Which Loan Option is Strongly Recommended for First-Time Buyers?

Contents

If you’re a first-time buyer looking for a loan, you may be wondering which option is best for you. There are many different loan options available, and it can be difficult to choose the right one. However, there is one loan option that is strongly recommended for first-time buyers: an FHA loan.

FHA loans are backed by the Federal Housing Administration, and they are a great option for first-time buyers because they offer low down payments and relaxed credit

Checkout this video:

FHA Loan

FHA loans are loans that are insured by the Federal Housing Administration. This means that if the borrower defaults on the loan, the FHA will pay the lender back a portion of the money that was borrowed. This makes it a very attractive option for first-time buyers because it minimizes the risk for the lender.

Down Payment

A down payment is the amount of money that you put towards the purchase of a home. The down payment is deducted from the purchase price of your home.

For example, if you buy a home for $200,000 and you pay a $20,000 down payment, your mortgage company will lend you $180,000. The amount of money that you need for a down payment depends on the type of mortgage that you get.

If you are buying a house with a conventional loan, you will need to put at least 3% down. If you are buying a house with an FHA loan, you will only need to put 3.5% down.

If this is your first time buying a home, it is strongly recommended that you get an FHA loan because it is easier to qualify for and it will allow you to put a smaller down payment.

Mortgage Insurance

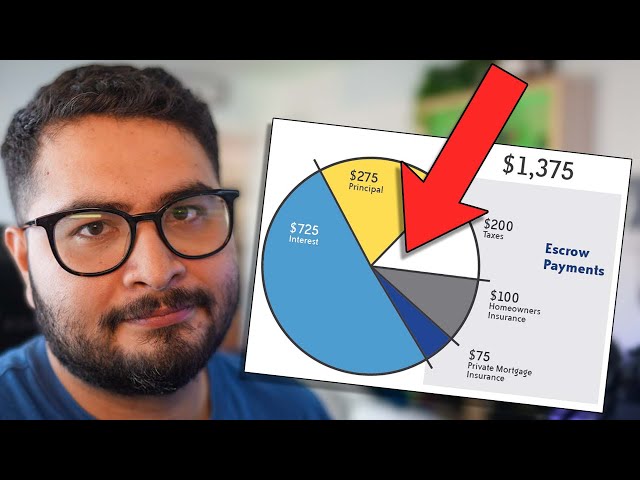

FHA loans require two mortgage insurance premiums: one is paid upfront, and the other is paid annually for the life of the loan if you put less than 10 percent down. The annual premium is divided into 12 monthly payments and added to your mortgage bill.

Credit Score Requirement

A credit score is a number that creditor’s use to determine an individual’s creditworthiness. A FICO score is the most common type of credit score, and it ranges from 300 to 850. The higher your credit score, the lower your interest rates will be, and vice versa.

For first-time homebuyers, a credit score of 580 or higher is required in order to get approved for an FHA loan. Borrowers with a credit score between 500 and 579 can still qualify for an FHA loan, but they will need to put down at least 10%.

First-time buyers with a credit score below 580 are not excluded from applying for an FHA loan altogether--they will just need to provide a larger down payment than those with higher credit scores. The minimum down payment required for an FHA loan is 3.5% of the purchase price of the home.

VA Loan

A VA loan is a mortgage loan in the United States guaranteed by the United States Department of Veterans Affairs (VA). The loan may be issued by qualified lenders. The VA loan was created in 1944 by the United States government to help returning service members purchase homes without needing a down payment or excellent credit.

Down Payment

For first-time homebuyers, one of the biggest hurdles to overcome is mustering up enough money for a down payment. But did you know that you may be able to buy a home with no money down? There are several loan options available that do not require a down payment, and each has its own set of pros and cons.

The VA loan is a government-backed mortgage available to eligible servicemembers, veterans, reservists, and eligible surviving spouses. It comes with several benefits, including no down payment or private mortgage insurance (PMI) requirements. But there are also some drawbacks to be aware of before deciding if a VA loan is right for you.

With a VA loan, you can buy a home with no money down as long as the home meets the VA’s minimum property requirements. You’ll also avoid paying PMI, which can add an extra layer of monthly costs onto your mortgage payment. But there are some potential drawbacks to consider before taking out a VA loan.

For one, VA loans are only available to eligible veterans, servicemembers, reservists, and eligible surviving spouses. If you don’t fall into one of these categories, then a VA loan is not an option for you.

Another potential drawback is that VA loans may come with certain restrictions, such as the need to live in the home as your primary residence or to use the home for certain approved purposes such as child care or medical care. These restrictions can limit your ability to sell or rent the property in the future if your circumstances change.

If you’re considering a VA loan, it’s important to compare your options and talk to a lender to see if it’s the right choice for you.

Mortgage Insurance

There are two types of mortgage insurance: private mortgage insurance (PMI) and mortgage insurance premium (MIP). VA loans require Veteran’s to pay a funding fee, which can be wrapped into the loan, instead of monthly mortgage insurance. The funding fee for first-time use is 2.15% of the loan and 3.3% for subsequent use. The good news is that you can finance this fee, so it doesn’t come out of your pocket at closing.

Credit Score Requirement

The minimum credit score required for a VA loan is 580. If you have a credit score below 580, you will be required to put down a down payment of at least 10 percent of the loan.

Conventional Loan

A Conventional Loan is a mortgage that is not backed by the government. Private lenders like banks and credit unions offer these loans. First-time home buyers can put down as little as 3% for a down payment. This is a great option for those who have saved up for a down payment but don’t have a ton of extra money for closing costs.

Down Payment

For first-time homebuyers, making a down payment can be a significant hurdle to buying a home. A conventional loan requires anywhere from 5% to 20% for a down payment. That’s a big chunk of change, especially for buyers who don’t have a lot of extra cash on hand.

FHA loans are a popular choice for first-time homebuyers because they only require a 3.5% down payment, which could be financed through the buyer’s down payment assistance program or through other sources. However, this low down payment option comes with trade-offs, such as higher mortgage insurance payments and stricter credit requirements.

For buyers who have the cash on hand and who want to avoid paying private mortgage insurance (PMI), putting 20% down on a conventional loan is the gold standard. But even if you can’t reach that level, know that every little bit helps; even putting 3% down on a conventional loan will get you below the 5% mark that would trigger PMI.

Mortgage Insurance

Mortgage insurance is insurance that protects the lender in the event that you default on your loan. Mortgage insurance is typically required for conventional loans with down payments of less than 20%.

Credit Score Requirement

Conventional loans are not insured or guaranteed by the federal government, so they typically have higher lending standards and rates than government-backed loans. That said, first-time home buyers with credit scores of at least 620 can often qualify for conventional mortgages with as little as 3% down.

For first-time home buyers with lower credit scores, FHA loans are usually the best option because they require only a minimum credit score of 580 with a maximum debt-to-income ratio of 43%. If your credit score is between 500 and 579, you can still qualify for an FHA loan but will be required to put down 10% instead of 3%.