Which Credit Score Matters the Most?

Contents

Have you ever wondered which credit score matters the most? Find out which one lenders look at the most before making a decision.

Credit Score Matters the Most?’ style=”display:none”>Checkout this video:

The Three Types of Credit Scores

There are three types of credit scores, and each one is important in its own way. The first is your FICO score , which is the score that most lenders use when they’re considering you for a loan. The second is your VantageScore, which is a score that is used by some lenders. The third is your Experian score, which is another score that is used by some lenders.

FICO Score

You’ve probably heard of your FICO score, but do you know what it is and why it matters? Your FICO score is a three-digit number that lenders use to assess your creditworthiness. It’s based on information in your credit report, and it can range from 300 to 850.

The higher your score, the better your chances of getting approved for a loan or credit card with favorable terms. A low FICO score could result in higher interest rates and less favorable loan terms.

There are a couple different types of FICO scores, but the most common one is the FICO 8 score. This scoring model was introduced in 2009 in response to the Great Recession. It’s used by about 90% of major lenders today.

If you’re wondering what kind of shape your credit is in, you can check your FICO score for free on a number of websites, including Credit Karma and Discover.

VantageScore

VantageScore is a credit scoring system developed jointly by the three major national credit bureaus: Experian, Equifax, and TransUnion. It is used by lenders to help make credit decisions, and by consumers to help track their credit health.

VantageScore was first introduced in 2006, and has since undergone a few revisions. The most recent version, VantageScore 3.0, was released in 2013. This version is what is most commonly used by lenders today.

There are three main differences between VantageScore and the other two major scoring systems, FICO and Advanced Credit Scoring:

1. VantageScore uses a different scoring range than FICO and Advanced Credit Scoring. VantageScore’s range is from 300 to 850, while FICO’s range is from 350 to 850, and Advanced Credit Scoring’s range is from 250 to 900.

2. VantageScore weighting of credit factors is different than the weighting used by FICO and Advanced Credit Scoring. The importance of payment history, for example, is weighted differently by each system.

3. VantageScore considers some types of information that are not factored into FICO or Advanced Credit Scoring scores. This includes things like rental payments and utility bills.

Experian Boost

Experian Boost™ is a new product that can help boost your credit scores. By adding certain types of financial data to your Experian credit report, you could see your scores go up.

Experian Boost is currently only available to people with an Experian credit report. And while it can help boost your scores, it’s important to remember that there are other factors that are also used in calculating your credit scores, such as your payment history and credit utilization ratio.

There are three main types of credit scores: FICO® Scores, VantageScore 3.0 and 4.0, and Experian Boost™.

FICO® Scores: FICO® Scores are the most widely used credit scores, and you’re likely familiar with them if you’ve ever applied for a loan or a credit card. There are actually multiple versions of FICO® Scores, but the most common ones used by lenders are FICO® Score 8 and FICO® Score 9.

VantageScore 3.0 and 4.0: These are newer versions of the VantageScore, which is a scoring model created by the three major credit bureaus (Equifax, TransUnion and Experian). VantageScore 3.0 was introduced in 2013, and VantageScore 4.0 was introduced in 2017.

Experian Boost™: Experian Boost is a new product from Experian that can help boost your credit scores. By adding certain types of financial data to your Experian credit report, you could see your scores go up.

Who Uses Which Score?

If you have ever applied for a loan or a credit card, you know that there are multiple credit scores out there. So, which credit score matters the most? That really depends on who is looking at your score.

FICO Score

The FICO® Score is the credit score most lenders use to determine your credit risk. You have three FICO® Scores, one for each of the three credit bureaus – Experian, Equifax and TransUnion. Each score is based on information the credit bureau keeps on file about you. As this information changes, your FICO® Score changes too.

The FICO® Score range goes from 300 to 850 — the higher your score, the lower the risk you pose to a lender. Scores 750 and up are good; scores above 800 are excellent. If your score is below 600, it’s time to take some steps to improve your credit health.

VantageScore

VantageScore is the score most widely used by lenders, and it was created jointly by the three major credit bureaus: Experian, TransUnion and Equifax. You’ll sometimes see it referred to as a FICO® score, but that term is no longer accurate.

The VantageScore model is constantly being updated, so there are slight variations depending on which version your lender is using. The most recent version, VantageScore 3.0, considers things like utility and cellphone payments when calculating your score.

Your VantageScore will range from 300 to 850—the higher the number, the better. Compared to other scoring models, VantageScore is more forgiving of recent late payments and balances owed. It’s also more likely to give you credit for positive financial behaviors like paying your bills on time or using a small percentage of your available credit limit (your “credit utilization ratio”).

Experian Boost

Experian Boost is a new service that allows you to add utility and cell phone bill payments to your credit report.

Experian is one of the three major credit reporting agencies in the United States, along with Equifax and TransUnion. Your Experian credit score is used by some creditors, but not all.

