can’t.

Co-signing is a big responsibility because you’re on the hook for the entire loan amount if the primary borrower can’t or doesn’t make their payments. This can damage your credit score and make it harder for you to get a loan in the future.

When you co-sign for a loan, the lender will look at both your credit score and the primary borrower’s credit score to decide whether to approve the loan. The lender will also look at your income and debts to see if you can afford to make the payments.

How to improve your credit score

Your credit score is one of the most important factors in your financial life. It is used to determine your interest rates on loans, credit cards, and other lines of credit. A higher credit score will save you money over the life of a loan, and can help you get approved for lines of credit that you might not have been approved for with a lower score. There are a few things you can do to improve your credit score.

Pay your bills on time

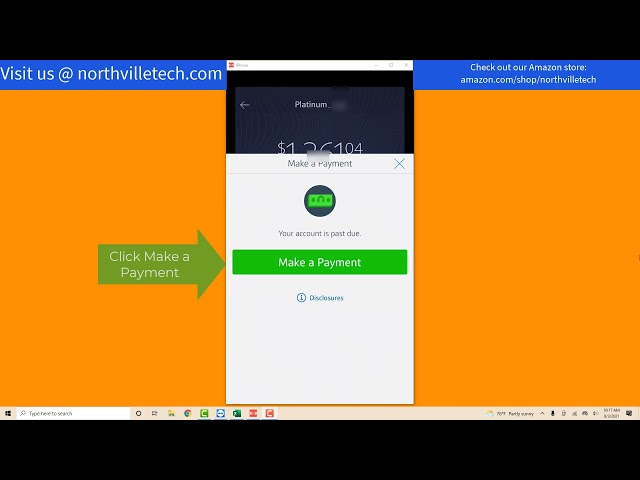

Life happens, and sometimes you might find yourself in a situation where you can’t pay a bill on time. If this happens, don’t panic. There are a few things you can do to minimize the damage to your credit score.

First, contact the creditor as soon as possible and explain the situation. Many creditors are willing to work with you to set up a payment plan or extend the due date. If you can’t reach an agreement with the creditor, your next step is to pay the bill as soon as possible. Even if you’re unable to pay the full amount, paying something is better than nothing.

If you’re still having trouble paying your bills, you might want to consider credit counseling or debt consolidation. Credit counseling can help you develop a budget and make a plan to pay off your debt. Debt consolidation involves taking out a new loan to pay off multiple debts. While this can be effective in reducing your monthly payments, it’s important to make sure that you don’t end up paying more in interest over time.

Keep your balances low

One factor that is taken into consideration when calculating your credit score is your credit utilization ratio. This is the amount of debt you have compared to the amount of credit available to you. For example, if you have two credit cards, one with a $5,000 limit and one with a $10,000 limit, and you currently have a balance of $2,500 on the first card and $7,500 on the second card, your credit utilization ratio would be 50%.

Ideally, you want to keep your credit utilization ratio below 30%. The lower it is, the better it will be for your credit score. So if you’re using a lot of your available credit, paying down your balances should help improve your score.

Monitor your credit report for errors

You are entitled to one free credit report every 12 months from each of the three major credit reporting bureaus, which include Equifax, Experian and TransUnion. You can access your report online at AnnualCreditReport.com. Regularly monitoring your credit report is the best way to catch errors and potential fraud early.

If you find any errors on your credit report, you should dispute them with the credit bureau in writing. Include a copy of your credit report with the erroneous information highlighted, as well as a letter explaining why you believe the information is inaccurate. You should also include supporting documentation, such as a cancelled check or letter from a creditor confirming that you paid a bill on time.

The credit bureau will investigate your dispute and remove any inaccurate or fraudulent information from your credit report if they find in your favor.

How to co-sign without affecting your credit score

If you’re thinking about co-signing for a friend or family member, you may be wondering whose credit score will be affected. Co-signing is a big responsibility, and it’s important to understand how it will impact your credit score before you commit. In this article, we’ll explain whose credit score is used when co-signing and how you can co-sign without affecting your credit score.

Get a co-signer release

A co-signer release is a document that removes the co-signer from the loan. It does not change the terms of the loan, and it does not affect the primary borrower’s credit score.

To get a co-signer release, you must usually make a certain number of on-time payments (usually 12 to 24 months) and meet other requirements, such as having a certain income level. Once you qualify for a co-signer release, you can contact your lender to request one.

If you can’t get a co-signer release, another option is to refinance the loan into your name only. This will require you to qualify for the loan on your own, which may be difficult if your credit score has improved since you originally took out the loan. But if you can qualify for a lower interest rate, it could be worth it in the long run.

Refinance the loan in your name

If you co-sign for a loan and then want to get your name off the loan, one option is to refinance the loan in your own name. You’ll need to qualify for the loan on your own and may need to provide collateral. If you have good credit, this may be the best option because you can get a lower interest rate.

Another advantage of refinancing is that it can help improve your credit score. That’s because refinancing pays off the existing loan and replaces it with a new one in your name only. As long as you make all of your payments on time, this will help improve your payment history, which is one of the biggest factors in credit scores.