According to Experian, ” Boost can help improve your credit scores instantly by adding positive payment history from utility and cell phone bills to your credit report.”

boost requires you to first sign up for an account with Experian. Then, you will need to provide your login information for your utility or cellphone provider. Experian will then verify the payments and add them to your credit report.

There is no cost for signing up for Experian Boost, and no negative impact on your credit score from signing up or from adding bill payments to your credit report.

How to Improve Your Score

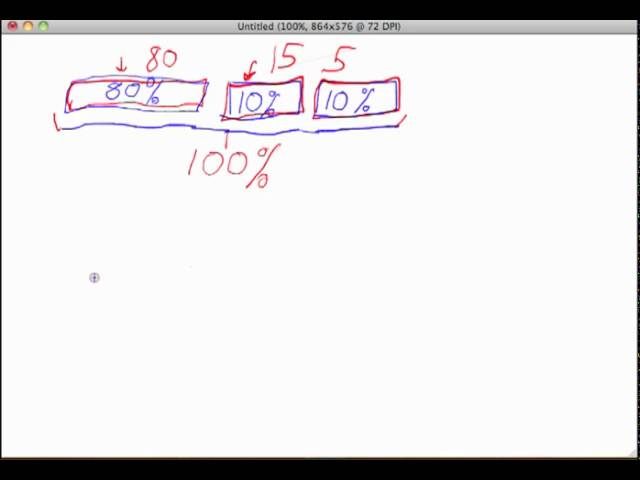

There are many factors that go into your credit score. The most important factor is your payment history. This accounts for 35% of your score. Other important factors are your credit utilization, which is 30% of your score, length of credit history (15%), and types of credit in use (10%). You can improve your credit score by paying your bills on time, keeping your credit utilization low, and by diversifying your credit portfolio.

FICO Score

FICO® Scores are the credit scores most lenders use to determine your credit risk. You have three FICO® Scores, one for each of the three credit bureaus – Equifax, Experian and TransUnion. Each FICO® Score is based on information the credit bureau keeps on file about you. As this information changes, your FICO® Score also changes.

You can get your free credit report from each of the three major credit bureaus every 12 months from AnnualCreditReport.com. This will give you an idea of where your scores stand and help you spot any errors that may be dragging down your scores.

If you’re looking to improve your score, there are a few things you can do:

-Pay Your Bills on Time: This is the most important factor in determining your FICO® Score, so be sure to pay all of your bills on time, every time. Credit cards, auto loans, mortgages and other types of loans all factor into your score.

-Keep Your Credit Utilization Low: This refers to the amount of debt you carry compared to your credit limit. For example, if you have a $1,000 credit limit and a balance of $500, your utilization would be 50%. It’s generally best to keep your utilization below 30% to maintain a good score.

-Avoid Opening Too Many New Accounts: Every time you open a new account, it’s like starting from scratch in terms of building up a good payment history. So if you don’t need another account, it’s best to avoid opening one.

-Check Your Credit Report for Errors: As mentioned above, you can get a free copy of your credit report from each of the three major bureaus once per year at AnnualCreditReport.com. Be sure to carefully review each report for any errors that could be draggin down your score.

VantageScore

While there are many credit scoring models available, the two most popular are FICO® scores and VantageScores.

VantageScore was created in 2006 by the three major credit bureaus (Equifax, Experian and TransUnion) as an alternative to FICO scores. Like FICO scores, VantageScores range from 300 to 850 – the higher your score, the better.

There are some key differences between VantageScore and FICO scores:

-The credit scoring models use different algorithms.

-VantageScores consider rental payment history, whereas FICO scores do not.

-VantageScores weight recent activity more heavily than FICO scores.

– VantageScores give less weight to medical debt than FICO scores.

If you have a strong credit history with a diversified mix of credit types (e.g., installment loans, revolving lines of credit and retail accounts), you’re likely to have a good FICO score and a good VantageScore.

Experian Boost

If you’re looking to improve your credit score, you may have come across Experian Boost. It’s a program that allows you to add certain types of monthly payments to your Experian credit report in order to potentially improve your credit score.

In order to be eligible for Experian Boost, you must first have an active Experian account and be a U.S. resident. You’ll also need to provide some information about your financial history, including your bank account login information so that Experian can access your account history.

Once you’ve provided the necessary information, Experian will analyze your account history and determine if there are any qualifying monthly payments that can be added to your credit report. Once these payments have been added, your credit score will be updated to reflect the new information.

It’s important to note that not everyone who is eligible for Experian Boost will see a significant increase in their credit score. The amount of boost you’ll see will depend on various factors, including the kind of monthly payments being added and how much positive payment history you already have on your Experian credit report.

If you’re looking for a quick and easy way to potentially improve your credit score,Experian Boost may be worth considering. However, it’s important to keep in mind that there are other factors that contribute to your credit score—such as payment history and credit utilization—so boosting your score with Experian Boost shouldn’t be your only focus when it comes to improving your overall credit standing